Key Insights

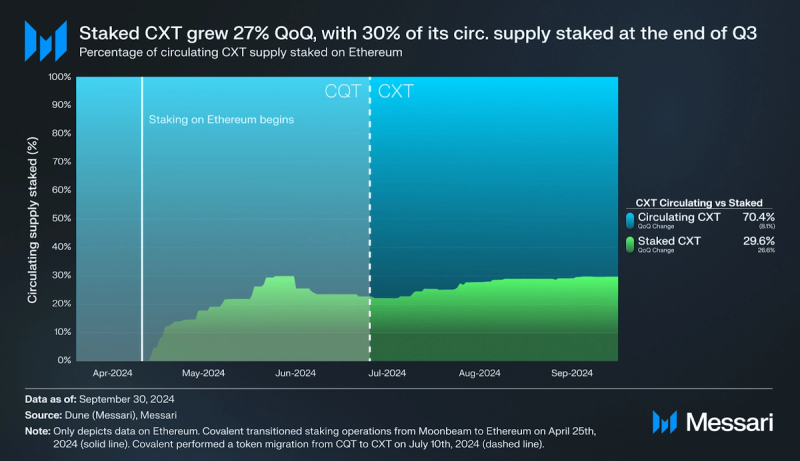

- After a successful token migration, staked CXT increased 27% QoQ to 30% of the circulating supply.

- Covalent added two new networks (Sei and Cronos) and five new operators for block specimen production in Q3. These additions grew the BSP set by 21% and increased the potential of the protocol’s staking supply sink.

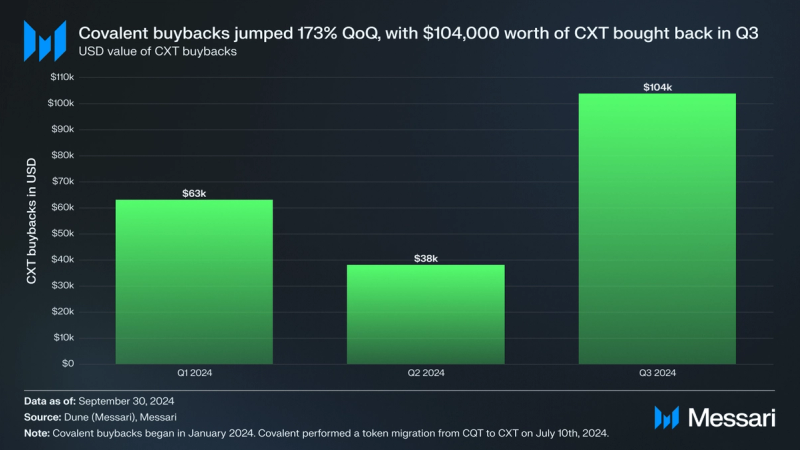

- Covalent bought back $103,800 in CXT in Q3, a 173% QoQ increase. The cumulative value of CXT bought back totaled $205,000 at Q3 close.

- Covalent governance increased the max multiplier to 40x, raised the CXT per epoch rewards to 89,700, and upped the CXT staking target to 35% of the circulating supply.

- Covalent launched the Ethereum Wayback Machine Light Client testnet. This product offering positions Covalent as a solution to Ethereum’s long-term data availability issue.

Primer

Covalent (CXT) is a long-term data availability protocol that structures data. It solves the problem of long-term data availability made prevalent after Ethereum’s Dencun upgrade, which deletes rollup history due to the state expiry feature. This particular solution is called the Ethereum Wayback Machine (EWM); it is used as a modular verifiable data infrastructure to solve AI challenges related to augmented decentralized training and inference.

Covalent supports over 234 networks across mainnets and testnets with GoldRush.dev, an API, SDK, and Frontend Kit. GoldRush.dev (formerly, Unified API) enables developers to query and use any blockchain’s data points in a standardized way. This feature is also available through the GoldRush SDK. The GoldRush Kit contains a set of React components that application developers can utilize to build their user interfaces.

Halfway through 2024, Covalent went through a rebrand and implemented a series of upgrades focused on accelerating its commitment to data availability and decentralized AI. It also raised $5 million in strategic funding to expand its operations in APAC. Following the rebrand, Covalent transitioned the previous CQT token to the new CXT token. For a full primer on Covalent, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics

Performance Analysis

Network

Covalent has over 150 paid API customers using its structured data protocol. These data consumers range from traditional finance and consulting companies to DeFi applications and investment tools. A few notable users include Fidelity, EY, Consensys, Matcha, Rainbow Wallet, and CoinLedger. With its focus on AI and long-term data availability on Ethereum, Covalent also serves Laika AI, Entendre Finance, SmartWhales AI, and more. To properly structure the data these entities consume, the protocol must extract, transform, and enrich the raw blockchain data to make it accessible.

Network Operators

Covalent has three core network operators: Block Specimen Producers (BSPs), Block Result Producers (BRPs), and Query Node Operators (QNOs). BSPs extract data from various blockchains and upload it to storage instances as block specimens. BRPs structure and transform block specimens into block results (queryable data) and upload them to storage instances. QNOs load block results into local data warehouses and serve API queries. Currently, the QNO role is operated by Covalent Labs, but it will be decentralized in the future. The QNOs may also have different implementations that allow for AI pipelines to leverage this modular data infrastructure.

In Q3, Covalent announced it had onboarded five new operators to run BSPs: Graphyte Labs, Sensei Node, StakeCraft, PierTwo, and Matrixed Link. Adding network operators increases the amount of stake the protocol can absorb and increases its workload capacity in block specimen and block result production. With the additional operators, Covalent raised its CXT staking target to approximately 35% of all circulating CXT. Staking acts as a supply sink, reducing the tradable supply and amplifying market forces. The number of BRPs remained steady QoQ at 15, with BSPs having a net gain of 4 QoQ after adding five new operators and disabling one BSP.

Block Specimens

A block specimen is a cryptographically secure representation of a block. BSPs extract and export block specimens to a storage instance. These new data objects can be reconstructed to represent a blockchain’s historical state. To ensure this offchain process is valid, BSPs then publish a proof to the ProofChain contract containing the block specimen hash and the IPFS access URL. The ProofChain contract will soon launch on a Byzantine fault-tolerant, high-throughput event streaming system built from the Cosmos SDK called EWM-ProofChain.

Block specimens produced in Q3 grew 32.7% QoQ, increasing from 287,600 to 381,500. Since block specimens represent data that could be reconstructed to form a blockchain’s history, the number of block specimens produced increases as more blockchains are covered. Additionally, as the number of BSPs increases, so does the number of block specimens produced. Along with growing the number of BSPs this quarter, Covalent also added support for Cronos and Sei Network.

Block specimens make blockchain data composable and reusable outside its respective execution environment. This property is vital in powering Covalent’s Ethereum-focused data availability solution, the Ethereum Wayback Machine (EWM). The EWM will address deleted rollup history due to the state expiry feature introduced in the Dencun upgrade. The EWM will also be pivotal in serving as a modular data infrastructure layer in Covalent’s initiatives to provide AI models with verifiable data for training and inference.

Block Results

After being saved to a storage instance, BRPs structure block specimens, perform data transformations, and output block results (queryable data by Query Node Operators) to a storage instance. As enriched transformations of raw block specimen data, block results can include offchain features related to the data, like NFT media. The data enrichment provides a more holistic context around the data, making it more useful to developers. BRPs also publish proofs to the ProofChain contract verifying their work and including an IPFS access URL.

Covalent Labs was the only BRP for the protocol until mid-Q3 2023, when it decentralized the role to shortlisted operators. In Q3, block results produced dipped 5.8% QoQ despite a rise in block specimens produced. The tradeoff was likely due to no new BRPs coming online in Q3. The increase in BSPs could indicate a need for Covalent to scale the number of BRPs, given the growth that BSPs have experienced over Q2 and Q3.

Staked CXT

Covalent uses a Stake-for-Access model where network operators (BSPs and BRPs) stake CXT (previously CQT) to perform work on the network. Covalent employs staking parameters, such as max/min values and a delegation ratio. These measures ensure that staked CXT remains distributed among the operator sets. BSPs must stake between 175,000 and 350,000 CXT. They also have a max delegation ratio of 40:1 (i.e., individual BSPs can only be allocated a maximum delegation of 14 million CXT). Alternatively, BRPs must stake a minimum of 35,000 CXT, while being restricted to a maximum of 70,000 CXT and receiving no delegation.

Since transitioning staking operations to Ethereum in Q2, Covalent has seen a 26.6% QoQ rise in the percentage of circulating CXT that is staked, moving from 23.4% to 29.6%. By closing Q3 with 29.6% of the CXT circulating supply staked, Covalent continued to make solid progress toward its goal of having approximately 35% of the circulating CXT supply staked.

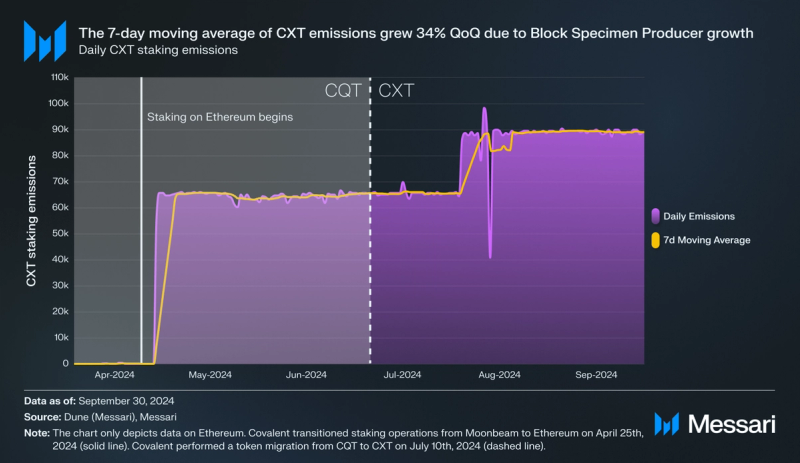

Alongside the approval of the increase in the max multiplier and new operators, Covalent governance also approved the increase of CXT emissions per epoch (24 hours) from approximately 66,400 to 89,700. In line with this change, the seven-day moving average of CXT emissions, which fluctuates based on the amount of CXT staked, grew 34% QoQ, moving from 65,300 to 89,100.

Financial

Rewards

BSPs and BRPs are currently subsidized with a budget of 20 million CXT rewards per year. However, Covalent only used about 10 million CXT in each of the 2022 and 2023 years and plans to use 24 million CXT in 2024. Before subsidization ends by 2026, Covalent plans to implement a revenue share. In this model, query revenue would be paid in US-denominated dollar stablecoins, with a portion being used to buy back CXT to reward node operators.

Currently, 20% of all query revenue is used to execute automatic buys of CXT, which are stored in a multisig wallet for later distribution. In Q3, CXT buybacks increased 173% QoQ growing from $38,000 to $103,800. Since a portion of query revenue is used to buy back CXT, it acts as a proxy for measuring the demand for Covalent’s GoldRush API. This growth in CXT buybacks suggests that the GoldRush API saw a large increase in demand in Q3.

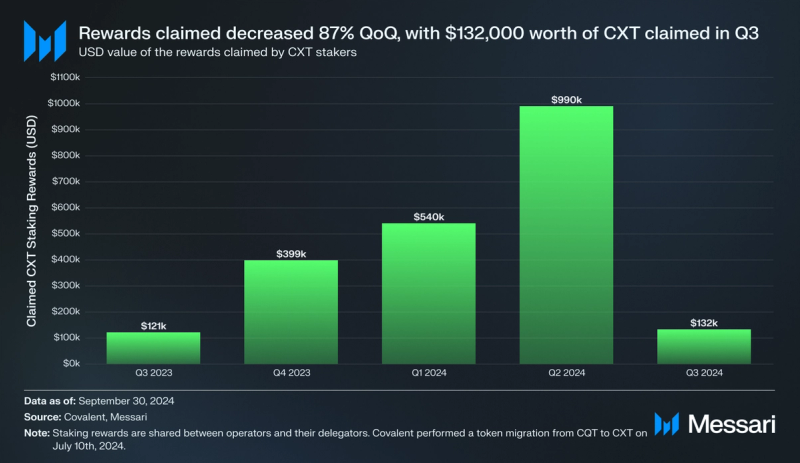

Network operators claimed 87% fewer USD rewards QoQ, dropping from $990,000 to $132,000. The price of CXT declined 37.2% in Q3, partially explaining the decrease in USD rewards claimed.

Market Cap

The CXT market cap fell 32.6% QoQ, moving from $130.4 million to $87.9 million. Despite the increase in CXT emissions, the circulating supply only rose 5.2% QoQ. This fall in market cap was largely due to CXT’s 37.2% QoQ price decline. Consequently, CXT’s market cap amongst all tokens fell 91 spots from 310 to 401, underperforming similarly priced cryptoassets. In the future, Covalent’s buyback program will link network demand directly to the increased buying pressure of CXT. As API query demand rises, Covalent’s revenue will increase, enabling further buybacks of CXT with the additional revenue. If there were to be a catalyst in decentralized AI protocols seeking structured historical onchain data, Covalent and CXT holders would be well-positioned to benefit from integrating AI with crypto.

Qualitative Analysis

Ethereum Wayback Machine

The Ethereum Wayback Machine (EWM) Light Client is a key addition to the Covalent Network, designed to preserve Ethereum’s historical blockchain data in a decentralized and scalable way. The EWM Light Client enables participants to validate blockchain data without operating full nodes, addressing the high resource demands of traditional validation.

The EWM Light Client works alongside BSPs as they produce Block Specimens by validating them against cryptographic proofs. Using methods like data availability sampling and KZG commitments, the Light Client allows for efficient validation without requiring extensive hardware or bandwidth. Doing so lowers the barrier to entry for network participation while supporting the decentralization of Ethereum’s data. Light Client operators must stake a minimum of 5,000 CXT per client instance to perform the validation process. In exchange, operators receive CXT rewards based on the accuracy and volume of their validation work, with an estimated APY of 20-25%.

The EWM Light Client launched its testnet towards the end of Q3 to allow early adopters to begin testing the client and providing feedback. Planned for November 2024, the mainnet launch of the Light Client will scale access and require participants to secure licenses through soulbound NFTs tied to their staked CXT. These licenses will allow participants to run Light Client instances and earn rewards. The EWM Light Client initiative aims to maintain Ethereum’s decentralized principles while addressing the challenges of scaling and data availability, ensuring the reliability of its historical records.

Day Zero of the New Dawn

Covalent’s New Dawn initiative, which began in Q2, set out to migrate all token activities (like staking) to Ethereum, sunset all activity on Moonbeam, and migrate CQT to CXT as part of the rebrand. This quarter, Covalent successfully achieved all of these key initiatives. Moving forward, the focus will be centered on upgrading and changing the protocol to align it more closely with decentralized AI and Ethereum data availability.

Covalent onboarded five new operators, aiming to stake approximately 35% of the circulating CXT supply. The new operators — Graphyte Labs, Sensei Node, StakeCraft, PierTwo, and Matrixed Link — were added as BSPs to expand Covalent’s ability to store and process Ethereum historical data. Additionally, governance voted to increase the Max Multiplier from 34x to 40x, ensuring sufficient delegation capacity to support network expansion and CXT holder participation.

Closing Summary

Covalent successfully completed a rebrand and token migration in Q3. Moving forward, Covalent will be focusing its efforts more deeply on AI and long-term data availability for Ethereum as it progresses towards its EWM Light Client roadmap. Covalent also improved on key metrics throughout the quarter, adding five new operators and two networks while increasing block specimen production. It also raised its stake percentage to 30% of the circulating supply and performed $104,000 in CXT buybacks. Covalent continues to position itself at the intersection of AI and crypto by working to solve Ethereum’s long-term data availability issue.