Key Insights

- Manta Network introduced MultiDA in Q3. MultiDA is a modular data availability solution that integrates multiple data availability services, including Celestia, EigenDA, NEAR DA, Nubit, and Dill.

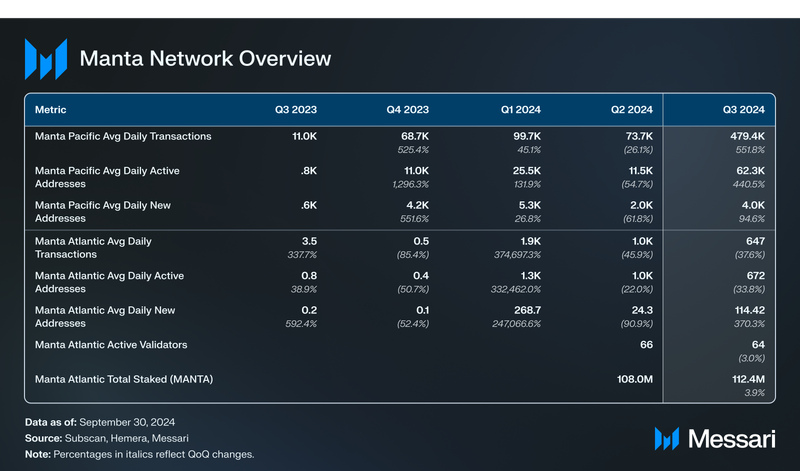

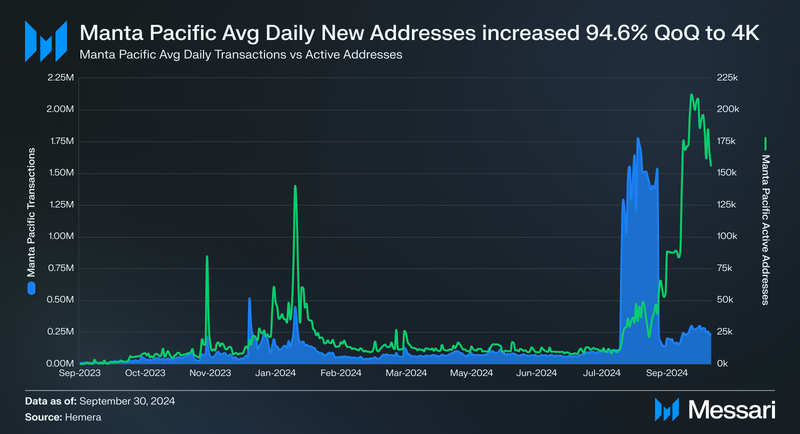

- Several of Manta Pacific’s metrics saw substantial growth QoQ, including average daily transactions (+551.8%), average daily active addresses (+440.0%), and average daily new addresses (+94.6%).

- GameFi transactions dominated Manta Pacific’s network activity, accounting for 97.5% of all Manta Pacific transactions in Q3. Telegram clicker game Taman was responsible for 30 million of Manta Pacific’s 39.5 million transactions over the quarter.

- The Manta Foundation supported six projects with its $50 million EcoFund. The Manta Foundation invested in or issued grants to blockchain projects, including dappOS, World of Dypians, DappLink, Cycle Network, Nest Layer, and Blocksense.

- Manta Network introduced the Gas Gain gas fee rebate program. This program redistributes 50% of gas fees to the top 400 participants, measured by points.

Primer

Manta Network (MANTA) is an ecosystem of networks offering scalable execution environments for applications. It consists of two distinct networks: Manta Pacific, a modular EVM-compatible Ethereum L2, and Manta Atlantic, an L1 chain on Polkadot. Since the launch of Manta Pacific, network activity has migrated away from Manta Atlantic to Manta Pacific. However, staking operations continue on Manta Atlantic.

With the introduction of the New Paradigm bridge in December 2023, Manta Pacific implemented native yield generation for ETH and supported stablecoins. Manta’s New Paradigm campaign concluded in Q1’24, but Manta has since launched the zkLink Aggregation Parade, Retaking Paradigm, Renew Paradigm, and most recently, Manta Expedition. Like New Paradigm, these campaigns incentivize users to bridge assets into the Manta ecosystem by providing additional rewards and yield opportunities. Manta Network has raised over $60 million from a pre-seed, seed, community, and Series A round. The Series A round was held at a $500 million valuation. For a full primer on Manta Network, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

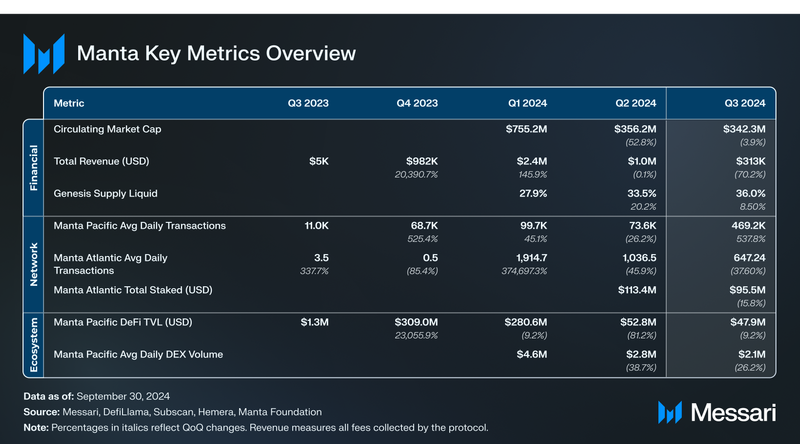

Key Metrics

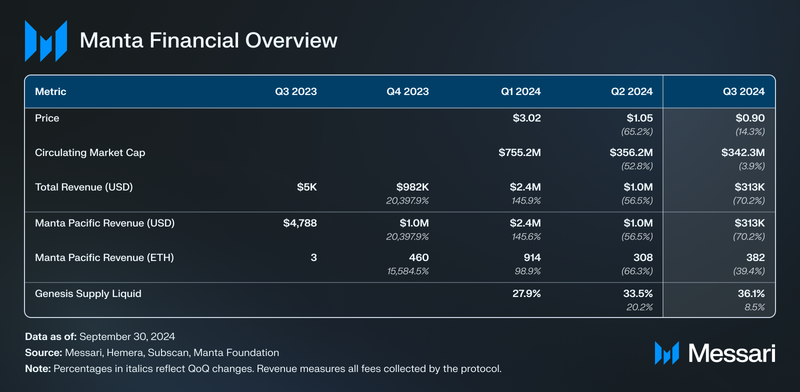

Financial Analysis

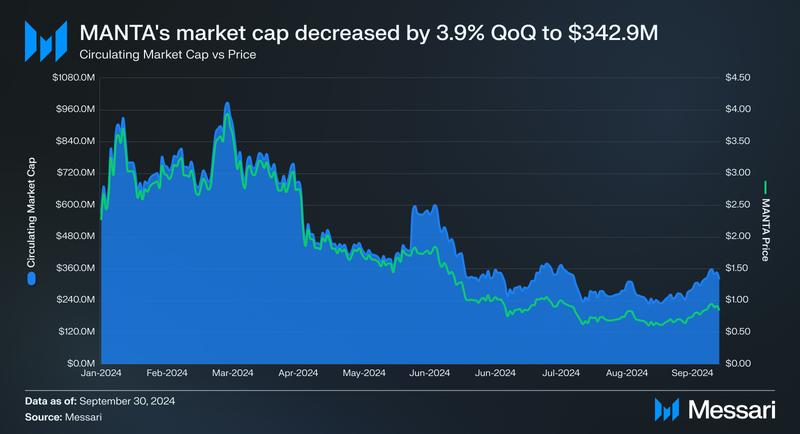

During Q3’24, Manta’s market cap decreased by 3.9% from $356.2 million to $342.3 million. The circulating supply of MANTA increased modestly, with the liquid supply rising to 36.0%, a QoQ increase of 8.5%. MANTA’s price fell by 14.3% over the quarter to $0.90. At the end of the quarter, Manta Network’s market cap ranked 163rd among all cryptocurrencies.

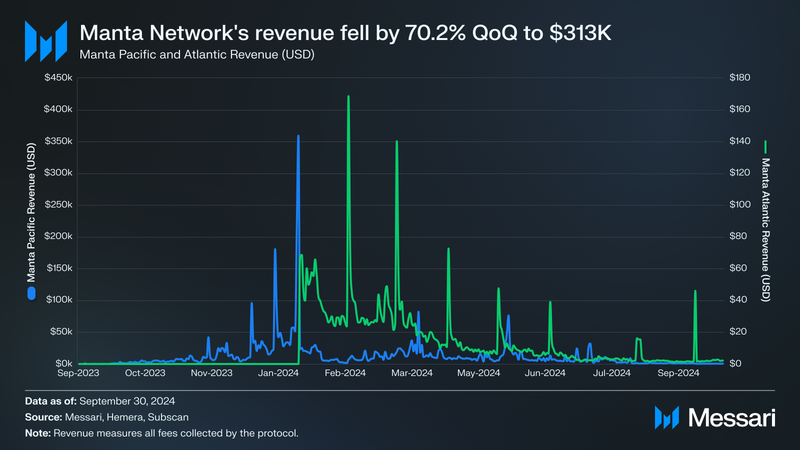

Manta Network’s total revenue, i.e., all fees collected by the protocol, experienced a 70.2% reduction QoQ, falling from $1.0 million in Q2’24 to $0.3 million in Q3’24. This decline in revenue occurred despite a surge in average daily transactions on Manta Pacific. This divergence can be attributed to the integration of Celestia for data availability and the rise of simple transactions related to GameFi applications on Manta Pacific. The integration with Celestia enabled Manta Pacific to reduce gas fees on the network, impacting revenue metrics but improving user experience. The revenue decline breaks down to a 70.2% reduction for Manta Pacific and a 71.9% drop for Manta Atlantic on a QoQ basis.

Since its inception, Manta Pacific has consistently generated the majority of Manta Network’s revenue as network activity and application development have migrated away from Manta Atlantic to Manta Pacific. Manta Atlantic accounted for a negligible portion of Manta Network’s total revenue in Q3’24, but it remained the hub for MANTA staking and emission distribution. Only MANTA staking and Bifrost, a liquid staking protocol, are currently supported on Manta Atlantic. The initial surge in Manta Pacific’s revenue coincided with the Token Generation Event (TGE) on Jan. 18, 2024, while subsequent peaks in Manta Atlantic’s earnings aligned with the token unlock schedule.

Toward the end of Q4’23, Manta Pacific began integrating Celestia for data availability to provide higher throughput and cheaper transaction fees on the network. Just 1 month after Celestia’s integration, Manta Network estimated a gas fee cost savings of over $1.1 million for users. As of this writing, Manta Network estimates a total savings of over $12.3 million on transaction fees due to this integration.

Manta Network’s transaction fees are allocated as follows:

- 10% is directed to block producers.

- 18% supports Manta Network’s community treasury for development initiatives.

- 72% is reserved as incentives for projects within the Manta ecosystem.

On Sep. 30, 2024, Manta announced the Gas Gain program, the first program to repurpose L2 gas fee profits as gas fee rebates. This program incentivizes onchain activity by rewarding MANTA to users who engage with various dApps on the network. With Gas Gain, 50% of Manta Pacific’s gas fee profits will be converted to MANTA and distributed among the top 400 participants based on a points system. Participants can view their rank on the global leaderboard here.

MANTA also determines collators for block production. Users stake MANTA to collators that participate in block production and earn inflationary MANTA rewards. Only the top 64 registered collators by stake weight can participate in block production. Users delegate their MANTA to collators to earn a share of block rewards.

Beyond staking and paying transaction fees, MANTA is used for governance. Manta Network’s governance will evolve through two phases. In the first phase (Manta Governance 1.0), Manta Network established a community forum for stakeholders to propose and discuss project-related matters. However, the ultimate decision-making and execution of proposals rests with the Manta Foundation.

Subsequently, in the second phase (Manta Governance 2.0), the network will transition to a “Five Council” governance model. As of the end of the quarter, the project team has yet to disclose when Manta Governance 2.0 will begin. Their development roadmap, along with important events, can be found here.

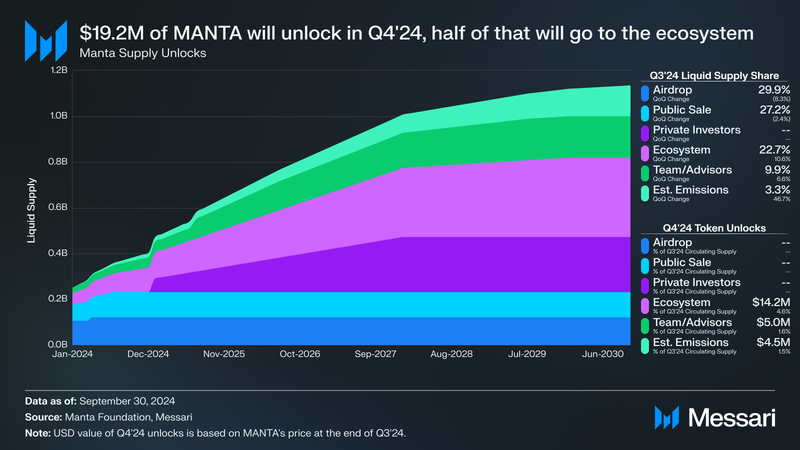

By the end of Q3’24, 36.0% of MANTA’s genesis supply was liquid, marking an 8.5% QoQ increase. This liquid supply is part of the 1 billion MANTA initially allocated during the token’s launch in January 2024. Looking ahead to Q4’24, an additional $19.2 million worth of MANTA, or 2.1% of Manta’s genesis supply, will unlock.

MANTA has an annual inflation rate of 2%, which accrues entirely to Manta Atlantic block producers. During Q3’24, an additional 5 million MANTA will be minted and emitted as block rewards.

The key components of the Q4’24 unlocks include:

- Ecosystem/Treasury (59.8% of Q4 unlocks): Approximately $14.2 million in MANTA tokens will unlock to the ecosystem, supporting community-driven initiatives like grants, ambassador programs, and boosted yield, along with allocations to the protocol’s treasury held by the Manta Foundation.

- Advisors (21.2% of Q4 unlocks): About $5.0 million in tokens will be unlocked for Manta Network advisors. The team has an 18-month cliff and will receive tokens on July 18, 2025.

- Estimated Emissions (19.0% of Q4 unlocks): Around $4.5 million in MANTA is set to be minted from emissions, providing additional liquidity to the market and supporting ongoing network participation incentives.

Notably, no unlocks are scheduled for private investors during Q4’24. Private investors’ first unlock is scheduled for January 18, 2025.

Network Analysis

Usage

In Q3 2024, Manta Pacific experienced substantial growth across key network activity metrics, showcasing an expansion in user engagement and onboarding.

Average daily transactions on Manta Pacific saw a significant increase, rising by 551.8% QoQ from 73,700 in Q2 to 479,400 in Q3. In addition, average daily active addresses increased significantly, growing by 440.5% QoQ from 11,500 in Q2 to 62,300 in Q3.

The creation of a new address on Manta Pacific also saw a notable uptick. The number of average daily new addresses nearly doubled, growing from 2,035 in Q2 to 3,961 in Q3.

In terms of dApp activity, the over 39.5 million dApp transactions on Manta Pacific over Q3 came from:

- DeFi – 554,000 (1.4%) transactions from DeFi dApps like QuickSwap DEX, KiloEx perpetual futures DEX, and the LayerBank money market protocol.

- Bridges – 382,000 (1.0%) transactions from Bridges and interoperability protocols like DappOS, Hyperlane, RhinoFi, and MiniBridge. As of writing, Manta Pacific has seen over $925 million in total value bridged, and the L2’s official bridge has seen over 46,000 unique addresses.

- GameFi – 38.5 million (97.4%) transactions from GameFi dApps like the Taman, World of Dypians, and Elfin. Over Q3’24, the Taman telegram clicker-game mini-app was responsible for more than 30 million transactions on Manta Pacific, accounting for 76% of the total transactions during the quarter.

- Social – 82,000 (0.2%) transactions from the social dApp DMail Network.

Security

As of this report’s writing, Manta Atlantic has 64 validators and 113.6 million MANTA staked. The Manta Atlantic parachain is connected to Moonbeam, Bifrost, AssetHub Polkadot, Acala, and the relay chain.

MANTA’s annual 2% inflation entirely accrues to Manta Atlantic block producers. Only the top 64 registered Collators by total stake can participate as block producers. To qualify as Collators, users must post a minimum of 400,000 MANTA as bonds and meet the network’s hardware requirements.

Manta Network partnered with BlockSec in July to launch the Sequencer Threat Overwatch Program (STOP). This program integrates BlockSec’s Phalcon engine directly into Manta Pacific’s Layer-2 chain, enhancing security at the sequencer level and protecting against malicious transactions such as front-running, transaction reordering, and DDoS attacks. This security upgrade reinforces Manta Network’s commitment to safeguarding the platform’s infrastructure.

On July 17, Manta Network announced its integration with Ledger for Manta Atlantic, enhancing token storage security. This integration allows users to safeguard their assets on Manta Atlantic using Ledger’s industry-leading hardware wallet solutions.

Ecosystem Overview

DeFi

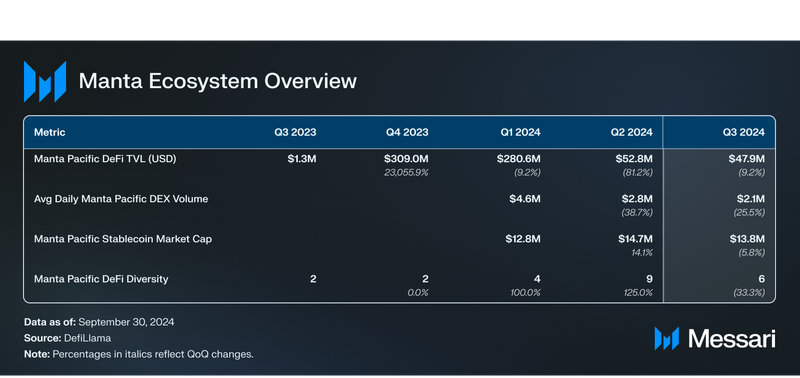

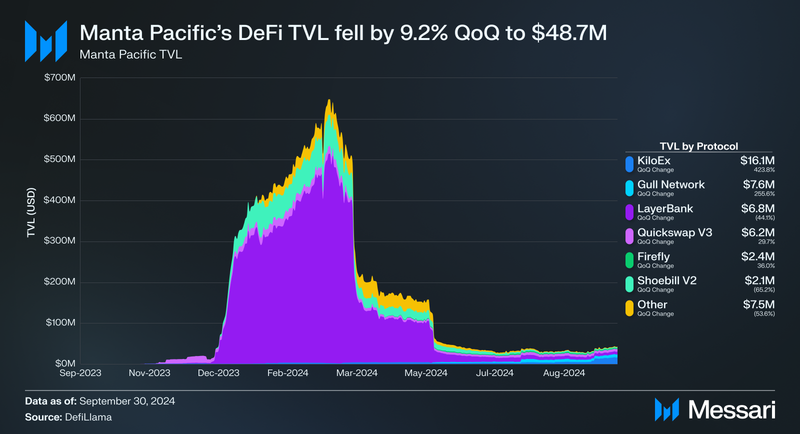

In Q3 2024, Manta Pacific’s DeFi total value locked (TVL) experienced a modest decrease, falling by 9.2% QoQ to $48.7 million. While this represents a stabilization compared to the significant losses in Q2, the platform’s DeFi TVL remains well below the peak levels seen earlier in the year. The stability in Q3 can be attributed to several leading protocols that drove increased activity on the network.

KiloEx, a perpetual futures DEX, emerged as the dominant protocol by TVL. It contributed $16.1 million to Manta Pacific’s TVL, a 423.8% increase QoQ. Other key contributors included:

- Gull Network with $7.6 million in TVL, up 255.6% QoQ.

- LayerBank, with $6.8 million in TVL, up 44.1% QoQ.

- QuickSwap, with $6.2 million in TVL, up 29.7% QoQ.

Additional contributions came from protocols such as Firefly ($2.4 million, up 36.0% QoQ), Shoebill V2 ($2.1 million, up 65.2% QoQ), and ZeroLend ($1.2 million, despite a 62.2% QoQ decline) and ApertureSwap ($1.2 million, down 48.6% QoQ). Even with this improvement, Manta Pacific’s TVL ended the quarter far below the highs of early 2024, reflecting ongoing challenges. Some of these challenges include the changing market conditions and the expiration of reward programs, which had previously driven much of the network’s liquidity.

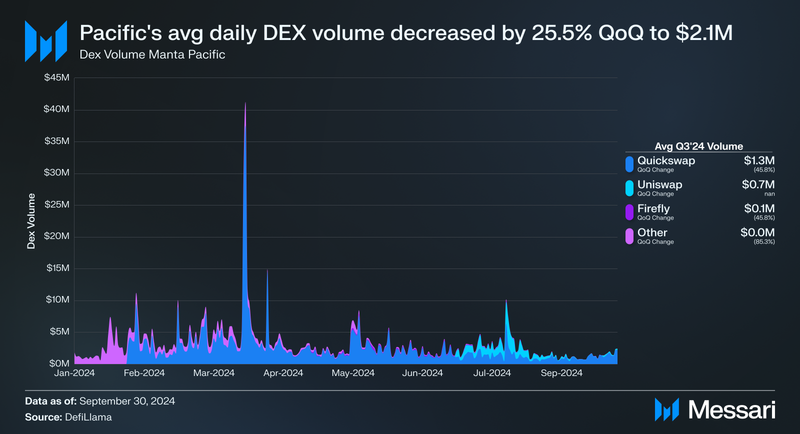

In Q3 2024, Manta Pacific’s average daily DEX volume declined by 25.5% QoQ, falling from $2.8 million in Q2 to $2.1 million. Despite the overall drop in volume, Quickswap remained the dominant DEX on Manta Pacific, accounting for 61.4% of the total volume. Quickswap’s average daily volume decreased by 45.8% QoQ to $1.3 million.

Uniswap followed as the second-largest contributor, recording an average daily volume of $724,000 during the quarter, while Firefly saw an average volume of $56,000, down by 45.8% QoQ. Other DEXs accounted for a negligible share of average daily volume, with their combined volume decreasing by 85.3%.

In Q3 2024, Manta Pacific’s DeFi Diversity declined by 33.3% QoQ, dropping from 9 to 6. This reduction was primarily due to consolidation within the ecosystem, with several larger protocols dominating the market. DeFi Diversity measures the number of dApps that make up 90% of the network’s total DeFi TVL.

Manta Pacific’s stablecoin market cap fell by 5.5% QoQ to $13.9 million in Q3 2024. USDT remains the dominant stablecoin, with a market cap of $9.3 million, making up 67% of the stablecoin market. USDC, the second-largest stablecoin, declined 28.6% QoQ, dropping to a $3.8 million market cap. USDz, Anzen Finance’s RWA-backed stablecoin launched on Manta Pacific this quarter, reached a market cap of $650,000. GAI and USDe remain minor players on the network, with GAI holding $43,000 in TVL and USDe at $2,700.

Perpetual Futures

Manta Network strengthened its DeFi offerings through a collaboration between KiloEx and Stake Stone, launching the KiloEx Hybrid Vault on July 22, 2024. This innovative product enables MANTA and STONE tokenholders to stake their assets and earn yields, adding valuable utility to the ecosystem. The vault experienced swift adoption, attracting over 2 million MANTA tokens within 24 hours, highlighting strong demand for new DeFi solutions within the Manta community.

Liquid Staking

On May 21, Bitfrost’s vMANTA remains the largest LST on Manta Pacific. As of quarter end, the product has 8.5 million MANTA staked and offers 18.4% APY. This yield is comparable to natively staking MANTA on Manta Atlantic, where yield ranges from 5% to 24%.

The other LST on Manta Network is stMANTA, offered by Accumulated Finance. Even though its product went live shortly after TGE on January 31, it only has 596,000 MANTA staked, offering a 19.4% APY.

Restaking Paradigm

In Q2, Manta Network also announced its Restaking Paradigm, which allows users to use LRTs to generate more yield on Manta Pacific by depositing ETH or stETH into Manta’s pools. Manta’s Restaking Paradigm continued through Q3. Currently, there are four pools for the Restaking Paradigm:

- Ether.fi: This pool has $310,000 in TVL and grants users 1x ether.fi points and 1x EigenLayer points.

- Puffer: This pool has $148,000 in TVL and grants users 5x Puffer points and 1x EigenLayer points.

- Kelp DAO: This pool has $30,000 in TVL and grants users 2x Kelp Miles and 1x EigenLayer points.

- Bedrock: This pool has $21,000 in TVL and grants users 4x Bedrock Diamonds and 1x EigenLayer points.

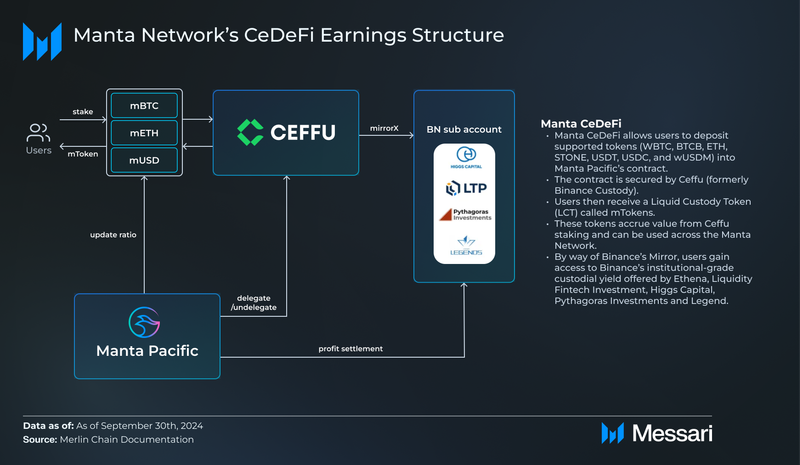

Manta CeDeFi

In Q2, Manta Network announced CeDeFi, a yield-boosting reward program. Manta CeDeFi allows users to deposit supported tokens into Manta Pacific’s contract, which will be secured by Ceffu (formerly Binance Custody). When users deposit to Manta CeDeFi, they receive mTokens, a collection of LSTs representing users’ deposits. In Q3, Manta announced the launch of staking functionality for mTokens. During Q3, users could stake mTokens to earn points redeemable for MANTA rewards. This points campaign ran from May 19 until July 27, 2024.

At the end of Q3, the CeDeFi program had $96.0 million TVL while offering the following APRs:

- BTC: 3.5% APR with $36.5 million TVL

- ETH: 3.0% APR with $46.0 million TVL

- USDT/USDC/wUSDM: 6.2% APR with $12.2 million TVL

Gaming

In Q3 2024, Manta Network saw growth in its blockchain gaming sector, with three standout projects gaining significant traction on the platform: Elfin Games, World of Dypians, and Taman.

Elfin Games

Elfin Games, the developer behind the Elfin Metaverse, broke records on Manta Network in Q3. On July 15, 2024, Elfin Metaverse became the top dApp for transactions on the platform for seven consecutive days. By August 5, 2024, Elfin Games reached a milestone of 1 million onchain transactions on Manta Pacific.

Expanding its gaming portfolio, Elfin Games also launched “BONK Spaceship Tap2Earn” on August 22, 2024. This play-to-earn game blends memecoin BONK with spaceship-building mechanics. Players tap their screens to earn Galactic Coins, used to upgrade their spaceships, with monthly rewards of up to 30,000 MANTA and 20,000 ELFIN tokens, distributed based on performance.

World of Dypians

Another standout, World of Dypians, a Play-to-Earn MMORPG, recorded over 5 million transactions during Q3, making it the second most active dApp on Manta Pacific. The game allows players to explore a metaverse, engage with other players, and earn rewards. World of Dypians also received a grant from the Manta Foundation’s Ecosystem Grant Program.

Taman

The Telegram-based mini-app clicker game Taman became prominent in Manta Network’s gaming sector. The game achieved 2 million transactions on Manta Pacific within two days of its launch by Aug. 8, 2024. By the end of Q3, Taman alone was responsible for over 38.5 million transactions, accounting for 76% of Manta Pacific’s total transactions over the quarter. These figures underscore the Manta Network’s growing appeal to developers and gamers in the blockchain gaming space.

Ecosystem Growth

On July 3, 2024, the Manta Foundation announced the launch of a $50 million EcoFund to support Manta Network builders. The EcoFund aims to accelerate the growth of the Manta Network ecosystem by investing in native applications and technology partners. The EcoFund has allocated $35 million for strategic investments, $10 million for grants, and $5 million for events and hackathons. Builders are invited to apply here.

The first projects to receive grants or investments include:

- dappOS (Infra): Intent execution network enabling dApps to be intent-centric.

- World of Dypians (Gaming): Play-to-Earn MMORPG that allows players to interact with each other in a digital environment.

- DIN (Infra): First modular AI-native data pre-processing layer building a data intelligence network to process data for AI.

- DappLink (Infra): An Infrastructure provider that enables Manta Network’s fast finality through optimized consensus mechanisms, interoperability and scalability enhancements, and modular infrastructure.

- Cycle Network (Infra): A blockchain infrastructure platform that provides seamless cross-chain liquidity and interoperability through bridgeless liquidity abstraction technology.

- Nest Layer (DeFi): a DeFi suite consisting of dropnest, stakenest, yieldnest, and earnnest, which help users access optimized yield strategies across DeFi.

- Blocksense (Infra): Zero-knowledge rollup for verifiable data and compute oracles secured by EigenLayer.

To further grow its ecosystem and strengthen its presence in the blockchain space, Manta Network actively engaged with the community by participating in several key industry events during Q3 2024, and community meet-ups, including:

- ETHCC (Ethereum Community Conference) in Belgium: The Manta Network team participated in talks, hosted events, and interacted with the community.

- Malaysia Blockchain Week (MYBW) in Kuala Lumpur: From July 31 to Aug. 1, 2024, the team participated in panels, attended side events, and maintained a booth at the main conference.

- Coinfest Asia in Bali: This event, which took place on Aug. 22-23, 2024, was sponsored by Manta Network and featured co-founder Victor Ji as a speaker.

- Korea Blockchain Week: The Manta Network attended this conference on Sept. 2-3. Manta Network also hosted a community meetup during the conference.

- Asia Blockchain Summit (ABS2024): Manta Network participated in ABS 2024 Aug. 6-12. Manta Network co-founder Kenny Li spoke at ABS 2024 and Foresight 2024.

- Manta Mafia Meet-Up in India: On Aug. 10, 2024, the Manta held a community meet-up in India.

- Manta Meet-Up in Moscow: On Aug. 19, 2024, the Manta held a community meetup in Moscow.

- Pho with Manta in Vietnam: On Aug. 23, 2024, Manta held a community meet-up in Ho Chi Minh, Vietnam

- Manta Meetup Tokyo: on Aug. 29, 2024, Manta held a community meet-up in Tokyo.

Other ecosystem development announcements include:

- MultiDA: In Q3, Manta Network introduced MultiDA, a modular data availability solution that integrates multiple data availability services, such as Celestia, EigenDA, NEAR DA, Nubit, and Dill. This innovation aims to enhance the network’s scalability and resilience by diversifying data storage, ensuring that the platform can handle increased user and transaction volumes without sacrificing security by establishing redundancies through working with multiple data availability service providers.

- Stablecoin Treasury Allocation: In July, the Manta Foundation allocated a portion of its stablecoin treasury to wUSDM, a yield-bearing stablecoin secured by BlackRock’s BUIDL Fund. This partnership connects Manta Network with institutional-grade custodianship and further strengthens its DeFi offering by integrating traditional financial expertise with decentralized systems.

- “Meme-ta szn” Initiative: Manta Network partnered with BONK to launch the “Meme-ta szn” campaign to boost community engagement through meme culture. The program allocated 1 million MANTA tokens as rewards for participants contributing to meme creation and community activities, fostering a fun and creative interaction between Manta and Solana ecosystem users.

- Manta Ambassador Program – Season 2: Following the success of Season 1, Manta Network launched Season 2 of its Ambassador Program. This initiative encourages content creators and community leaders globally to promote Manta’s ecosystem. Participants earn rewards based on their contributions, furthering the network’s global outreach and community-building efforts.

- Manta Expedition: Most recently, Manta introduced the Manta Expedition, a point-based program designed to engage users through onchain quests and challenges. It offers rewards for completing various tasks like bridging, depositing to Manta CeDeFi, or holding various assets like STONE or wUSDM. This gamified approach aims to boost user interaction and incentivize participation within the ecosystem, contributing to increased engagement and onboarding of new users. Manta Expedition will run from October 23, 2024, to January 23, 2024.

Closing Summary

During Q3 2024, Manta Network’s market cap experienced a smaller decline than in Q2, falling 3.9% from $356.2 million to $342.3 million. Revenue dropped significantly, decreasing by 70.2% from $1.1 million to $0.3 million Manta Pacific’s DeFi TVL also fell by 9.2%, from $52.8 million to $47.9 million. Despite these declines, Manta Pacific recorded notable growth in several key metrics.

Average daily transactions surged by 551.8% to 479,400, while average daily active addresses increased by 440.5% to 62,300, and average daily new addresses rose by 100.3% to 4,000. These metrics highlight strong user engagement and activity across the ecosystem, with much of the growth driven by the gaming sector. In Q3 2024, GameFi accounted for 97.4% of total transactions, led by popular games like Taman, a Telegram-based clicker game, alongside Dypian and Elfin, which together generated over 38.5 million of Manta Pacific’s 39.5 million total transactions during the quarter.

Manta Network expanded its ecosystem by launching the $50 million EcoFund, which supported projects like dappOS and World of Dypians in Q3. Manta also launched initiatives like “Meme-ta szn,” “Gas Gain,” and “Manta Expedition” to drive community engagement and growth into Q4 and beyond.