Key Insights

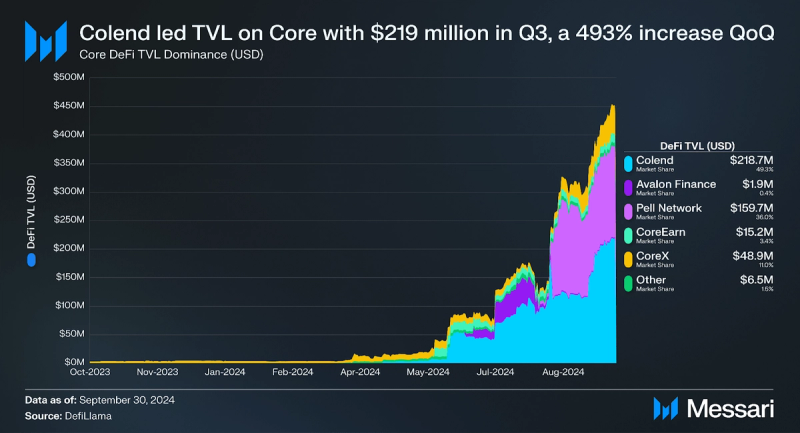

- Core’s DeFi TVL (USD) increased by 614% QoQ to $443.4 million. Colend topped the leaderboard for DeFi TVL, followed by Pell Network which launched BTC restaking on Core in August.

- CORE and BTC Staked (USD) increased by 85% QoQ to $556.7 million. The increase was largely due to 2,000 BTC being staked through Core’s Non-Custodial BTC Staking product, which launched in April.

- Average daily active addresses increased 49% QoQ to 96,100. At the end of Q3, Core finished with a cumulative total of 21.9 million unique wallets.

- Season 2 of Core Ignition went live in September, featuring new boosters to earn Sparks. Ignition offers users rewards for engaging with the Core Ecosystem.

- Core announced the Fusion Upgrade, which will introduce Dual Staking for BTC and CORE, and LstBTC, Core’s first BTC liquid staking token. The upgrade is set to go live in Q4.

Primer

Core developed the Core blockchain (CORE) as a scaling and programmability solution for Bitcoin, differentiating it with its Satoshi Plus consensus, EVM execution environment, Core governance, and coreBTC bridge. Launched in early 2023, the Core community is building an ecosystem of Bitcoin-focused applications, leveraging Bitcoin security such as consensus resources, wherever possible.

Satoshi Plus consensus involves staking and hash rate delegation from Bitcoin miners. Staking includes both the native CORE token and BTC. This combination of security resources results in a hybrid model that leverages Bitcoin mining, rewards miners, and separates block production to mitigate censorship and MEV risks. The network’s EVM compatibility allows Core to run smart contracts and applications by leveraging existing Ethereum developer tools and the Ethereum ecosystem. coreBTC is the enshrined Core-native bridged BTC, enabling users to access BTC liquidity in Core’s fully expressive execution environment. For a complete primer on Core, refer to our Initiation of Coverage report.

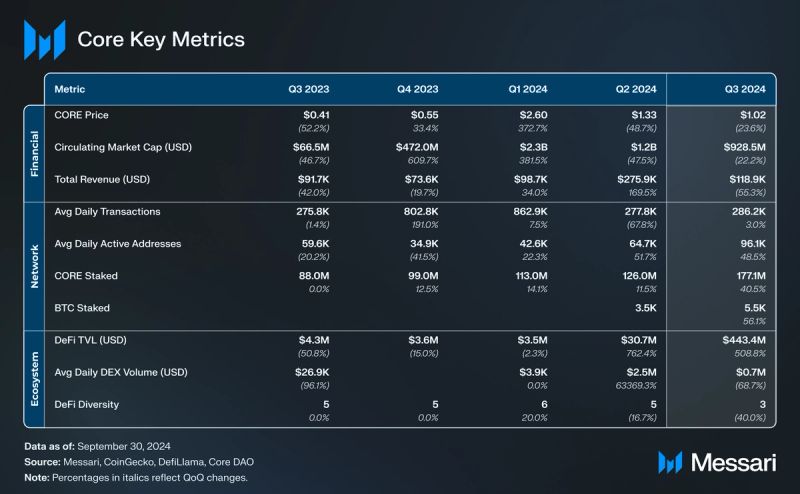

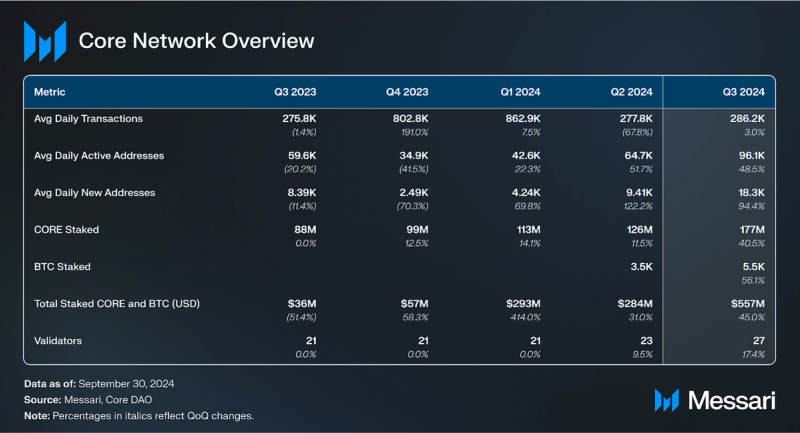

Key Metrics

Financial Analysis

CORE is the native token of the Core blockchain and is used as the primary medium of exchange when transacting on the network. CORE has three primary use cases:

- Paying transaction fees.

- Staking to secure the network and earn rewards.

- Participating in onchain governance.

The total supply of CORE is 2.1 billion tokens, with block rewards distributed over 81 years. CORE also has a minor deflationary burn mechanism aimed to counteract inflationary pressure. Additionally, block rewards decrease by 3.6% annually.

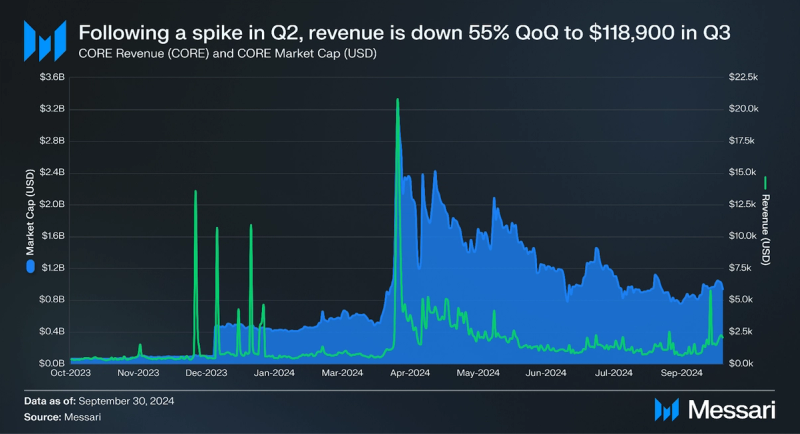

Market Cap & Revenue

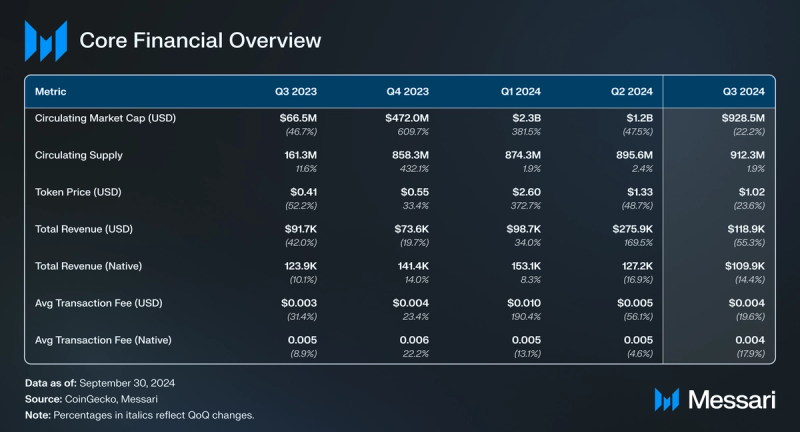

Core’s market cap decreased by 22% QoQ to $928.5 million, and price decreased by 24% QoQ to $1.02 in Q3. This discrepancy is due to a 3% increase in the circulating supply of CORE.

Bitcoin continued its trend of increasing market dominance, rising from 51% to 53% in Q3. Still, BTC’s market cap remained relatively flat, increasing 1% QoQ to $1.3 trillion in Q3. Bitcoin’s open interest remained mostly flat, indicating less active market participation. Core price activity is usually correlated to Bitcoin’s, but altcoins pulled back in Q3, and other BTC sidechains/L2s followed a similar pattern. Given rising BTC dominance, investors were likely retreating to BTC ahead of the U.S. election.

Revenue decreased by 55% QoQ to $118,900 in Q3. Core DAO earns revenue through transaction fees on the network. Transaction activity for the Core network was relatively flat, increasing 3% in Q3. Since fees are earned in CORE tokens, the falling price of CORE would also impact revenue. Low DEX activity may have also contributed to lower revenue this quarter. Bitcoin similarly saw a 30% decline in miner revenue in Q3, driven by BTC’s lower average price, muted transaction fees, and reduced block rewards following April’s halving.

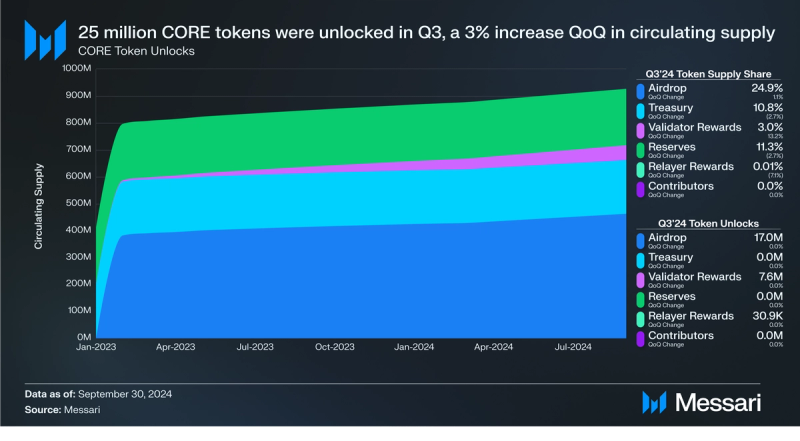

Token Vesting

In Q2, 24.7 million CORE tokens were unlocked. Of the token unlocks, 17.0 million were for airdrop participants, 7.6 million were for validator rewards, and 30,900 were vested for relayers.

Airdrops participants will be vested for 484.9 million CORE by January 2025. Block rewards decrease by 4% annually, extending the emissions schedule and maintaining deflationary pressure. Rewards for Relayers and Validators will continue being distributed for 81 years. Contributors, which include team incentives, begin vesting in January 2024.

Network Analysis

The average block time on Core was only 3 seconds in Q3, whereas the average block time on Bitcoin was 10 minutes. Bitcoin L2s and sidechains can execute transactions offchain, like the Lightning Network, or on their own networks, like Stacks or Merlin Chain. Certain transactions, such as opening and closing channels or disputes, may require anchoring to Bitcoin’s mainnet, which means they are not fully independent from Bitcoin’s high latency. Core is not limited by Bitcoin’s block time and can execute at an independent pace in any instance since it executes on the Core network.

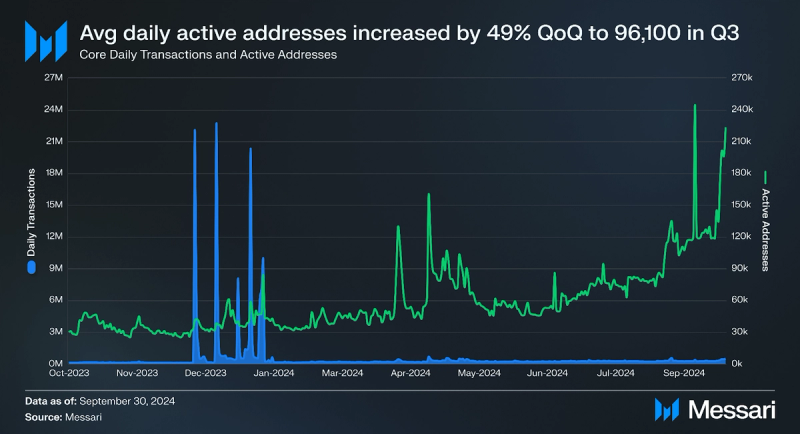

In Q3, average daily active addresses increased 49% QoQ to 96,100, and average daily transactions increased 3% to 286,200. From Q4’23 to Q1’24, inscription activity spiked, causing increases in the number of average daily transactions and average active addresses. Inscription activity began to decline by late January. While average transactions remained mostly flat, average new addresses increased by 94% to 18,300. Additionally, Core reached 21.9 million unique wallets in Q3, a 40% increase QoQ.

In Q2, Core announced the passing of CIP-2, which outlines the expansion of Core’s active validator set from 21 to 31 by Q2 2025. Core added four additional validators in Q3, a 17% increase QoQ. Currently, Core uses its Validator Election mechanism to rank the top 27 validators based on a weighted score of their hash and stake (CORE and BTC), creating the validator set for a consensus period of 200 slots, known as an epoch.

Staking

Core uses the novel Satoshi Plus consensus mechanism. Satoshi Plus is a hybrid model of Delegated Proof-of-Work (DPoW), Delegated Proof-of-Stake (DPoS), and Non-Custodial BTC Staking. Unlike merge-mined sidechains, Core validators, rather than Bitcoin miners, are responsible for mining new blocks.

CORE staked was up 17% QoQ to $197.6 million in Q3. 177.1 million CORE tokens were staked, a 41% increase from Q2. BTC staked increased 57% QoQ to $359.1 million in Q3. There were 5,500 BTC tokens staked, a 64% increase QoQ.

Core plans to launch Dual Staking, which offers BTC stakeholders a yield boost that correlates to how much CORE they’ve staked. By granting stakers of both Bitcoin and CORE the highest Bitcoin staking rates, the protocol incentivizes Bitcoin stakers to become more committed to the Core ecosystem by accumulating and staking CORE tokens.

Consensus

Core has multiple validators (M Labs, InfStones, OKXEarn, etc.) participating in Satoshi Plus consensus. In Q3, four new validators joined Core – notable additions include:

- DeFi Technologies, which aims to provide traditional investors with opportunities to invest in digital assets through venture funds and exchange-traded products. It is the parent company of Valour, which manages a CORE exchange-traded product and a BTC exchange-traded product; Valour joined as a validator in May.

- Animoca Brands, which is a Hong Kong-based company that develops and publishes digital entertainment, such as games, NFTs, and metaverse projects. Animoca is also one of the largest investors in Web3 projects.

In Q3, Core had over half of the delegated hash rate from BTC miners on the Core network. Core leverages the large pool of computing power to promote decentralization and enhance security on its network.

Core currently has 27 validators, but the DAO has stated it will have 31 validators by Q2 2025.

Ecosystem Analysis

Core saw a 52% rise in dApps integrated into their ecosystem QoQ. Notable integrations include Pell Network, iZUMi Finance, and Rubic. As of Q3, Core has 93 dApps listed on its ecosystem page. The accelerating rate of capital locked on the protocol suggests higher adoption and usage of CORE throughout the ecosystem, especially as the Core ecosystem grows. The influx of new dApps offers users several unique, competitive ways to manage capital and find yield with CORE and BTC.

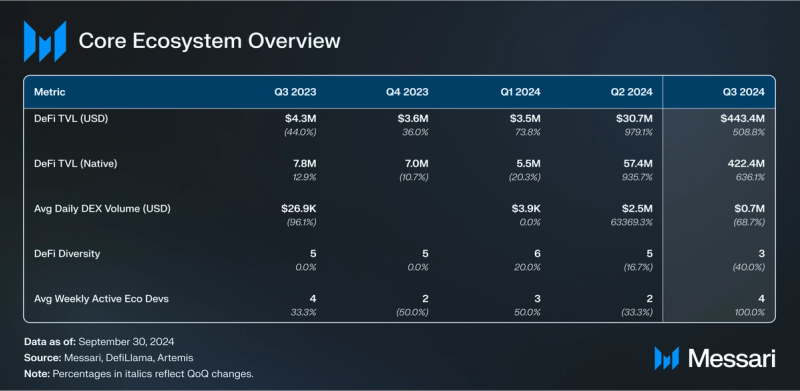

DeFi diversity represents the number of protocols that make up >90% of DeFi TVL. Core’s DeFi diversity was 3 in Q3; TVL was concentrated in Pell Network, Colend, and CORE Liquid Staking.

DeFi

Colend, a lending and borrowing platform native to Core, led TVL for the second quarter in a row with $218.7 million in Q3. Most of Colend’s TVL increase came from users supplying SolvBTC.m, a bridged version of BTC from the Solv Protocol. Colend launched a points program with an airdrop that went live in November.

Pell Network, a Bitcoin restaking layer followed Colend as the second largest dApp with $159.7 in TVL. Pell Network launched on Core in August, offering users higher yields for restaking coreBTC or SolvBTC, among other BTC derivatives. Pell Network offers BTC restaking across multiple other chains, including Merlin Chain, Rootstock, Base, and ETH.

COREx, a V3-style DEX forked from Uniswap, launched on Core in May 2024. It offers some unique features, such as copy trading and AI-enhanced analytics. COREx finished Q3 with $6.5 million in TVL, a 54.8% increase QoQ. They hold a 2% market share, the highest of any DEX on Core. Other DEXs, such as SushiSwap and ArcherSwap, saw decreased TVL in Q3, while Glyph saw a 71% increase QoQ in TVL.

Avalon Finance, a decentralized lending protocol, launched in June 2024. Avalon offers overcollateralized lending to reduce lender’s risk. Avalon ended Q2 with $1.9 million in TVL, down 87% QoQ.

stCORE, Core’s native liquid staking product, was launched in January 2024. The token is designed to give CORE stakers liquidity to participate in DeFi and other yield opportunities while contributing to the Core blockchain. stCORE ended Q2 with $9.3 million in TVL, roughly 5% of the 126 million CORE tokens staked (valued at $168.5 million at the end of Q2). stCORE ended Q3 with $15.2 million, a 63% increase QoQ. This makes up roughly 15 million CORE tokens, approximately 8% of all staked CORE.

Valour, the asset management arm of DeFi Technologies, leveraged the Core blockchain to introduce the first yield-bearing BTC exchange-traded product in June. It’s available to German investors on the Börse Frankfurt, the largest German stock exchange. Valour generates yield by delegating BTC to their validator node on Core through the non-custodial BTC staking feature. The yield is attributed to the Net Asset Value daily, providing investors with yield without selling or trading their BTC holdings. In Q3, Valour launched a CORE ETP on the Swedish Spotlight Market, providing Swedish investors an accessible way to invest in Core.

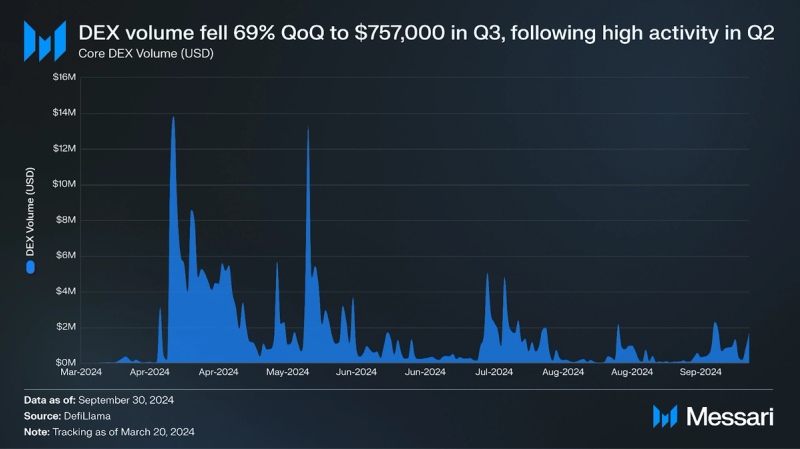

DEX Volume

Core had an average daily DEX volume of $757,000 in Q2, a 69% decrease QoQ. DEX Volume maxed out at $5.1 million on July 16. Volume decreases on Core coincided with an 8% DEX volume decrease across DeFi in Q3.

Ecosystem and Growth

Two mutually reinforcing offerings define the Core ecosystem:

- Bitcoin Yield Product

- EVM-Compatible BTCfi Platform

Non-Custodial BTC Staking secures the Core network and delivers yield to Bitcoin holders. The yield is sourced from Core’s BTCfi platform, providing an endogenous source of Bitcoin value creation.

The Core network uses the EVM, which means it can leverage Ethereum’s infrastructure and ecosystem for expansion. Wallets like MetaMask, developer tooling like Hardhat, and DEXs like SushiSwap are found on Core. This familiarity reduces the development overhead and has other benefits, such as reducing the risk of exploits. Core’s ecosystem developers can leverage the learnings of EVM development on Ethereum, Arbitrum, Avalanche, and other EVM chains.

Fusion Upgrade

Core announced they would release two new products in Q4: Dual Staking and LstBTC. The introduction of the two new features has been termed the Fusion Upgrade.

Dual Staking gives BTC stakers the opportunity to earn higher BTC staking rates by also staking CORE tokens. Higher proportions of staked CORE relative to staked BTC result in greater yields. This addition closes the value loop between Core and Bitcoin by incentivizing BTC stakers to accumulate and stake CORE tokens.

LstBTC is a liquid staking token pegged 1:1 to BTC. It allows stakers to earn CORE token rewards while keeping their BTC liquid. Liquid staking tokens aim to eliminate the tradeoff between choosing liquidity and choosing yield. LstBTC will ultimately replace coreBTC as the default choice for natively using BTC on Core. A multi-sig on Bitcoin manages LstBTC.

Core has chosen to sunset coreBTC by introducing LstBTC in the Fusion Upgrade. While coreBTC initially enabled users to hold BTC on Core, LstBTC allows them to keep BTC liquidity while also staking, thereby contributing to Core’s consensus mechanism.

By unlocking BTC liquidity and providing more utility and yield generation opportunities on its network, Core expands its moat as a leader in BTCFi.

Sparks Incentive Program

In May 2024, Core DAO updated the Core Ignition Incentive Program to introduce Sparks, the network’s way of measuring user activity and engagement. Sparks are synonymous with the “points” that several popular pre-airdrop protocols began offering the past year.

Users receive a daily allocation of Sparks, determined by their level of engagement and participation in the Core ecosystem. The more active and involved a user is, the greater their daily allocation of Sparks will be. Additionally, Core offers a multiplier on specific assets that adjusts your conversion rate (i.e., if you hold an asset with a 1.5x multiplier and earn 100 base Sparks a day, you’ll receive an additional 50 Sparks through the asset multiplier, totaling 150 Sparks for the day).

In September, Core launched Season 2 of the Ignition Program. Sparks reset to 0 for all participants. Season 2 introduced new campaigns and ways to earn Sparks through Core network dApps, bridging, and trading.

Other Key Developments

Several other key developments and initiatives took place in Q3:

- DeFi updates: Core has integrated multiple DeFi platforms, including iZUMi Finance, Shoebill Finance, Rubic, DZap, Dorian, and Rivera Money. This enhanced liquidity, token swapping, yield opportunities, and liquidity management tools.

- Core partners with Copper (August 7): Copper, a leading digital asset custody provider, will now be able to offer custody and staking support for BTC and CORE. Copper works with multiple notable crypto and financial institutions, including Brevan Howard, GCR, and Ethena.

- Core DAO co-hosted Bitcoin Fusion (September 17): Core DAO, along with HTX and Metaschool, hosted Bitcoin Fusion in Singapore with over 2,700 registered attendees.

- Core announces plans to launch BTC ETF (September 19): Core announced plans to launch a BTC ETF in the US. The ETF could everage Non-Custodial BTC Staking to provide investors with a yield-bearing alternative to the available BTC ETFs, further bolstering the Core network and creating an opportunity to penetrate TradFi markets.

- Core bridging to Base goes live (September 20): Base blockchain is connected to Core via the official Core bridge. Base users can bridge WETH and USDC to Core’s network.

- Solv protocol launches SolvBTC.CORE on the Core network (October 1): Users can earn yield through CORE tokens by holding SolvBTC.CORE. The token is fully backed 1:1 by BTC, and Ceffu manages custody.

Closing Summary

Core saw many areas of network growth and ecosystem expansion in Q3, such as increases in TVL, active addresses, and unique wallets. Core continues to establish itself as a leader in developing DeFi for BTC and is well-positioned to onboard users from the Bitcoin and Ethereum networks.

Core’s success in Q4 and beyond will likely depend on the new products introduced in the Fusion Upgrade, including Dual Staking and LstBTC. Their ability to capture BTC holders has been proven with Non-Custodial BTC Staking; the next step is creating opportunities for BTC holders to earn higher yields through CORE staking and Core DeFi partners.