Key Insights

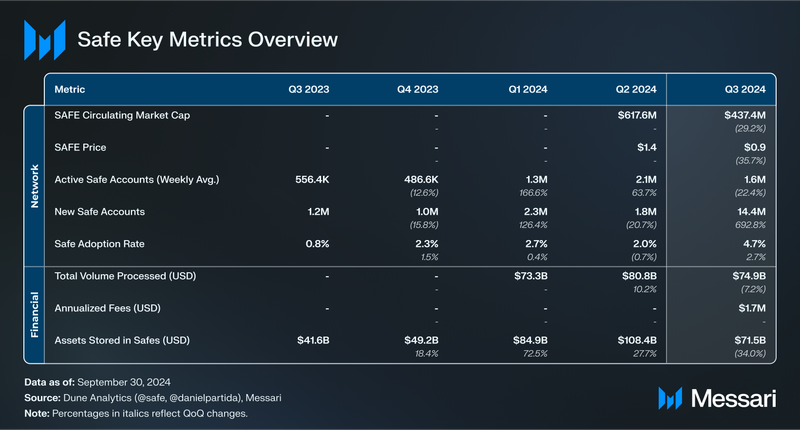

- To facilitate revenue generation, Safe launched community-aligned fees for the native swap integration. Thus, SafeDAO accrued $1.7 million in annualized fees in Q3’24.

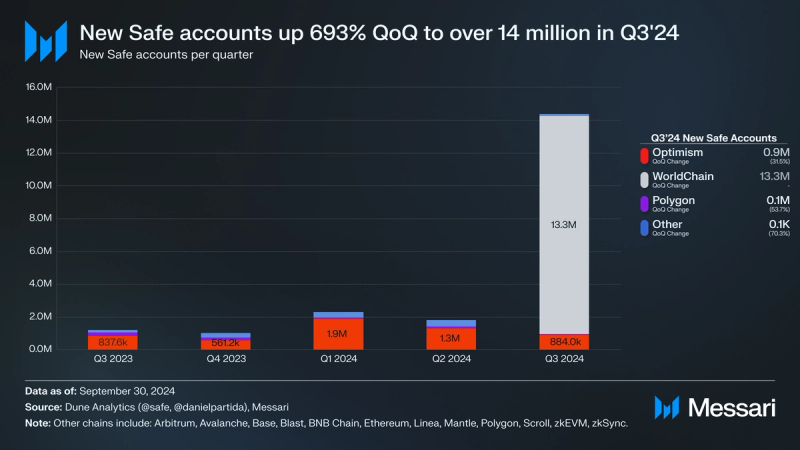

- Safe witnessed an all-time high of over 14 million new accounts in Q3’24, up 693% QoQ. World IDs accounted for nearly 93% of Safe’s new accounts in Q3.

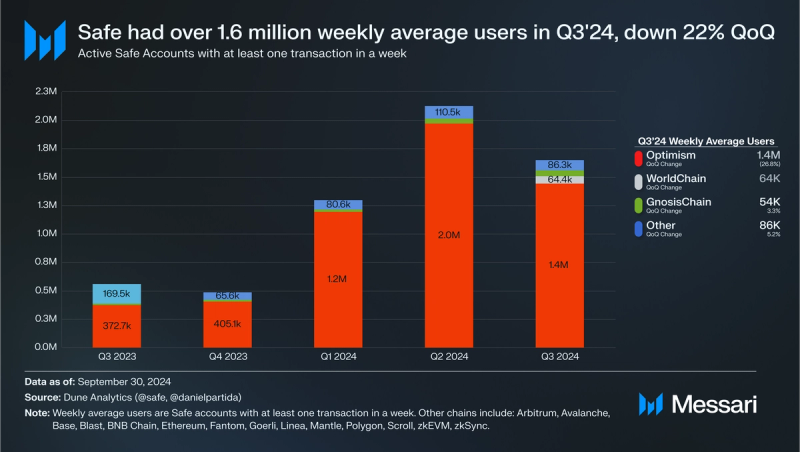

- Safe users continued to derive value from the core wallet product, with 1.6 million weekly active accounts (down 22% QoQ).

- In Q3’24, Optimism accounted for 88% of Safe’s active users and World Chain onboarded 93% of all newly created accounts. In contrast, Ethereum accounted for over 83% of the total volume processed and 84% of assets stored in Safes in Q3’24.

- Safe expanded its technological offerings by launching Safe{Foundry}, an open-source initiative focused on account abstraction and chain interoperability.

Primer

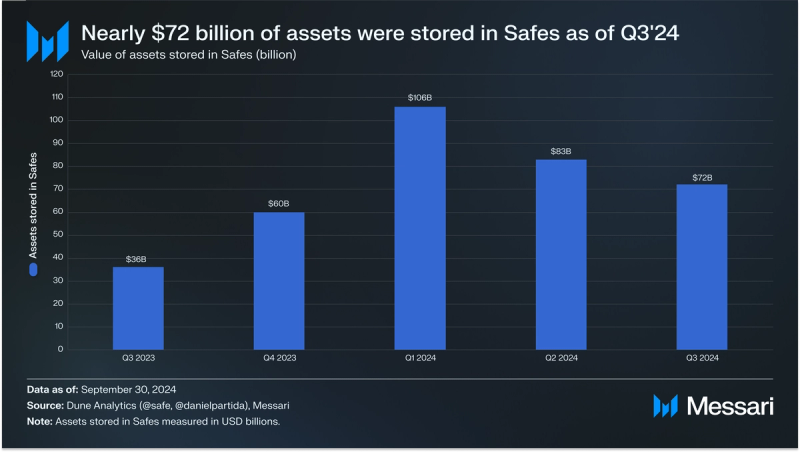

As of Q3’24, over $72 billion of assets were stored in 25+ million deployed smart accounts, making Safe one of the go-to solutions for smart contract wallets. Previously called Gnosis Safe, Safe aims to create the standard for ownership with smart accounts.

Safe is largely used as a multi-sig wallet. It enables individuals to securely self-custody their funds and organizations to manage their treasury operations effectively. As per Messari’s wallet landscape analysis, Safe is a wallet infrastructure aggregator, in addition to offering smart contract wallets, namely:

- Safe{Wallet}: Main product in the form of a smart wallet solution (i.e., Safe’s user-facing smart contract wallet),

- Safe{Core}: Infrastructure protocol that powers both Safe’s wallet solutions and other projects (e.g., Worldcoin),

- Safe{Foundry}: Open source initiative on account and chain abstraction.

The Safe community voted to make the SAFE token transferable in Q2’24. In Q3’24, Safe launched community-aligned fees for native swaps as the first integration within Safe{Wallet} to facilitate revenue generation for SafeDAO.

Website / X (Twitter) / Discord

Key Metrics

Network

The usage of Safe can be gauged in terms of account and transaction activity across Safe’s multiple deployments. As of Q3’24, Safe has been deployed on 20+ networks, including Optimism, Worldchain, Gnosis Chain, Polygon, zkSync, Arbitrum, Avalanche, Base, Blast, BNB Chain, Celo, Ethereum, and Fantom.

New Accounts

Nearly 14.4 million Safe smart accounts were newly created in Q3’24, up 693% QoQ from 1.8 million in Q2’24. The deployment of the Safe{Core} smart account infrastructure on the World Chain in August 2024 corresponded to over 13.3 new Safe accounts being created on World Chain. That is, 93% of all new accounts in Q3’24 were created on World Chain.

Prior to the World Chain launch, Worldcoin migrated from Polygon to Optimism’s ecosystem via OP Mainnet in Q2’23. As of Q3’24, Optimism accounted for 884,000 (6%) of all newly created Safe smart accounts, second to World Chain. The rise in new Safe accounts on both World Chain and Optimism can be largely attributed to the creation of new World IDs, making World App one of the first applications leveraging Safe smart accounts at scale.

Active Accounts

Weekly average users are measured as Safe smart accounts with at least one outgoing transaction in a week.

Safe had over 1.6 million weekly average users in Q3’24, down 22% QoQ from 2.1 million in Q2’24. There were over 1.4 million weekly average Safe users on Optimism, totaling 88% of Safe’s weekly average users in Q3’24. Simultaneously, World Chain and Gnosis Chain accounted for over 64,000 (4%) and 54,000 (3%) weekly active users in Q3’24, respectively.

For context, weekly active users started to grow considerably as of Q1’24, following the Dencun upgrade, which has led to significant reductions in transaction fees on Layer-2s. The lower transaction costs may alleviate the high usage costs associated with smart wallets, as per Messari’s analysis.

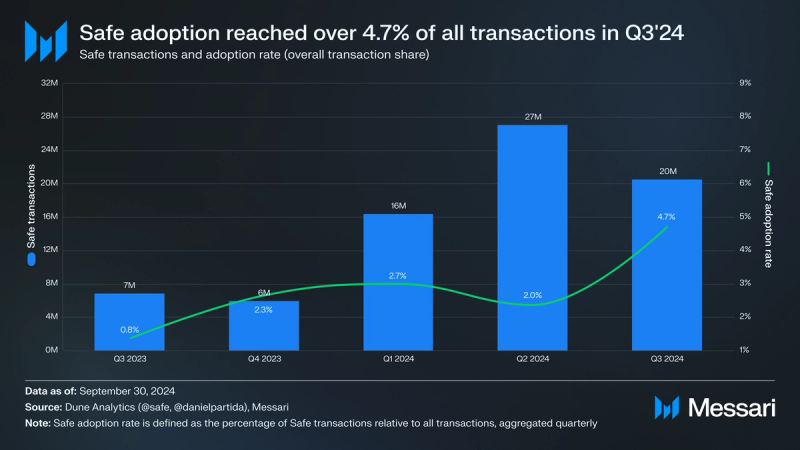

Adoption

In line with the number of active Safe users, transactions involving Safe smart accounts — Safes — declined 24% QoQ from 27 million in Q2’24 to over 20 million in Q3’24. For perspective, the share of Safe transactions relative to all transactions reached nearly 2% in Q3’24. To add more color to these figures, it is worth analyzing the volume of transfers where a Safe smart account is involved.

Total Volume Processed

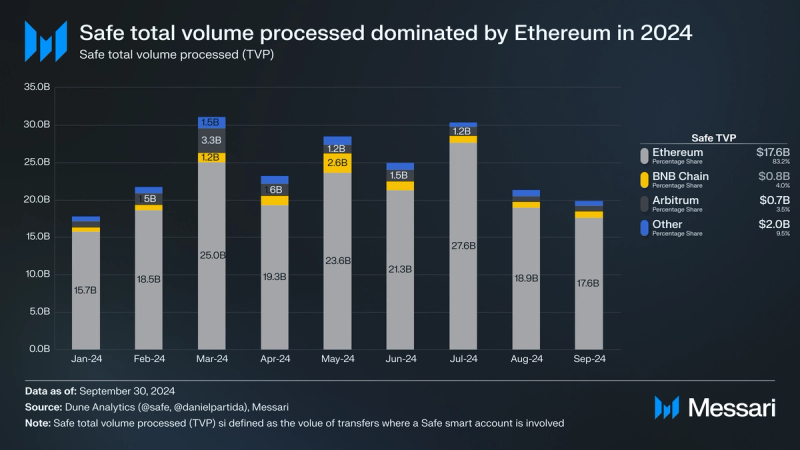

In Q3’24, the total volume processed (TVP) on Safe was nearly $75 billion. In Sept. 2024, Ethereum accounted for over 83% of TVP, whereas BNB Chain and Arbitrum accounted for 4% and 3.5%, respectively.

As per Messari’s wallet landscape analysis and the recent infrastructure vs. applications debate, infrastructure aggregators such as Safe are expected to further benefit from an influx of new crypto applications.

Financials

Over the past quarters, the Safe community discussed several strategies to enhance the utility of the SAFE token and potentially generate revenue by linking activity to token utility.

Fees

In Q3’24, the Safe DAO approved the first revenue stream for SafeDAO in the form of community-aligned fees using a license model. Safe launched community-aligned fees for native swaps as the first integration within Safe{Wallet} to facilitate revenue generation for SafeDAO. For token pairs excluding stablecoin-only pairs, the swap fees that contribute to the Safe community-aligned fees are as follows:

- 0.35%: for trade size between $0 – $100,000;

- 0.20%: for trade size between $100,000 – $1,000,000;

- 0.10%: for trade size above $1,000,000.

For stablecoin-only pairs, the fees are:

- 0.10%: for trade size between $0 – $100,000;

- 0.07%: for trade size between $100,000 – $1,000,000;

- 0.05%: for trade size above $1,000,000.

Annualized Safe community-aligned fees reached $1.7 million since their introduction in Q3’24. Further revenue streams, such as native staking, are expected to be launched in the following quarters.

Assets Stored in Safes

A further way to gauge the economic value of Safe accounts is to consider assets under management (AUM). In the case of Safe, the dollar value of assets stored (total value locked) in Safe smart accounts is a suitable proxy for AUM.

As of the end of Q3’24, there was over $72 billion in assets stored in Safes, after reaching an all-time high of $106 billion in Q1’24. The drop was in line with the overall crypto market cool-off. In terms of distribution by chains, Ethereum led the way with $60 billion (84%) of assets stored on Safe smart accounts, followed by Optimism with $4 billion (5%), and BNB Chain with $4 billion (5%).

Notably, while Optimism accounted for 88% of Safe’s active users in Q3’24, its corresponding share of assets stored in Safes is only 5%; in turn, Ethereum accounted for less than 1% of active users, but for 84% of assets stored in Safes in Q3’24. This shows that Ethereum stores a large share of assets that are moved less frequently than on Layer-2s.

Qualitative Analysis

Key Developments

Launch of Safe{Foundry}

In Q3’24, Safe launched Safe{Foundry}, an open-source research initiative focused onchain abstraction through smart accounts. Developed in collaboration with Scroll and Base, Safe{Foundry} is leading two projects:

- L1 KeyStore: aims to create a unified multichain keystore. By abstracting key management at the Layer-1 level, L1KeyStore aims to simplify cross-chain interactions and improve security for users operating across multiple networks.

- Base Minimum KeyStore Rollup (MKSR): integrates KeySpace with Safe SmartAccount, focusing on advanced key management solutions. MKSR aims to reduce complexity and improve security when handling cryptographic keys.

Community-Aligned Fees

SafeDAO approved the first revenue stream for SafeDAO in the form of community-aligned fees using a license model. In Q3’24, Safe launched community-aligned fees for native swaps as the first integration within Safe{Wallet} to facilitate revenue generation for the SafeDAO.

Multi-Chain Gas Station Program

Safe announced the Safe{Core} multi-chain Gas Station program, an initiative to support developers by providing credits to cover gas fees with ERC-4337 paymasters. Safe has allocated $200,000 on Polygon PoS and $50,000 on Gnosis Chain for the program.

Integrations with Linea, Mantle, and World Chain

In Q3’24, Safe announced the integration of Safe{Core} account abstraction stack and Safe{Wallet} multisig with Linea, Mantle, and WorldChain. The Safe{Core} stack offers developers a robust framework for building advanced smart contract wallets and decentralized applications (dApps). These deployments aim to make account abstraction more accessible and versatile across the blockchain ecosystem.

Additionally, users who previously managed wallets on multisig.mantle.xyz must now access their wallets and funds via app.safe.global by selecting the Mantle Network, as the Mantle mainnet on multisig.mantle.xyz is expected to be sunset by the end of October. Contacts will need to be manually transferred. Mantle has provided a migration guide for users.

Key Governance

The SafeDAO governance cycle saw community participation through multiple proposals allocating more than $300,000 for initiatives supporting decentralized decision-making and ecosystem development. Several key Safe Ecosystem Proposals (SEPs) were proposed and voted on during this quarter, each addressing different aspects of the Safe ecosystem.

Resource Lock Module (SEP 34)

This successful proposal allocated 75,000 USDC to develop a new module for SAFEs enabling instantaneous cross-chain interactions. The aim is to improve interoperability and expand Safe‘s multichain capabilities, thus removing cross-chain friction.

Enhanced Voting UI/UX on Mobile (SEP 35)

This successful proposal, with a budget capped at $28,000, aims to streamline governance participation through the Lighthouse app. The goal is to simplify the process of proposing, collecting, and executing transactions within governance systems, making it easier and more secure for users, especially delegates managing multiple governance projects, to participate in governance activities.

Governance Cycle Amendments (SEP 40)

This successful proposal suggests changes to the current governance cycle, e.g., implementing a 24-hour proposal change freeze period and adding a 48-hour reflection period.

Transition Period for Committees and Councils Structure (SEP 45)

This successful proposal supports a new governance structure (i.e., the Committees and Councils Structure) and implements a transitional period to migrate to the new structure. By allowing this transition period, SafeDAO attempts to ensure that the governance structure is aligned with the goals as outlined in its Constitution.

Closing Summary

While most smart contract wallets have struggled to find mainstream adoption, Safe has continued to be an exception. As the leading smart contract wallet system, Safe stored nearly $72 billion of assets in its smart contract wallets in Q3 and launched community-aligned fees for native swaps as the first integration within Safe{Wallet} to facilitate revenue generation. The resulting annualized Safe community-aligned fees reached $1.7 million in Q3’24.

Safe witnessed an all-time high of over 14 million new accounts in Q3’24, up 693% QoQ. World IDs accounted for nearly 93% of Safe’s new accounts in Q3. Safe users continued to derive value from the core wallet product, with 1.6 million weekly active accounts (down 22% QoQ) securing $72 billion assets in Q3’24.

While Optimism accounted for 88% of Safe’s active users and World Chain onboarded 93% of all newly created accounts, Ethereum accounted for over 83% of the total volume processed and 84% of assets stored in Safes in Q3’24.

In Q3’24, Safe expanded its technological offerings by launching Safe{Foundry}, an open-source research initiative focused on account abstraction and chain interoperability.

The Safe DAO governance cycle saw community participation through multiple proposals allocating more than $300,000 for initiatives supporting decentralized decision-making and ecosystem development.