Key Insights

- ApeCoin DAO committed over $86 million to fund governance proposals in Q3 2024, a 1007.54% QoQ increase in funding.

- AIP-454, accounting for 88% of committed funds, awarded ~$76 million to the Commercial Agreements Initiative and User Incentives Initiative in the BANANA Bill.

- AIP-436 adds the requirement of a supermajority vote of 69% for any proposal requesting over $250,000 in funding.

- ApeChain’s Curtis testnet was launched in Q3 2024, alongside strategic partnerships with gaming and DeFi platforms.

Primer

ApeCoin (APE) is an ERC-20 token used to govern the ApeCoin DAO, encompassing Ecosystem Fund distribution, governance rules, partnerships, and more.

APE is the adopted token of the APE Foundation, a legal entity that administers the decisions of the ApeCoin DAO. The foundation has a Special Council, called the DAO’s Board, to perform certain functions within the governance process. The operations of the foundation are run by transient administrative entities elected by members of the ApeCoin DAO.

The ApeCoin DAO and the APE Foundation are separate entities from Yuga Labs, the creator of Bored Ape Yacht Club (BAYC) and its associated NFTs. Below is a breakdown of the relevant entities related to APE:

- ApeCoin DAO — A decentralized autonomous organization (DAO) comprising APE tokenholders that create and vote on ApeCoin Improvement Proposals (AIPs).

- APE Foundation — A legal entity that administers the decisions of the ApeCoin DAO.

- Special Council (the DAO’s Board) — Five individuals that oversee the foundation’s administrators and can (i) approve grants outside the AIP process, and (ii) perform certain functions within the ApeCoin DAO governance process. As of October 2024, the Special Council members are Bored Ape G, Waabam, mo_ezz14, Hazel, and Airvey.

- WebSlinger — Administrator of the APE Foundation.

- Yuga Labs — A Web3 company responsible for creating BAYC. Yuga Labs contributes to ApeCoin’s development and plans to use APE as the primary token in future projects like Otherside.

The APE Foundation, the DAO’s Board, and WebSlinger are the primary entities that ensure the implementation of relevant successful AIPs.

Website / X (Twitter) / Snapshot / ApeChain

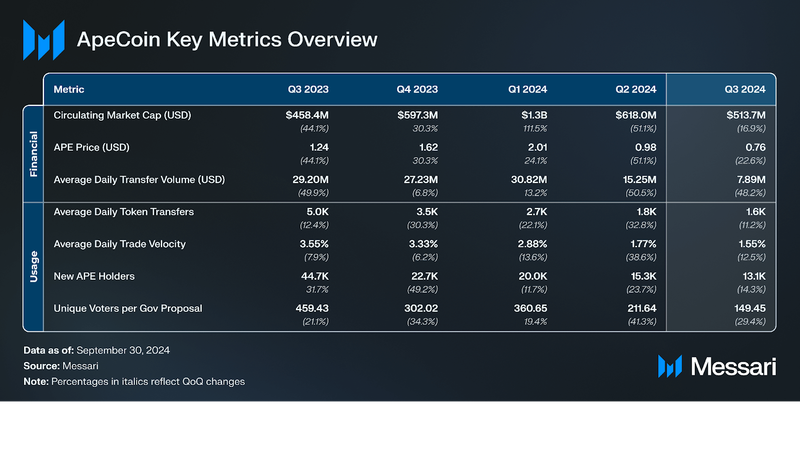

Key Metrics

Performance Analysis

Market Cap

In Q3 2024, APE’s market capitalization declined ~17% QoQ (ranging between $370-$585 million), while the token’s price decreased ~23% QoQ. Notably, the overall crypto market experienced a period of chop from Q2-Q3 2024; however, the higher drop in token price versus market capitalization can be attributed to 46.80 million APE (4.68% of the maximum token supply) being unlocked.

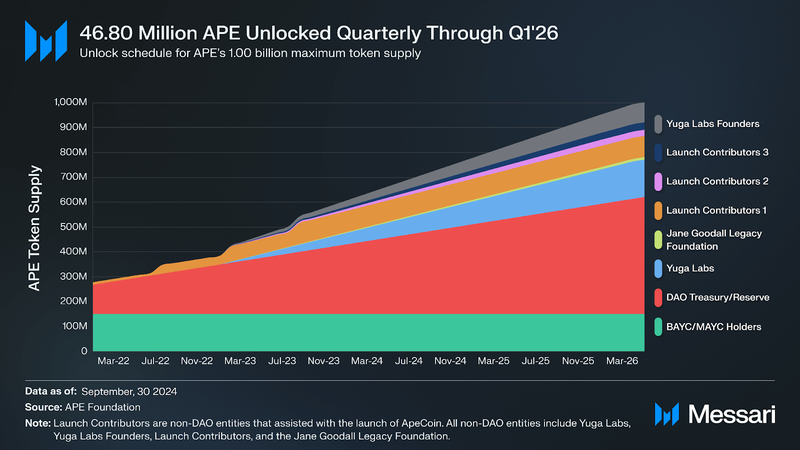

APE Token Unlocks

Token supply curves help determine when an increase in sell pressure may occur. More specifically, they show when tokens unlock and to whom.

Of the 46.80 million APE unlocked in Q3 2024, 22.03 million went to the DAO Treasury, and 24.77 million went to non-DAO entities. The DAO plans to distribute or sell APE to fund select governance proposals, contingent on them successfully being passed. Alternatively, non-DAO entities can freely sell upon funds being unlocked.

As of the quarter’s end, ~72.97% of the maximum token supply (~729.71 million APE) was in circulation, up 6.84% QoQ.

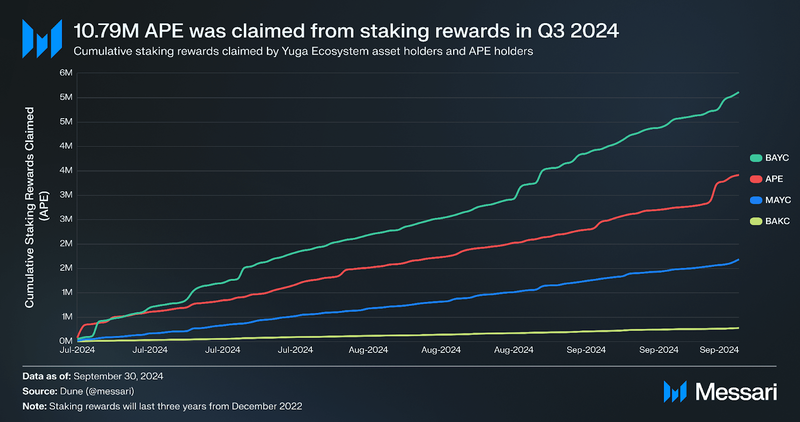

Claimed Staking Rewards

ApeCoin DAO began issuing staking rewards in Q4 2022 after passing AIP-21 and AIP-22, which finalized staking parameters. APE tokenholders and Yuga Labs’ ecosystem asset holders, including Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Bored Ape Kennel Club (BAKC) received staking allocations.

Staking was implemented in early December 2022 and will last for three years. In total, 175.00 million APE (17.50% of the maximum token supply) are to be distributed to existing APE tokenholders and Yuga Labs’ ecosystem asset holders. Due to the emissions curve, the amount of APE claimed has decreased every quarter. In Q3 2024, ~10.79 million APE were claimed, ~10.83% less than the previous quarter. This trend will continue until December 2025.

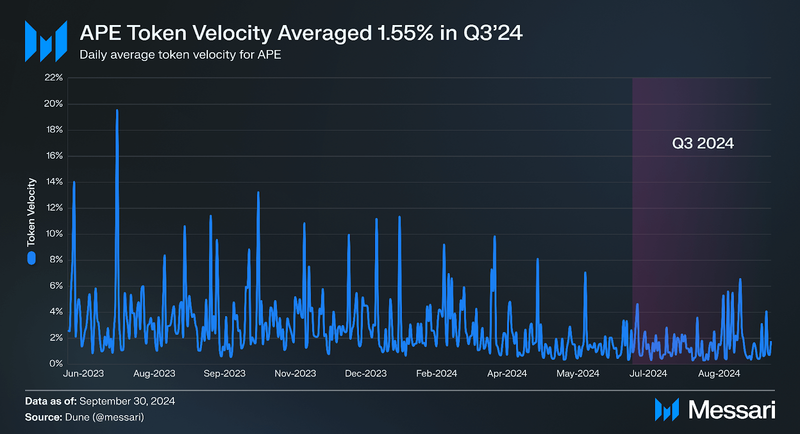

Token Velocity

Token velocity shows the frequency through which an asset changes accounts. A change in token velocity can show a few things depending on the asset.

- If the asset can be used beyond trading, such as within a game, an increase in token velocity may imply that the game encourages the adoption/use of the asset.

- If the asset’s intended use case is more speculative, a decrease may mean that users are more interested in holding it or that it has low demand.

The chart below calculates token velocity by dividing the circulating supply by the seven-day moving average (7DMA) transfer volume.

APE’s daily average token velocity fell from ~1.70% to ~1.55% QoQ, marking a new low. The steady decline and low volatility may indicate that existing tokenholders are actively using the asset for governance or less overall activity (e.g., trading and transfers). Compared to Q2 2024, Q3 2024 saw more pronounced spikes throughout the quarter, particularly in mid-August. These spikes suggest periods of heightened activity, potentially due to the buzz around ApeChain and other ecosystem initiatives. Token velocity could see an increase when Otherside and ApeChain launch as APE will be used in new ways.

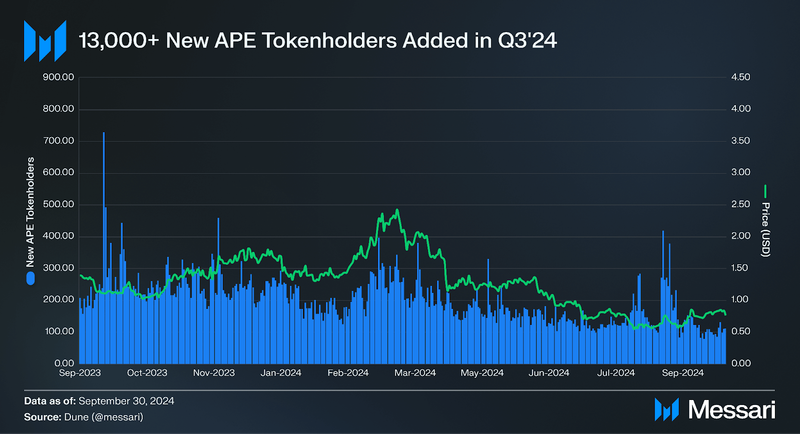

New APE Tokenholders

New APE tokenholders are defined as addresses that have received APE for the first time. This metric excludes new tokenholders using centralized exchanges to custody their assets.

Despite the trend, ApeCoin DAO approved initiatives in Q3 2024 that should help attract new tokenholders and provide additional exposure for the ecosystem. Notably, AIP-454 allocates 100.00 million APE (~$76.00 million) to fund two initiatives that support and grow ApeChain. Other notable initiatives are highlighted in this report’s “Governance Analysis” section.

ApeChain Overview

ApeChain is an Optimistic Layer-3 blockchain built on Arbitrum’s Orbit framework, designed to create a high-performance, secure, and scalable infrastructure tailored for the ApeCoin ecosystem. ApeChain benefits from the security guarantees of Ethereum while offering faster transaction throughput and lower fees through Arbitrum’s Layer-2 technology. This combination ensures both security and efficiency for developers and users.

ApeChain is specifically built to address the unique needs of the ApeCoin ecosystem, providing a dedicated blockchain environment that aims to drive user adoption, encouraging developer innovation, and promoting the ecosystem’s overall growth. The use of APE as the native gas token on ApeChain enhances its utility by making it integral to all network transactions.

One of the standout features of ApeChain is its native yield mechanism, which allows users to earn yield on assets bridged into the ecosystem. These assets are forwarded to yield-generating protocols on Ethereum, integrating ApeChain with Ethereum’s existing yield infrastructure. This setup ensures that users can maximize their earnings while interacting with the broader blockchain ecosystem.

ApeChain also supports cross-chain functionality through LayerZero and canonical bridges, enabling assets to easily move between ApeChain and other blockchains. This multi-hop bridging is crucial for fostering interoperability between ApeChain and other decentralized ecosystems, allowing developers and users to move more efficiently between blockchains.

The decision to build on Arbitrum Orbit provides several benefits, as outlined in AIP-378. A main benefit of being on Orbit is the customization and flexibility that allows ApeChain to implement its own governance and features, specifically tailored to the unique needs of the ApeCoin ecosystem, like using APE as the native gas token.

ApeChain is strategically designed to provide a scalable, secure, and user-friendly blockchain experience that is deeply integrated with the broader crypto ecosystem. Its focus on yield generation, developer empowerment, and seamless cross-chain interactions positions it as a promising platform for Web3 innovation and decentralized applications.

ApeChain Activity

On July 16, 2024, ApeChain successfully launched the Curtis testnet, and the ApeCoin DAO announced the development of MBA 2.0, a revamped version of the Made By Apes platform, which is set to launch on ApeChain. A new website and Telegram group were also launched.

To accelerate adoption and development on ApeChain, the ApeCoin team introduced BluePrint, a set of initiatives focused on creating consumer-grade applications, a robust ecosystem website, and developer tools. These initiatives include supporting the growth of its DeFi ecosystem. ApeChain has announced strategic partnerships (i.e., Halliday and Portal Pay) to enhance payment solutions and cross-chain functionality. The partnership with Halliday will allow integrations with MoonPay and Stripe, enabling developers to accept APE payments from any blockchain and with settlements in the token of their choice. Portal Pay’s partnership will bring their cross-chain liquidity layer to ApeChain, offering another option for developers.

Another significant development in the ApeChain ecosystem was the announcement of Camelot as a native decentralized exchange (DEX). Camelot is a well-known DEX on Arbitrum with over $23 billion in total volume. This partnership aims to bring liquidity infrastructure to ApeChain and support various decentralized applications, including the Otherside metaverse project.

Camelot will not be the only DEX on ApeChain. Saru.ex will also be launching in collaboration with SushiSwap. Saru.ex, whose name derives from the Japanese word for “Ape,” will be built by Sushi Labs. To support the launch, SushiSwap has announced plans to reward its loyal users and APE community members. This strategy aims to create an initial user base for Saru.ex.

Lastly, ApeChain has introduced the Ape Builder toolkit, a comprehensive suite of tools designed to empower game developers and content creators within the ecosystem. Ape Builder offers features such as plug-and-play game development, custom marketplace creation, and implementation of invisible wallets.

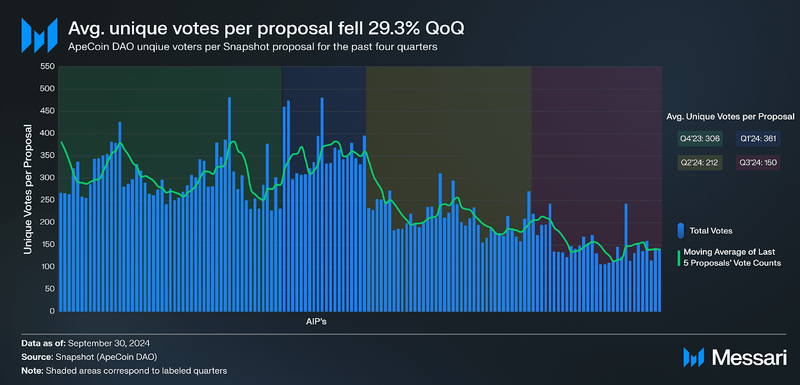

Unique Votes per Proposal

Unique votes per proposal measure the number of individuals participating in governance. If new voters only hold small amounts of a governance token, then the impact of their votes would be marginal on proposal outcomes in token-weighted governance systems like ApeCoin DAO. However, aggregating unique votes conveys governance interest, diversity of the active tokenholder base, and decentralization of the active tokenholder base.

The number of proposals in Q3 2024 remained relatively similar to Q2 2024, at 31, while the average unique votes per proposal dropped for the second consecutive quarter (down ~29% QoQ).

In the future, ApeCoin DAO plans to move more of the voting process onchain. Doing so would remove central points of failure (like the reliance on Snapshot) and add to the governance structure’s decentralization. With ApeChain being built on the Arbitrum technology stack, it will be inexpensive to participate in governance when migrated onchain. Given that the current system is free, the potential bridging and added gas costs may deter some from participating in governance. However, the prospects of a more scalable and useful ecosystem may encourage more tokenholders to participate in guiding the direction of said ecosystem.

Governance Analysis

Throughout Q3 2024, ApeCoin DAO voted on 31 proposals: 16 passed and 15 failed. The total value of passed proposals was over $86 million, of which $76 million is set aside for the incentive program explained in AIP-454. The DAO’s implementation costs vary for each approved proposal and are spent monthly upon reaching project milestones or when the project is completed.

To maintain community engagement and transparency, weekly ApeCoin AIP (ApeCoin Improvement Proposal) Roundups are held, typically on Mondays at noon PT on “X.”

Below are five proposal highlights from the past quarter, from newest to oldest. For a complete overview of ApeCoin governance, including preliminary discussions, see Messari’s Governor page on ApeCoin.

AIP-463: Empowering Otherside Wiki – A Summary and Analysis

August 28, 2024

AIP-463 was passed to fund the Otherside Wiki, a platform that aims to be the primary information hub for the Otherside Metaverse created by Yuga Labs. The proposal will allocate $715,000 from the treasury, with an additional commitment of $300,000 from Sky is the Limit Ventures, bringing the total budget to $1,015,000. The funding will support ongoing operations, integration into ApeChain, and enhancements to the platform over a two-year period.

Implementation Plan and Timeline:

- The proposal outlines a five-milestone implementation plan with detailed timelines and cost breakdowns for each stage.

- The milestones cover key aspects such as design, development, smart contract implementation, launch, and ongoing operations.

Proposed Solution:

- General Overhaul of UI/UX Design: Updating the platform to align with modern web standards and provide a better user experience.

- Modern Web Technologies: Implementing modern technologies like Laravel, VueJS, and serverless scaling technologies to enhance scalability and ensure the platform can handle a large number of users.

- Tailored Data Streams: Developing a personalized ApeCoin/Gaming feed to aggregate data and information from various platforms and community initiatives into a single, customizable stream.

- Deep Insights: Continuing to provide and expand deep data insights into ApeChain and Otherside, including support for a growing number of games.

- Multilingual Support: Adding support for Chinese and Spanish to cater to a global audience.

AIP-436: Enhancing Financial Decision-Making

August 14, 2024

AIP-436 changes ApeCoin DAO’s governance process to require a supermajority vote, 69% of tokens cast, for proposals requesting over $250,000. The supermajority vote will ensure that significant financial decisions have large community support which helps increase community engagement and serve as a risk mitigation tool. AIP-436 was passed with over 96% support from the community. The APE Foundation will be responsible for identifying proposals subject to the supermajority rule and communicating this information to the ApeCoin DAO community. They will also be responsible for implementing the change on Snapshot, the platform used for governance voting.

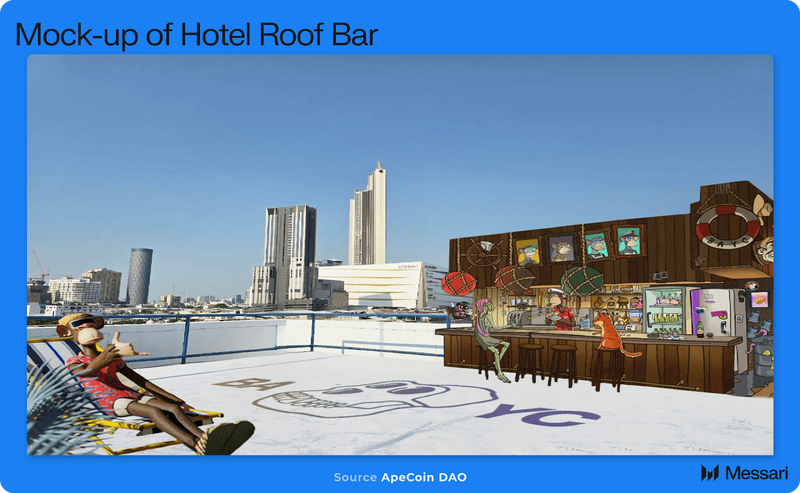

AIP-448: ApeCoin Hotel

July 31, 2024

AIP-448 was passed to fund the creation of an ApeCoin-themed hotel in Bangkok, Thailand for 410,000 APE (~$335,272). The main goals of the themed hotel are to generate revenue, increase ApeCoin brand exposure, provide community benefits, and increase the real-world utility of APE. The project’s token will be accepted as a payment method for hotel rooms and on-property amenities, with 50% of the hotel room revenue redistributed to the ApeCoin DAO in the first year.

AIP-438: ApeCoin Ventures

July 31, 2024

AIP-438 passed the creation of ApeCoin Ventures, a venture capital fund focused on investing in early-stage Web3 companies. ApeCoin Ventures is structured in partnership with Animoca Ventures and involves a 1-1 matching of funds. As such, ApeCoin DAO contributed $5 million and Animoca Venture matched the DAO, bringing the total to $10 million. The fund’s goal is to increase ApeCoin’s value and help create network effects surrounding the project’s ecosystem.

The fund deployment is planned over a two-year timeline, during which any unused APE will be returned to the ApeCoin DAO treasury. Targeting check sizes between $100,000 and $250,000 per startup, this strategy can support 80 ventures at Seed or Series A stages. A management fee of 1% will be charged for project vetting, due diligence, ecosystem support, partnership outreach, and other services rendered by Animoca Ventures to carry out the required operations. Fund management will be provided by ASCENT Fund Services, who will act as the custodian and distribute funds as needed; however, they will not make any fund decisions.

AIP-438 specifies that 50% of all token proceeds from successful venture exits will be used to repurchase APE on the open market and sent to the ApeCoin DAO. The DAO will receive quarterly reports on all investment activities, financial performance, and industry insights.

AIP-454: The BANANA Bill: Apes Gotta Eat

July 3, 2024

AIP-454 allocates 100 million APE (10.00% of the maximum token supply) to fund two initiatives that support and grow the ApeChain: the Commercial Agreements Initiative and the User Incentives Initiative. These initiatives align with ApeChain’s push to the public. ApeChain is anticipated to generate ongoing revenue for the ApeCoin DAO by capturing ~77.50% of fees from user activity.

- Timeline: The program will run for two years, starting July 24, 2024, and any unallocated APE will be returned to the ApeCoin DAO treasury.

- Budget Allocation:

- User Incentives Initiative: 23 million APE.

- Commercial Agreements Initiative: 73 million APE.

- Administrative Budget: 2 million APE per year.

- Transparency Reports: Quarterly transparency reports detailing APE allocations and the number of commercial agreements made will be published.

The Commercial Agreements Initiative will negotiate agreements to provide value and generate reusable funding for the ApeCoin DAO. The User Incentives Initiative will use rewards to encourage engagement with ApeChain decentralized applications. These initiatives will be overseen by an advisory committee and supported by a Program Facilitator (Full Moon Labs) and a Strategic Accounts Manager (Horizen Labs).

Closing Summary

In Q3 2024, ApeCoin’s ecosystem evolved with the launch of ApeChain’s testnet, marking a pivotal transition from a token-based project to a fully-fledged blockchain ecosystem. This shift was accompanied by key developments like the introduction of MBA 2.0, the release of the Ape Builder toolkit, and partnerships to bring decentralized applications to ApeChain. The ApeCoin DAO also allocated over $86 million to fund approved proposals, a 1007.54% increase from the previous quarter, with most of the funds set aside for The BANANA Bill. The DAO’s governance structure continues evolving with a new voting threshold and ongoing strategic initiatives to expand the ApeCoin ecosystem.