(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

Former President of China Deng Xiaoping famously quipped the following when asked about his pragmatic approach to the implementation of an economic system for China which directly contradicted the “purist” socialism or Marxism of Chairman Mao Zedong: “不管黑猫白猫,捉到老鼠就是好猫。 It doesn’t matter if a cat is black or white as long as it catches mice.” Xi Jinping, though, took it a bit further, proclaiming that he plans to implement Socialism with Chinese Characteristics (中国特色社会主义). I’m not sure exactly what that means. But I guess it means “Socialism” is whatever Xi Jinping says it is.

Given that Xi Jinping is ethnically Han Chinese, it means China has a Socialist system with Chinese Characteristics. That’s kinda #REF, but the truth is yours to define when you’re the 皇帝 (emperor). If you ever listened to Kamala Harris speak without a teleprompter, you know what I’m talking about. A similar sophistry at work in the land of “freedom”, pickup trucks, and Doritos. I want to put my spin on a malleable economic “-ism” concerning the economic system of Pax Americana. I shall refer to the current iteration of policies implemented by the Orange Man, the newly re-elected President Trump, as American Capitalism with Chinese Characteristics.

Similar to Deng, the elite that rule Pax Americana care not whether the economic system is Capitalist, Socialist, or Fascist, but whether implemented policies help them retain their power. America stopped being purely capitalist in the early 19th century. Capitalism means that the rich lose money when they make bad decisions. That was outlawed as early as 1913 when the US Federal Reserve was created. As privatised gains and socialised losses took their toll on the nation and engineered an extreme class divide between the multitudes of inland-dwelling deplorable or trashy people and the upstanding, venerable, sophisticated coastal elites, President Franklin Delano Roosevelt had to course correct and hand out some crumbs to the poor folk via his New Deal policies. Then, as is now, expanded government handouts for those left behind weren’t a popular policy with wealthy supposed capitalists.

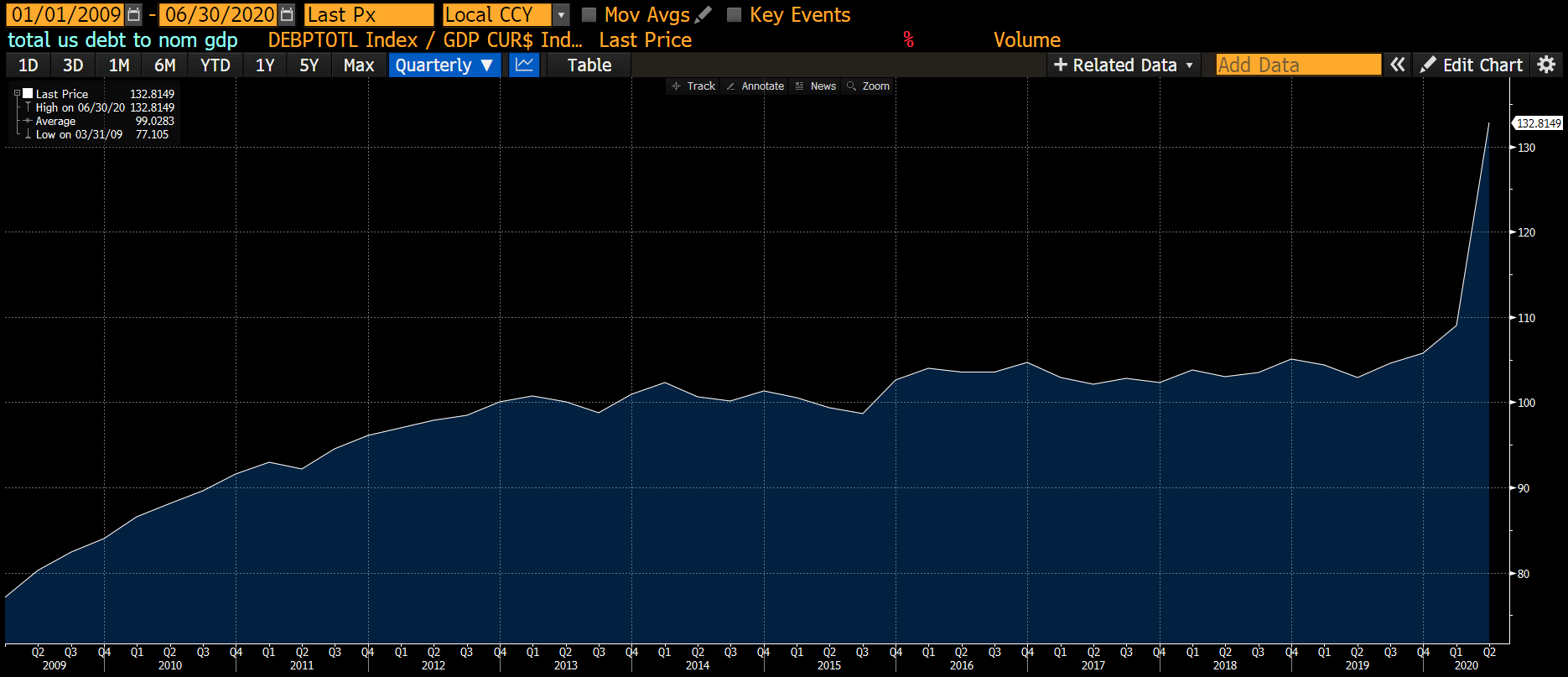

The pendulum swung back from extreme socialism (the highest marginal tax rate in1944 was raised to 94% on incomes of over $200,000) to unfettered corporate socialism, which started in the Reagan 1980s. Following that, the neoliberal economic policies of central bank money printing handed out to the financial services sector in the hopes that the riches would trickle down from top to bottom epitomised the state of play until the 2020 COVID pandemic. President Trump responded to the crisis by channelling his inner FDR; he handed out the most money since the New Deal directly to ALL the people. The US printed 40% of all dollars in existence between 2020 and 2021. Trump started the stimmie check party, and President Biden continued the popular handouts under his reign. When evaluating the effects on the government’s balance sheet, a strange thing happened between 2008 to 2020 and 2020 to 2022.

2009 until 2Q2020 was the peak of trickle-down economics, paid for with central bank money printing and euphemistically called quantitative easing (QE). As you can see, the economy (nominal GDP) grew slower than the debt accumulation at the national level. Said another way, rich people spent their government windfalls on assets. These types of transactions generated no real economic activity. Therefore, handing out trillions of dollars, funded by debt, to wealthy financial asset holders increased the debt-to-nominal GDP ratio.

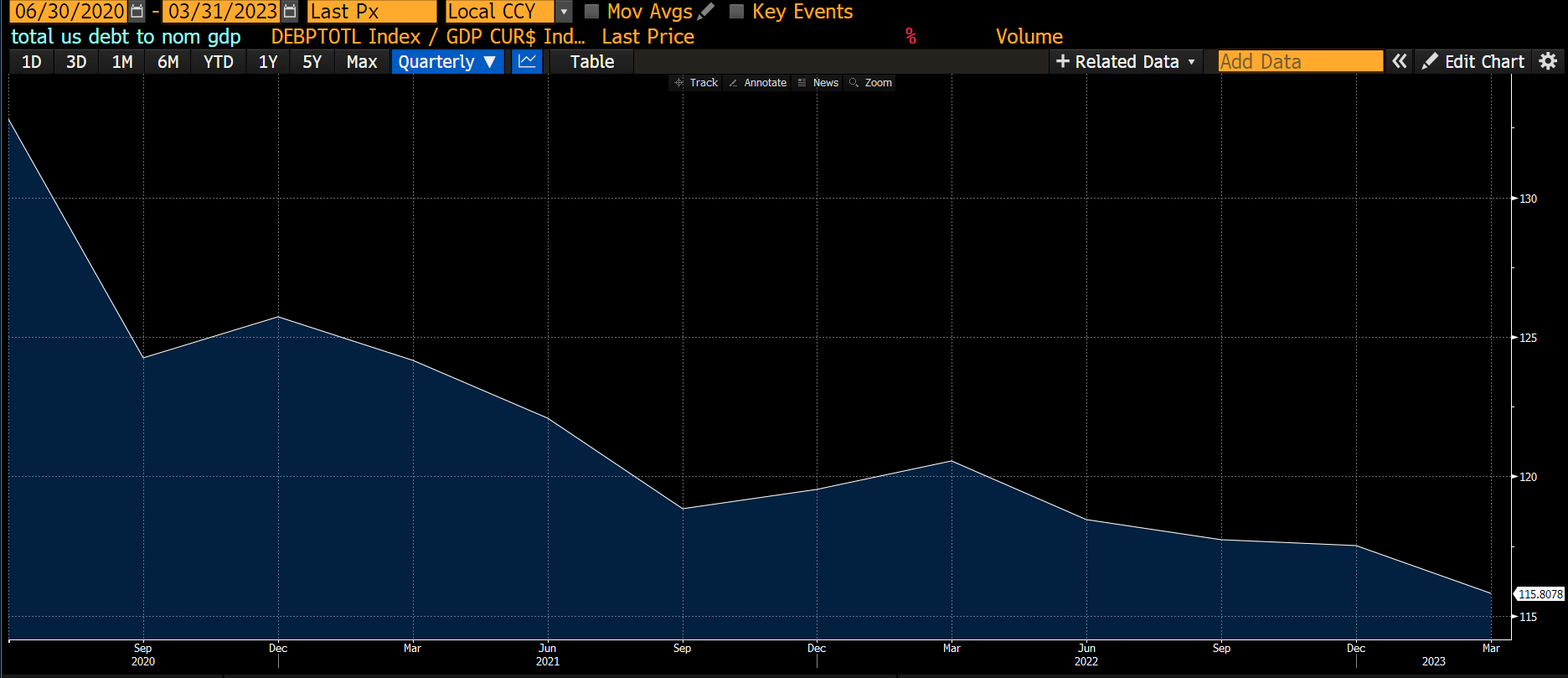

From 2Q2020 until 1Q2023, Presidents Trump and Biden bucked the trend. Their Treasury departments issued debt that the Fed purchased using printed dollars (QE), but instead of handing it out to rich cunts, the Treasury mailed checks out to everyone. Poor people got actual cash in their bank accounts. Obviously, Jamie Dimon, CEO of JP Morgan, took a cut due to transaction fees on government transfers … he’s the motherfucking Li Ka Shing of America; you can’t escape paying this geezer. The poor tend to be poor because they spend all their money on goods and services, and that’s exactly what they did during this period. Economic growth boomed as the velocity of money increased well above one. That is, $1 of debt created more than $1 of economic activity. And thus, magically, the US debt-to-nominal GDP ratio fell.

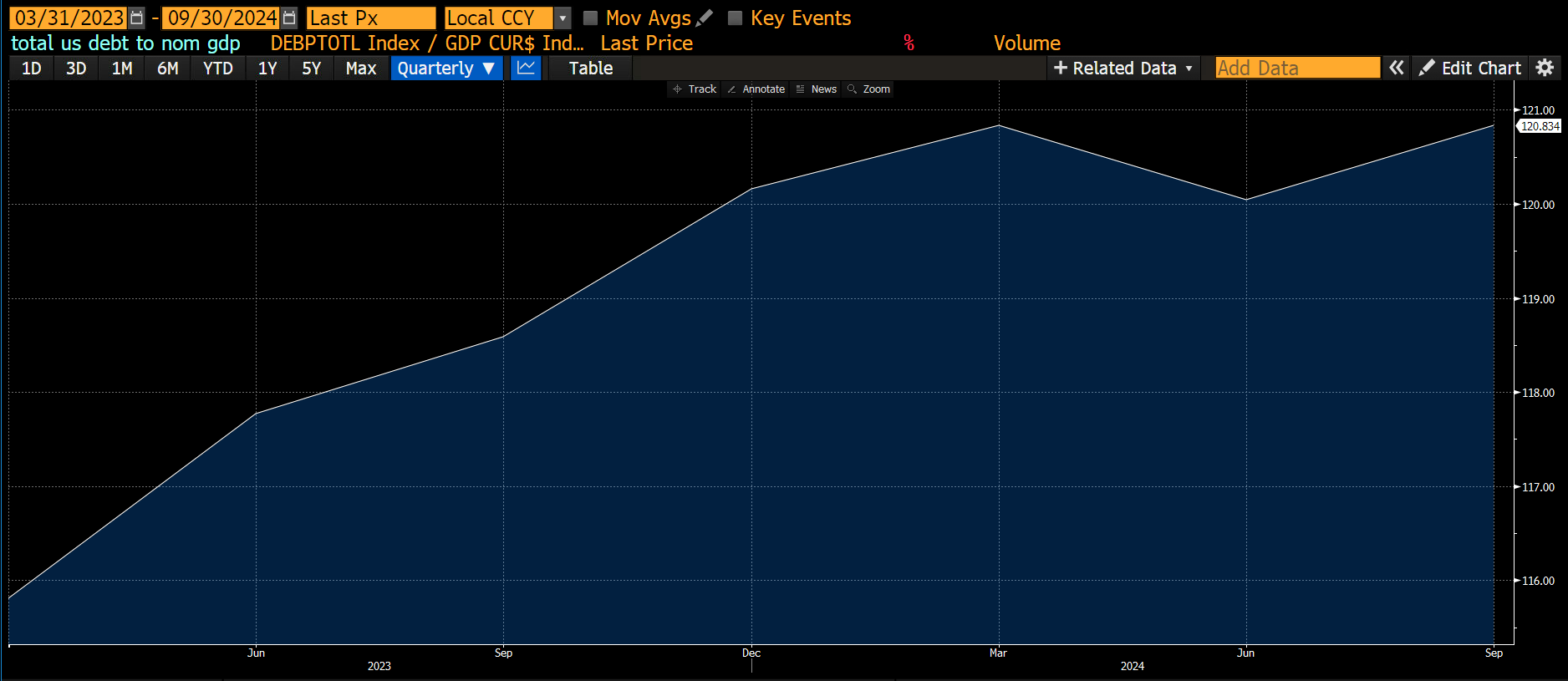

Inflation raged because the supply of goods and services didn’t grow as fast as the population’s government debt-funded purchasing power. The rich who owned government bonds were not pleased with these populist policies. These rich, bond-holding suckers got creamed by the worst total returns since 1812. The rich fought back by dispatching their white knight, the beta cuck towel bitch boy, Fed Chairman Jay Powell. He started raising rates in early 2022 to rein in inflation, and while Gen Pop would have loved another round of stimmie checks, such a policy became verboten. Bad Gurl Yellen, the US Treasury Secretary, stepped in to neuter the effects of the Fed attempting to tighten monetary conditions. She drained the Fed’s Reverse Repo Facility (RRP) by shifting the issuance of debt from the long end (coupons) to the short end (bills). This provided nearly $2.5 trillion of financial stimulus, primarily benefiting rich people who held financial assets from September 2002 until the present; asset markets Pumped Up The Jam. As in the post-2008 period, these wealthy government handouts generated no real economic activity, and US debt-to-nominal GDP began to rise again.

Has Trump’s incoming cabinet learned the proper lessons for recent Pax Americana economic history? I believe so.

Scott Bassett, the man most believe will be Trump’s pick to replace Bad Gurl Yellen as the US Treasury secretary, has given many speeches about how he would “fix” America. His speeches and op-eds provide details on how to execute Trump’s America First Plan, which bears a considerable resemblance to China’s development plan (which started with Deng in the 1980s and continues to this day). The plan is to run nominal GDP hot by providing government tax credits and subsidies to re-shore critical industries (shipbuilding, semiconductor fabs, auto manufacturing, etc.). Companies that qualify will then receive cheap bank financing. The banks will again fall over themselves to lend to real companies because their profitability is ensured by the American government. As companies expand inside of America, they must hire American workers. Better paying jobs for ordinary Americans means more consumer spending. The effects are amplified if Trump limits the number of Sombrero-wearing, cat and dog-eating, dark and dirty immigrants crossing the borders from “shithole countries”. These things juice economic activity, and the government takes its cut through corporate profit and wage income taxes. The government deficit must remain large to fund these programs, and the Treasury Department funds the government by selling bonds to banks. The banks can now re-lever their balance sheets because either the Fed or lawmakers suspended the supplemental leverage ratio. The winners are ordinary workers, companies that produced “approved” products and services, and the US government, which sees its debt-to-nominal GDP ratio fall. This is QE for poor people on steroids.

Wow, that sounds great. Who would be opposed to such a magical era of American prosperity?

The losers are those who hold long-term bonds or savings deposits. That is because the yield on such instruments will be intentionally kept below the nominal growth rate of the American economy. Folks also lose if their wages cannot keep up with the higher inflation levels. If you haven’t noticed, being in a union is cool again. 4 and 40 is the new mantra. That is, pay workers 40% more over the next 4 years, i.e. 10% per year wage hikes, to continue working.

For those readers who believe themselves to be rich, don’t worry. Here is a cheat sheet on what to buy. This is not financial advice; I’m simply sharing what I’m doing with my portfolio. Every time a bill passes and hands out money to approved industries, read it, and buy stocks in those verticals. Instead of saving in fiat bonds or bank deposits, purchase gold (the boomer financial repression hedge) or Bitcoin (the millennial financial repression hedge).

Obviously, the hierarchy of my portfolio starts with Bitcoin, other cryptos, and crypto-related company equity, then gold held in a vault, and finally, stonks. I’ll keep a small float of filthy fiat in a money market fund to pay my Amex bill.

I will use the rest of this essay to explain how QE for the rich and the poor affects economic growth and the money supply. Then, I will offer a prediction on how exempting banks from the supplemental leverage ratio (SLR) once again creates the ability to do infinite QE for poor people. In the final section, I will debut a new index to track the supply of US bank credit and show how Bitcoin outperforms all other assets when deflated by the supply of bank credit.

The Money Supply

I must offer extreme admiration for the quality of Zoltan Pozar’s Ex Uno Plures essays. On my recent long weekend in the Maldives, I read the entirety of his written corpus in between surfing, Iyengar Yoga, and myofascial massages. His work will feature heavily throughout the rest of this essay.

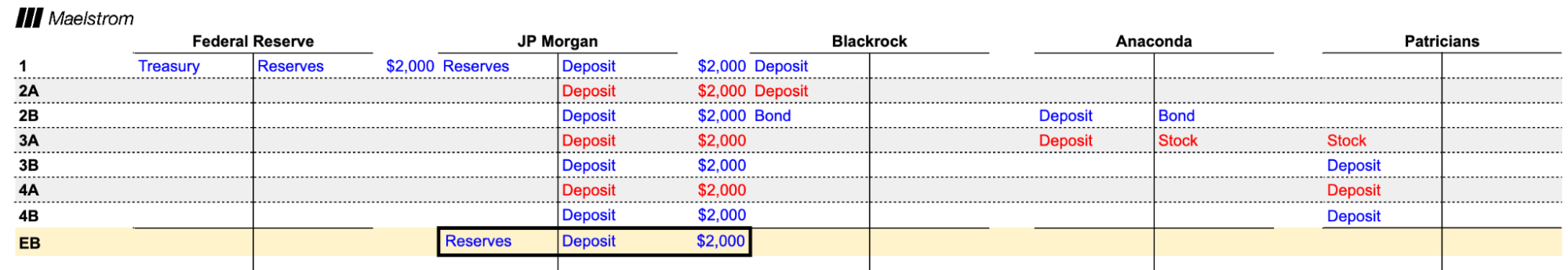

I will post a series of hypothetical accounting ledgers. On the left-hand side of the T are assets. On the right-hand side of the T are liabilities. Entries in Blue are increases in value, and entries in Red are decreases in value.

The first example focuses on how the Fed’s purchase of bonds via QE impacts the money supply and economic growth. Of course, this example, and the rest that follow, will be a bit silly to make them interesting and engaging.

Imagine you are Powell during the March 2023 US regional banking crisis. To let off some steam, Powell headed to the Racquet and Tennis Club at 370 Park Ave in New York City to play squash with another one of his centa-millionaire crusty finance buddies. Powell’s friend was apoplectic.

This friend, who we’ll call Kevin, is a crusty finance bro, and he says “Jay, I’m going to have to sell the Hamptons house. I have all my money deposited at Signature Bank, and obviously I won’t qualify for federal deposit insurance as my balance is over the limit. You have to do something. You know how Bunny gets when she has to spend even a day in the city during the summer. She is quite insufferable.”

Jay responds, “Don’t worry, I got you. I’m going to do $2 trillion of QE. It will be announced on Sunday night. You know the Fed always has your back. Without your contributions, who knows what kind of place America would be. Imagine if Donald Trump returned to power because Biden had to deal with a financial crisis on his watch. I still remember when Trump stole my chick at Dorsia back in the early 80’s, fuck that guy.”

The Fed created the Bank Term Funding Program which was different from straight QE, to solve the banking crisis. But allow me some artistic liberty on this one. Now, let’s walk through what happens to the money supply due to the $2 trillion in QE. All numbers will be in the billions of dollars.

- The Fed buys $2,000 of Treasury securities from Blackrock and pays for them with reserves. JP Morgan performs its role as a bank by facilitating this swap. JP Morgan receives $2,000 of reserves and credits Blackrock with a $2,000 deposit. Fed QE leads to banks creating deposits, which ultimately becomes money.

- Blackrock, now deprived of its Treasury securities, must lend this money to someone else, i.e., acquire another interest-bearing asset. Larry Fink, CEO of Blackrock, doesn’t rub shoulders with poor folks. He only conspires with captains of industry. But right now, he is in a tech mood. There is a new social networking booty app that is building a community of users sharing phat-ass photos. It’s called Anaconda. Their tagline is, “My anaconda don’t want none unless you got buns, hun.” Anaconda is in the growth stage, and Blackrock happily buys $2,000 of their bonds.

- Anaconda is a pillar of American capitalism. They have conquered their market by getting the 18-45 male population addicted to their app. Productivity amongst this group has cratered as they stopped reading books and started scrolling asses. Anaconda is tax optimising by issuing debt to fund stock buybacks so they don’t have to repatriate their foreign retained earnings. Reducing the share count not only boosts the share price, but their earnings, as even though their earnings aren’t growing on a per-share basis, they rise due to the lower denominator. Thus, passive index investors like Blackrock are even more likely to buy their stock. The result is that Patricians, after selling their stock, have $2,000 in bank deposits.

- Anaconda’s wealthy shareholders don’t have any immediate use for the money they receive. Gagosian threw a ripper of a party at Art Basel Miami. While all sorts of fucked up, the Patricians decided to buy the latest squiggles on canvas to burnish their credentials as serious art collectors and impress the baddies working the booths. The sellers of the artworks are fellow members of their economic class. The net effect of the patronage of the “arts” is that the sellers’ bank accounts are debited, and the buyers are credited.

After all those transactions, no real economic activity was created. By pumping $2 trillion of printed money into the economy, all the Fed did was increase the bank balances of rich folks. Even the financing of an American company didn’t generate any growth because the funds were used to pump the stock price, creating zero jobs. $1 of QE led to a $1 increase in the money supply, which led to $0 in economic activity. This is not a good use of debt. Hence, from 2008 until 2020, debt-to-nominal GDP rose during the QE period for rich people.

Now, let’s look at the decision-making process of President Donald during COVID. Travel back in your mind to March 2020: it’s the onset of COVID, and Trump’s advisors are instructing him to “flatten the curve” (remember that bullshit?). He is advised to shut down the economy and only allow “essential workers” (remember them, the poor folks who delivered your shit for sub-minimum wage?) to go about their business.

Trump: “What the fuck, so I need to shut down the economy because some quack doctors think this flu thing is the real deal?”

Advisor: “Yes, Mr. President. I should remind you it’s primarily old fat boomers, like you, who are dying from comorbidities brought on by a COVID-19 infection. I should also add that it would be costly to treat the entire over-65 segment if they get sick and require a hospital stay. You need to lock down all non-essential workers.”

Trump: “That’s going to crash the economy, let’s hand out checks to everyone so they don’t bitch and moan. The Fed can buy the debt issued by the Treasury, which will fund these handouts.”

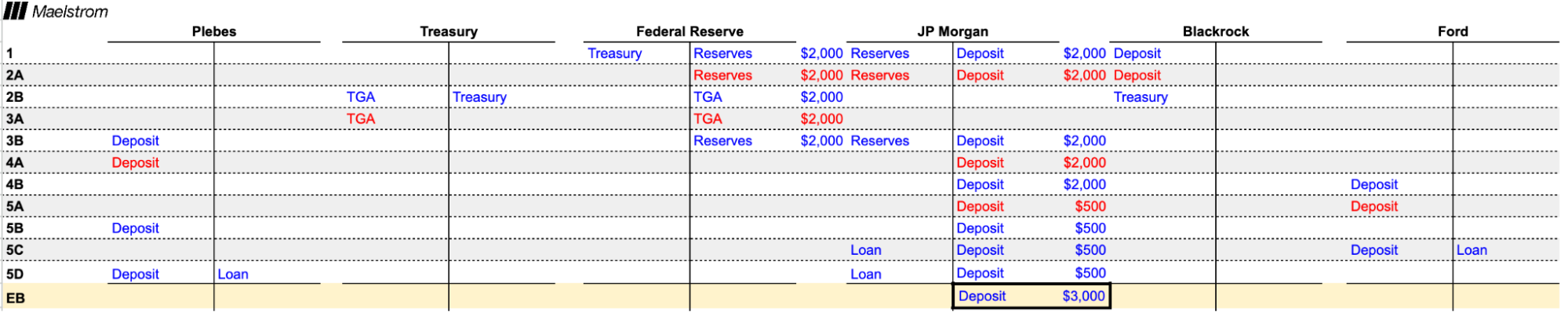

Using the same accounting framework, let’s step through how QE works for poor people.

- Just like in the first example, the Fed conducts $2,000 of QE by purchasing Treasury bonds from Blackrock with Reserves.

- Unlike the first example, the Treasury gets involved in the flow. To pay for the Trump stimmie checks, the government must borrow money by issuing Treasuries. Blackrock buys Treasuries instead of corporate bonds. JP Morgan helps Blackrock convert their bank deposit into reserves held at the Fed, which can be used to purchase Treasuries. The Treasury receives a deposit at the Fed in its Treasury General Account (TGA), akin to a checking account.

- The Treasury mails out stimmies to everyone – mainly the vast unwashed horde of plebes. This causes the TGA balance to shrink, matched by a corresponding increase in reserves held at the Fed, which become deposits that the plebe’s bank with JP Morgan.

- The plebes are plebes and spend all of their stimmies on new Ford F-150 pickup trucks. Fuck that EV shit, this is ‘murica, and thus they all guzzle that black gold. The plebes’ bank account is debited, and Ford’s bank account is credited.

- Ford does two things while it’s selling all these trucks. First, they pay their workers, which moves deposits at the bank from Ford’s accounts to their plebian workers’. Then Ford goes to the bank for a loan to increase production; as you can see, the issuance of the loan creates its own deposit from the recipient, Ford, and increases the money supply. Finally, the plebes want to go on a vacation and take a personal loan from the bank, which the bank is happy to provide given the strong economy and their well-paying jobs. The plebian bank loan creates additional deposits, just like when Ford borrowed money.

- The ending balance of deposits or money is $3,000. That is $1,000 higher than the initial $2,000 the Fed injected via QE at the start.

As you can see from this example, QE for poor people stimulates economic growth. The Treasury handing out stimmies encouraged the plebes to buy trucks. Due to the demand for goods, Ford was able to pay its employees and apply for a loan to increase production. The employees with good-paying jobs qualified for bank credit, allowing them to consume even more. $1 of debt generated more than $1 of economic activity. This is a good outcome for the government.

I want to take this one step further and discuss how banks can infinitely finance the Treasury.

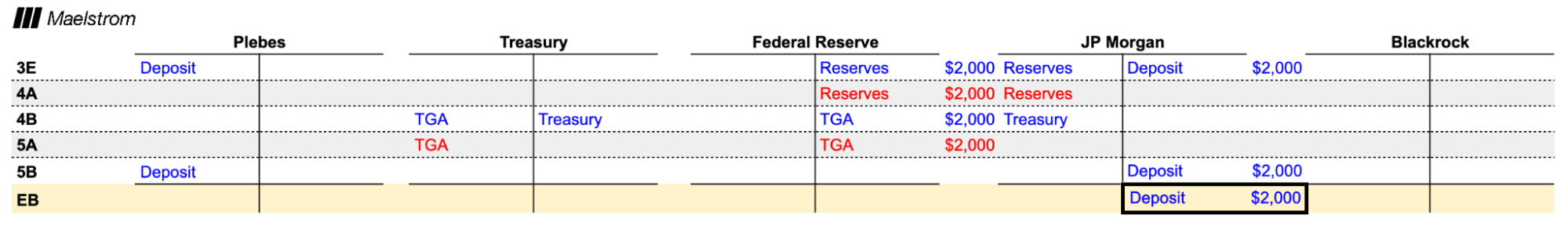

We are going to start at step 3 from above.

- The Treasury is doling out another round of stimmies. To fund the handouts, the Treasury auctions bonds, which JP Morgan, as a primary dealer, purchases with reserves held at the Fed. Selling bonds increases the Treasury’s TGA balance at the Fed.

- Like the last example, the Treasury sends out the checks that appear as the plebes’ deposits at JP Morgan.

When the Treasury issues bonds that the banking system purchases, it transforms reserves held at the Fed, which do nothing productive in the economy, into deposits held by the plebes, which can be used to buy stuff and generate economic activity.

Just one more T chart. What happens when the government conducts industrial policy by promising tax breaks and subsidies for companies to produce desired goods and services?

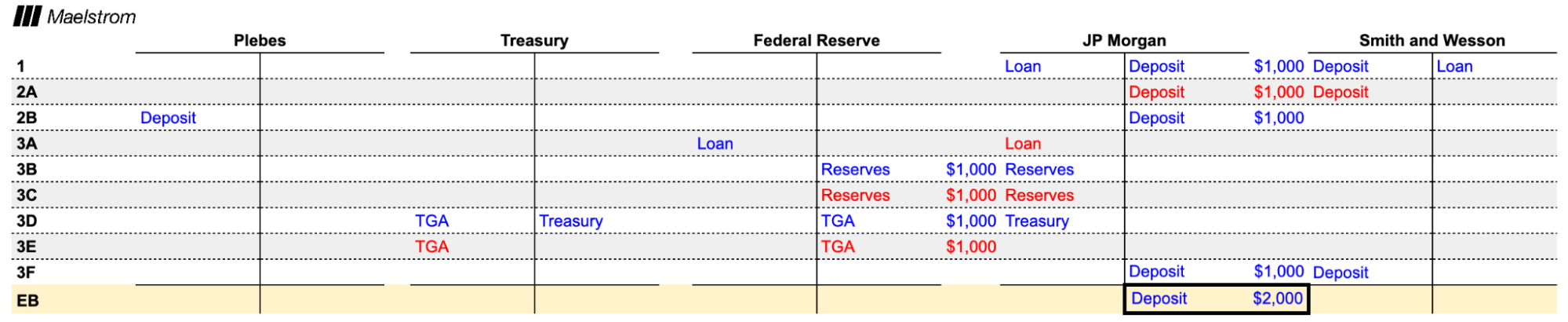

In this example, Pax Americana is running out of bullets for their Clint Eastwood Western movie-inspired shoot-em-up in the Persian Gulf. The government passes a bill that promises subsidies for the production of bullets. Smith and Wesson applies for and is granted, a contract to supply the military with ammo. Smith and Wesson can’t produce enough bullets to fulfil the contract, so they go to JP Morgan for a loan to build a new factory.

- The loan officer at JP Morgan is given the government contract and confidently loans $1,000 to Smith and Wesson. Out of thin air, $1,000 of money is created by the act of loaning money.

- Smith and Wesson builds its factory, which creates wages for the plebes that ultimately become deposits at JP Morgan. The money JP Morgan created became deposits held by those with the highest propensity to spend, the plebes. I have already gone through how plebes’ spending habits create economic activity. Let’s alter the example a bit.

- The Treasury needs to fund its subsidy to Smith and Wesson by issuing $1,000 of new debt at auction. JP Morgan shows up at the auction to buy the debt but doesn’t have any reserves to purchase the debt. Because there is no longer any stigma associated with accessing the Fed’s discount window, JP Morgan pledges its Smith and Wesson corporate debt asset as collateral against a Fed loan of reserves. These reserves are used to purchase the newly issued Treasury debt. The Treasury then pays the subsidy to Smith and Wesson which becomes a deposit at JP Morgan.

This example showed how using industrial policy, the US government induced JP Morgan to lend money into existence, and the asset the loan created was used as collateral with the Fed to purchase additional US Treasury debt.

Constraints

It would appear that there is a magic money machine that the Treasury, Fed, and banks operate which can accomplish one or more of the following:

- They can pump financial assets for rich people that generate zero real economic activity.

- They can fill the bank accounts of the poor, who tend to spend their handouts on goods and services, generating real economic activity.

- They can guarantee the profitability of certain players in select industries. This allows businesses to expand using bank credit, which generates real economic activity.

Are there any constraints?

Yes, banks cannot create an infinite amount of money because they must provision expensive equity against every debt asset they hold. In technical jargon, there is a risk-weighted asset charge for different types of assets. Even supposedly “risk-free” government bonds and central bank reserves attract an equity capital charge. This is why, at a certain point, banks are unable to participate meaningfully in bidding for US Treasury bonds or issuing corporate loans.

There is a reason why equity capital must be pledged against loans and other types of debt securities. If the borrower goes bankrupt, whether that be the government or a company, the losses need to be absorbed by someone. Given that the bank made the decision to create money to lend or purchase government bonds for profit, it’s only fair that their equity shareholders absorb losses. When the losses exceed the amount of bank equity capital, then the bank fails. When banks fail, depositors lose their money, which is bad. However, what is even worse from a systemic perspective is that banks are unable to continue increasing the amount of credit in the economy. Given that the fractional fiat financial system requires a steady emission of credit to survive, bank failures could collapse the entire house of cards. Remember – one player’s asset is another’s liability.

The only way to save the system when bank equity credit is exhausted is for the central bank to create fresh fiat and exchange it for banks’ underwater assets. Imagine Signature Bank only lent to Su Zhu and Kyle Davies of the now-defunct Three Arrows Capital (3AC). Su and Kyle gave the bank a fugazi balance sheet that misrepresented the firm’s health. They then withdrew the cash out of the fund and gave it to their wives in hopes it would be bankruptcy exempt, and when the fund failed, the banks had nothing to seize, and the loans were worth zero. This is fiction; Su and Kyle are good dudes. They would never do anything like what I described ;). Signature gave a lot of campaign donations to Elizabeth Warren, who sits on the US Senate Banking Committee. Using their political pull, Signature convinced Senator Warren they were worthy of being saved. Senator Warren called Powell and told him that the Fed must exchange dollars for 3AC debt at face value via the discount window. The Fed did as it was told, Signature was able to swap 3AC bonds for fresh dollar bills, and the bank was able to service any deposit outflows. Again, this didn’t actually happen; it’s just a “silly” example. But the moral of the story is that if banks don’t put up sufficient equity capital themselves, the entire population will end up footing the bill due to a debasement of the currency.

Maybe there is a modicum of truth to my hypothetical example; this is a recent story from the Straits Times:

The wife of Zhu Su, the co-founder of collapsed cryptocurrency hedge fund Three Arrows Capital (3AC), has managed to sell a mansion she owns in Singapore for $51 million, despite a court-imposed freeze on some of the couple’s other assets.

Back to reality.

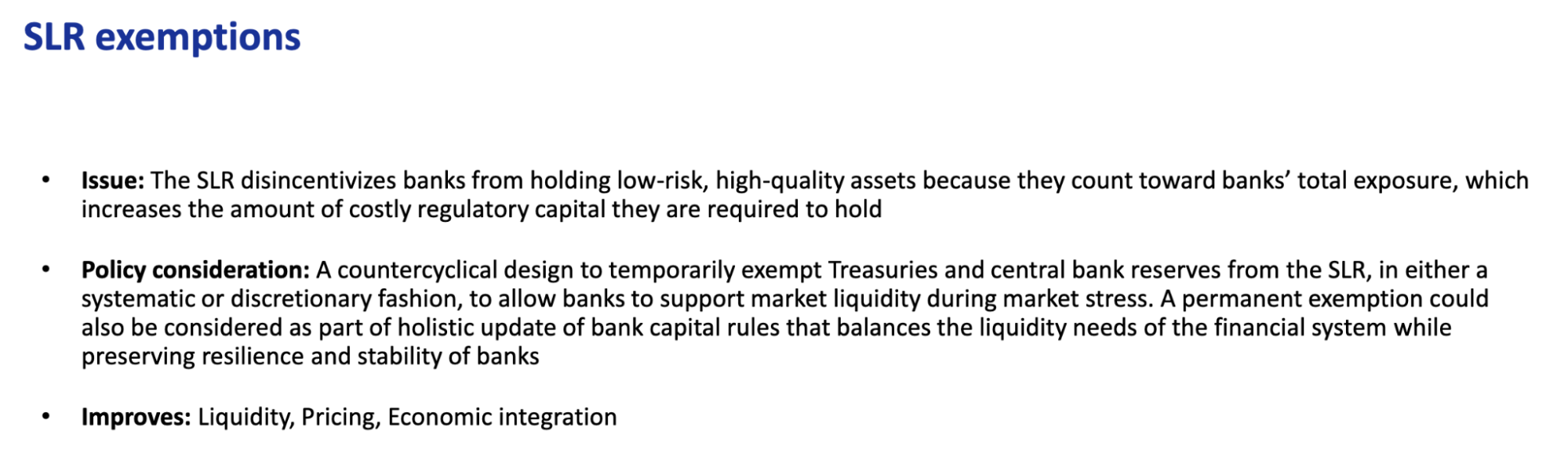

Suppose the government wants to create an infinite amount of bank credit. In that case, they must change the rules such that Treasuries and certain types of “approved” corporate debt (this could be by type, e.g., investment-grade bonds, or by industry, e.g., debt issued by semiconductor firms) are exempted from something called the Supplemental Leverage Ratio (SLR).

If Treasuries, central bank reserves, and/or approved corporate debt securities were exempted from the SLR, a bank could purchase an infinite amount of debt without having to encumber themselves with any expensive equity. The Fed has the power to grant an exemption. They did just that from April 2020 to March 2021. If you remember, the US credit markets seized up at that time. The Fed needed to get banks to lend again to the US government by showing up at Treasury debt auctions because the government was about to hand out trillions of dollars worth of stimulus without the tax revenue to pay for it. The exemption worked like a charm. It led to banks purchasing a fuck ton of Treasuries. The downside was that after Powell jacked rates from 0% to 5%, the same Treasuries dropped a lot in price and caused the March 2023 regional banking crisis. There is no free lunch.

The level of bank reserves also acts as a constraint on the willingness of the banking sector to purchase Treasuries at auction. Banks will stop participating in auctions when they feel their reserves at the Fed hit the LCLoR (Lowest Comfortable Level of Reserves). You don’t know what LCLoR is until after the fact.

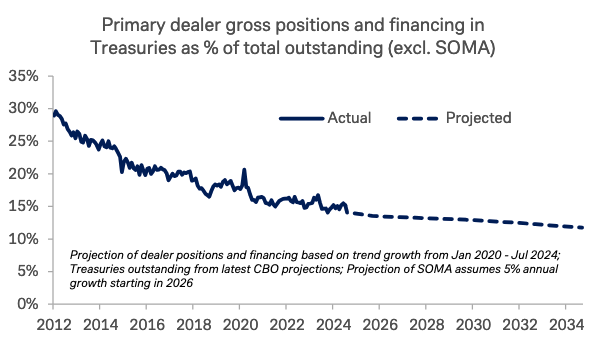

This is a chart from a Treasury Market Financial Resilience presentation produced by the Treasury Borrowing Advisory Committee (TBAC) published on 29 October 2024. What this chart shows is that the banking system is nearing the LCLoR as it holds fewer and fewer Treasuries as a percentage of the total outstanding. This is a problem because with the Fed selling (QT) and surplus nation central banks selling (or not reinvesting) their net export earnings (de-dollarisation), the Treasury market’s marginal buyers became flighty bond trading hedge funds.

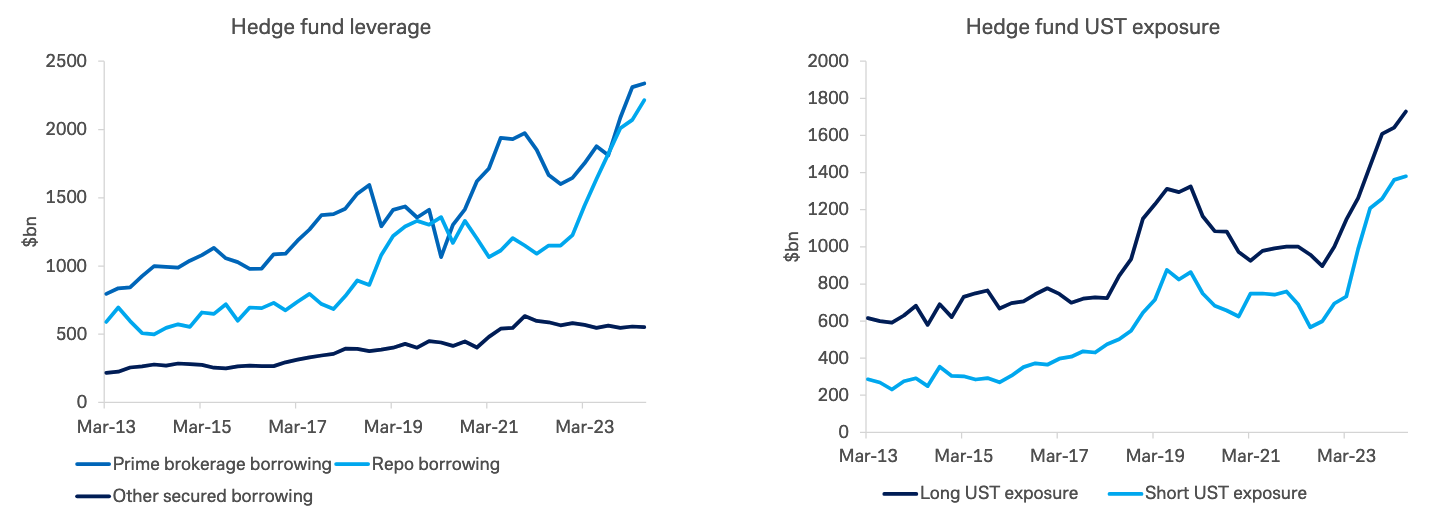

Here is another chart from the same presentation. As you can see, hedge funds are picking up the slack. But hedge funds are not real money buyers. They are putting on an arbitrage trade where they buy cheap cash Treasuries and short a Treasury bond futures contract. The cash leg of the transaction is financed in the repo market. A repo is when you exchange an asset (Treasury bill) for cash at a rate for a certain amount of time. The repo market’s pricing of overnight funding using Treasury securities as collateral is based on the amount of available commercial banking balance sheet. As the balance sheet capacity diminishes, the repo rate rises. If the cost of financing a Treasury rises, hedge funds can only buy more of them if the price cheapens relative to futures. This ultimately means the price of Treasury bonds at auction must decline, and yields rise. This is not what the Treasury wants to happen as it needs to issue additional debt at hopefully cheaper and cheaper prices.

Due to regulatory constraints, banks cannot buy enough Treasuries, nor will they be able to finance hedge funds’ purchases of Treasuries at affordable prices. This is why the Fed must once again exempt banks from the SLR. It improves the liquidity of the Treasury market and allows infinite QE that can be directed at the productive parts of the American economy.

And if you weren’t sure that the Treasury and the Fed got the message about the necessity of regulatory relief for banks, the TBAC clearly stated what is required on slide 29 of the same presentation:

Tracking Number

If Trump-o-nomics operates as I just described, then we must concentrate on the amount of bank credit growth we can expect to see. Following the examples above, we know that QE for rich people works by increasing bank reserves, and QE for poor people works by increasing bank deposits. Thankfully, the Fed provides both numbers for the entire banking system weekly.

I created a custom Bloomie index, which is a combination of Reserves and Other Deposits and Liabilities <BANKUS U Index>.

This is my custom index that tracks the quantity of US bank credit. In my opinion, this is the most important money supply metric. As you can see, sometimes it leads Bitcoin, like in 2020, and sometimes it lags Bitcoin, like in 2024.

However, what is more important is how an asset performs when deflated by the supply of bank credit. Bitcoin (white), the S&P 500 Index (gold), and gold (green) have all been divided by my bank credit index. The values are indexed to 100, and as you can see, Bitcoin is the standout performer, rising over 400% since 2020. If you can only do one thing to counter the fiat debasement, it is Bitcoin. You can’t argue with maths.

The Way Forward

Trump and his monetary lieutenants have been extremely clear they will pursue policies that weaken the dollar and provide the necessary financing to re-shore American industry. Given that the Republicans will control all three branches of government for the next two years, they can pass the entirety of Trump’s economic plan without any effective opposition from the Democrats. Note that I believe Democrats will join the money-printing party, because what politician can resist handing out free goodies to their constituents?

The Republicans will start by passing bills that incentivise manufacturers of critical goods and materials to expand production onshore. These will be similar to the CHIPS Act, Infrastructure Bill, and Green New Deal passed under the Biden administration. Bank credit growth will explode higher as companies take these government subsidies and obtain loans. For those who fancy themselves stock pickers, buy the listed companies that produce the things the government wants made.

At some point, the Fed will cry uncle and exempt, at a minimum, Treasuries and central bank reserves from the SLR. When that happens, the path to infinite QE will be clear of obstacles.

The combination of legislated industrial policy and the SLR exemption will result in a gusher of bank credit. I have already shown how the monetary velocity of such policies is much higher than that of traditional QE for rich people overseen by the Fed. Therefore, we can expect that Bitcoin and crypto will perform as well, if not better, than they did from March 2020 until November 2021. The real question is, how much credit will be created?

The COVID stimulus injected ~$4 trillion of credit. This episode will be much larger. Defence and healthcare spending alone are growing faster than nominal GDP. And they will continue to grow quickly as America beefs up defence spending to counter the shift to a multi-polar geopolitical environment. Individuals over the age of 65, as a percentage of the US population, will peak by 2030, which means an acceleration in healthcare spending growth from now until then. No politician can cut defence spending and healthcare as they will be swiftly voted out of office. All this means is that the Treasury will be busy pumping the market full of debt quarter after quarter just to keep the lights on. I showed earlier how QE paired with Treasury borrowing has a monetary velocity greater than one. This deficit spending will raise America’s nominal growth potential.

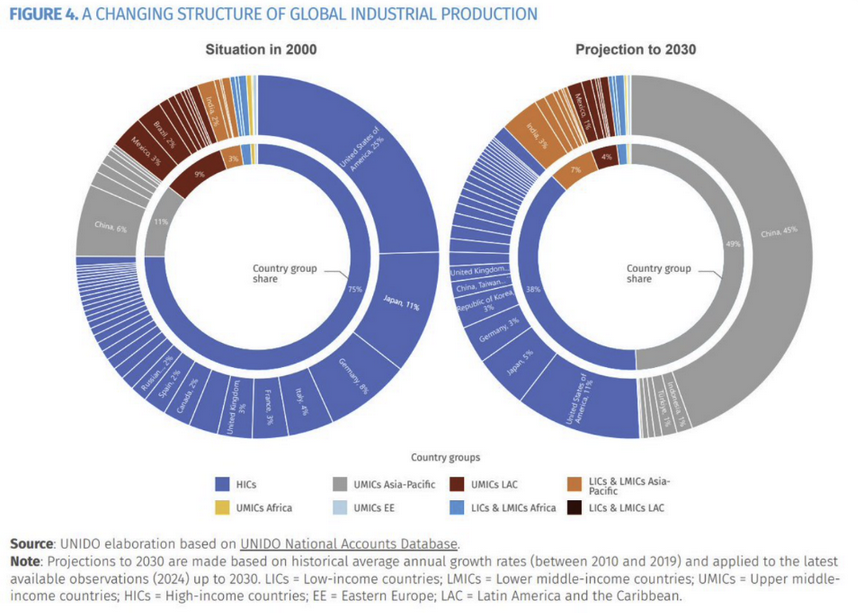

When it comes to re-shoring American businesses, the costs of accomplishing this goal will also be in the trillions of dollars. America gave its manufacturing base to China voluntarily, starting in 2001 when it allowed China to enter the World Trade Organisation. In under three decades, China has become the workshop of the world, producing the highest quality goods at the lowest prices. Even companies that want to diversify their supply chains outside of China to supposedly cheaper countries come to the realisation that the integration of so many suppliers along the eastern coast is so deep and effective that even if the per-hour wage is much lower in Vietnam, for example, these companies still need to import intermediate parts from China to produce finished goods. All that is to say, it is going to be a gargantuan task to re-align supply chains to America, and if it must be done for political expediency, it will be fucking expensive. I’m talking about high single-digit to low double-digit trillions of dollars of cheap bank financing that must be provided to shift productive capacity from China to America.

It took $4 trillion to decrease the debt-to-nominal GDP ratio from 132% to 115%. Let’s say the US reduces it further to 70%, which is where the ratio was in September 2008. Just using a linear extrapolation equates to $10.5 trillion of credit that must be created to accomplish this deleveraging. This is how Bitcoin goes to $1 million, because prices are set on the margin. As the freely traded supply of Bitcoin dwindles, the most fiat money in history will be chasing a safe haven from not just Americans but Chinese, Japanese, and Western Europeans. Get long, and stay long. If you doubt my analysis of the impact of QE for poor people, just read up on the Chinese economic history of the past thirty years, and you will understand why I call the new economic system of Pax Americana, “American Capitalism with Chinese Characteristics.”

Want More? Follow the Author on Instagram and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

The post Black or White? appeared first on BitMEX Blog.