- Bill Dudley warns Bitcoin reserves could harm U.S. interests and the dollar’s global reserve status.

- Senator Lummis proposes U.S. Bitcoin reserves, aiming for 1M BTC to reduce national debt.

Bill Dudley, the former chairman of the New York Federal Reserve, has expressed serious worries about Bitcoin’s prospective inclusion in the US national reserves, according to Bloomberg. This would compromise the dollar’s longstanding status as the world’s reserve currency and most Americans’ interests, Dudley warns.

His criticism coincides with discussions about Bitcoin’s place in national financial policies, especially among legislators and supporters of cryptocurrency, which keep growing.

The Risks and Macroeconomic Impact of Bitcoin Reserves

Dudley’s case emphasizes how naturally volatile and speculative Bitcoin is. Bitcoin is a dangerous investment for a national reserve, unlike conventional assets like bonds or gold, as it does not provide income and suffers extreme price swings.

Moreover, Dudley noted that large government acquisitions of Bitcoin could artificially raise its value, therefore favoring present owners disproportionately and providing few advantages for the general society. Such acts, he contends, could do more damage than benefit, aggravating economic disparity and encouraging mistrust of government programs.

Dudley also stressed the possible macroeconomic effects of building a sizable Bitcoin reserve. Funding such an endeavor could aggravate the already heavy debt load of the country and raise inflationary pressures, whether through more debt or money creation.

These difficulties, he said, exceed any theoretical advantages from using Bitcoin as part of a reserve diversification plan. Rather, Dudley supports a more targeted legislative approach to control the possibilities and hazards the bitcoin market presents. Such steps, he thinks, will preserve economic stability and better fulfill the needs of the American people.

Some legislators are acting differently even if Dudley expresses worries. Proposed by Senator Cynthia Lummis, a U.S. Bitcoin reserve would help to lower national debt and position the government favorably in the changing financial environment.

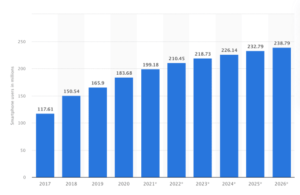

Her scheme calls for selling some of the gold reserves of the government to pay for the purchase of up to one million Bitcoin over five years. Advocates of such projects contend that increased acceptance of Bitcoin and its deflationary character could act as a buffer against inflation and changes in the world economy.

According to CNF, as part of a diversification strategy to combat inflation, Pennsylvania recently proposed funding Bitcoin with 10% of its state treasury funds.