Key Insights

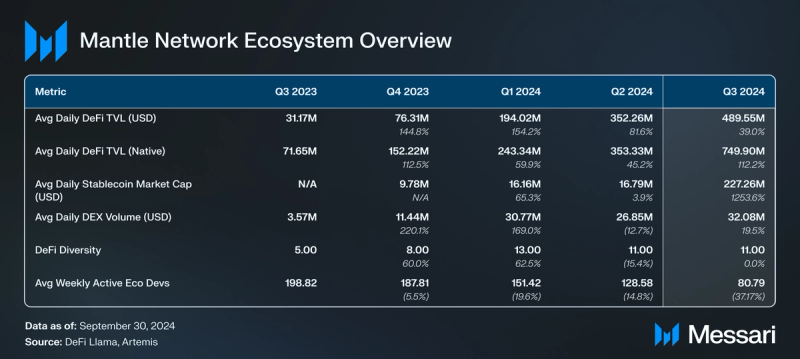

- Mantle Network strengthened its decentralized finance (DeFi) ecosystem through key initiatives, such as Methamorphosis Season 1 and the mETH Protocol, attracting over 500,000 staked ETH and driving Total Value Locked (TVL) to a record ~$92.20 million.

- Mantle’s MNT-based revenue grew by ~33.51%, highlighting the network’s underlying strength in staking and participation in DeFi.

- Strategic partnerships with blockchain-based gaming projects Catizen and MetaCene expanded Mantle’s reach into the gaming sector, attracting new users and driving a peak of 240,231 daily active addresses.

- The Mantle Rewards Station distributed 4.30 million ENA (~$2.19 million) and 200.00 million COOK (~$6.20 million) in 2024 via partnerships with Ethena, MYSO Finance, IntentX, and others.

- Community events like Mantle AI Fest: CH(AI)N REACTION, along with the protocol’s active presence at industry conferences, demonstrated strong community engagement, supported by reward incentives backed by Mantle’s extensive treasury.

Primer

Mantle is focused on building a sustainable hub for onchain finance by combining institutional-grade infrastructure with blockchain technology. At the heart of Mantle is its community-owned treasury, which, with over $4.00 billion in assets, actively funds innovative products and fosters the growth of ecosystem partners. Mantle drives financial utility and liquidity through core offerings like Mantle Network, mETH Protocol, and FBTC, enabling the development of solutions that enhance sustainable yield, deep liquidity, and composability across decentralized finance (DeFi).

Mantle Network (MNT) is a Layer-2 (L2) scaling solution for Ethereum built using OP Stack Bedrock. The EVM-compatible network employs an optimistic rollup mechanism to batch multiple transactions into a single transaction on the Ethereum mainnet (Layer-1). Mantle Network aims to offer lower gas fees, reduced latency, and higher throughput than the Ethereum network. The project’s ecosystem consists of restaking, gaming, DeFi, and NFT protocols, which are anchored by its large community-owned treasury. Mantle’s treasury is a major catalyst for asset partner growth, paving the way for protocols such as Ethena USDe, Ondo USDY, Agora AUSD, and EigenLayer restaking to provide enhanced yield options and liquidity solutions. Mantle Network’s target objective as a protocol is to enhance sustainable yield, deep liquidity, and financial utility across its network.

Mantle’s core product offerings include:

- Mantle Network: An Ethereum L2 known for its modular design and as the first adopter of EigenLayer and EigenDA, serving as the backbone for a diverse range of products and applications within its ecosystem.

- mETH Protocol: Mantle’s liquid staking and restaking protocol for ETH opens up new possibilities for users to maximize asset potential.

- Ignition FBTC: A decentralized Bitcoin solution that combines Bitcoin’s security with the composability of decentralized finance. It bridges BTC into the Web3 economy and unlocks new financial opportunities.

Website / X (Twitter) / Discord

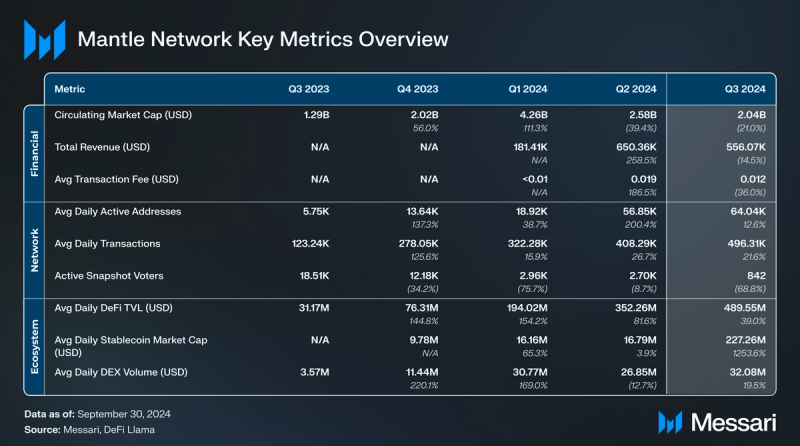

Key Metrics

Financial Analysis

Market Cap and Price

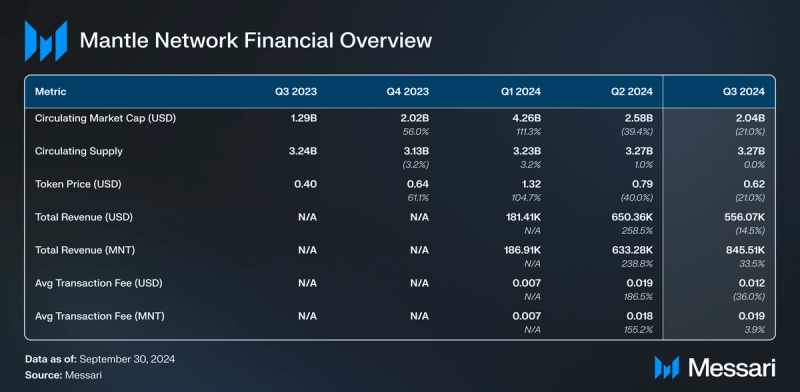

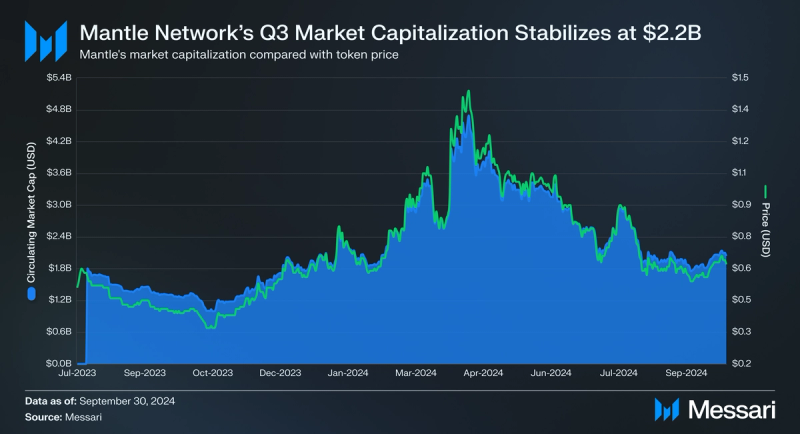

The market cap of Mantle Network’s native token, MNT, reached ~$2.92 billion in Q3 2024, ranking as the 31st largest cryptocurrency. During the week of July 15, 2024, MNT’s price rose from ~$0.76 to ~$0.89, a ~17.11% increase week over week. This price action was temporary, as MNT would retrace ~30.34% over the following weeks, falling back down to ~$0.62 by the end of the quarter.

Revenue

Mantle Network generates revenue through various mechanisms:

- Transaction Fees: Mantle Network charges gas fees based on the computational complexity of transactions, paid in its native MNT token. This differentiates Mantle from other EVM-based L2s, which typically require ETH to settle gas fees.

- Incentive Programs: Programs like the Mantle Rewards Station generate fees via users locking MNT to earn rewards.

- Liquid Staking and Restaking: Products like the mETH Protocol have attracted significant TVL, with Mantle earning revenue from staking-related activities and associated fees.

- Partnerships: Q3 2024 partnerships with projects such as Catizen and Ignition FBTC expand Mantle’s reach into sectors such as Telegram gaming and the Bitcoin ecosystem, generating revenue through increased transaction fees and user activity on the network by new user groups.

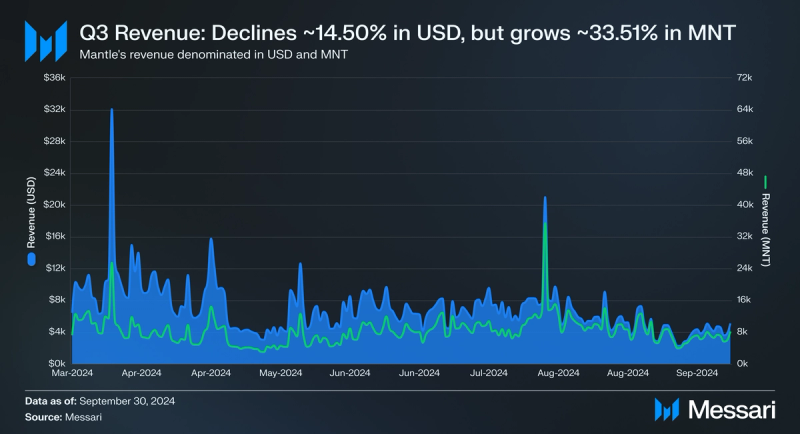

Mantle Network generated ~$556,066 in total revenue during Q3, reflecting a ~14.50% QoQ decline in USD terms. Despite this drop, the protocol demonstrated resilience as revenue measured in MNT increased by ~33.51%. This underscores the network’s sustained activity and growth in staking and DeFi participation despite market fluctuations.

On Aug. 5, 2024, Mantle recorded its second-highest revenue day, with an influx of ~$20,993 (~35,407 MNT). This spike was driven by high user engagement with the Mantle Rewards Station and the locking of 111 million MNT tokens on that day. Three days later, on Aug. 8, 2024, the protocol achieved its all-time high TVL of ~$92.20 million, marking a notable milestone in the network’s liquidity and user participation.

Network Overview

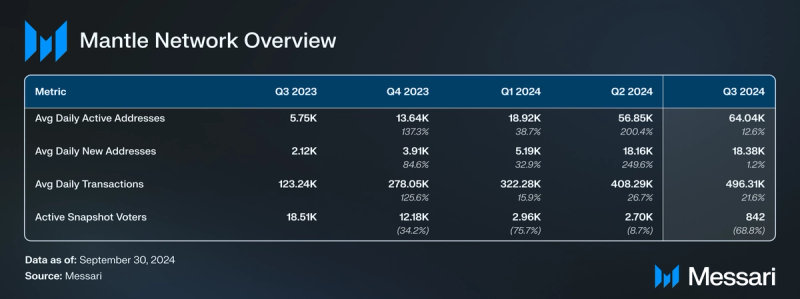

Mantle Network’s average daily active addresses increased ~12.65% QoQ, from 56,854 in Q2 to 64,044 in Q3. Similarly, average daily transactions rose from 408,291 to 496,313 over the same period, a ~21.56% increase QoQ. Average daily new addresses showed positive growth in Q3, increasing ~1.23% QoQ (from 18,158 to 18,382 addresses). Active snapshot voters experienced a decline in Q3, dropping ~68.81% QoQ (from 2,700 to 842 voters).

Treasury Value and Holdings

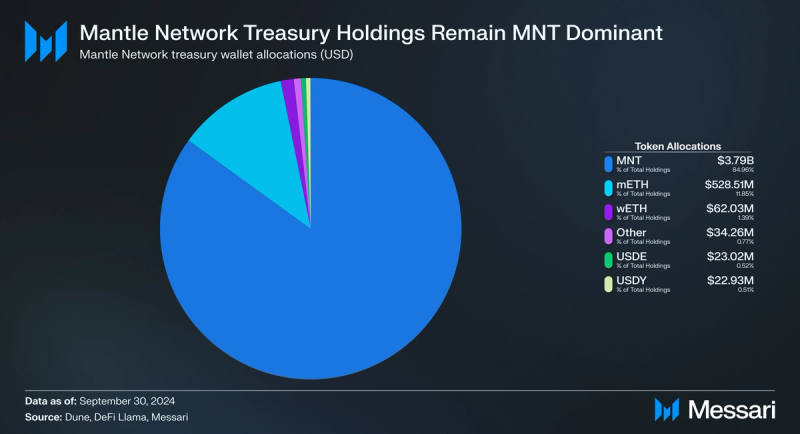

Mantle Network’s treasury holdings in Q3 2024 were predominantly concentrated in MNT, which accounted for ~84.96% of the total, valued at ~$3.79 billion. mETH represented the second-largest allocation at ~11.85%, totaling ~$528.51 million, while wETH comprised ~1.39% of holdings, worth ~$62.03 million. Smaller allocations included “Other” assets (~0.77%, ~$34.26 million), which were primarily composed of USDC (~$5.24 million), sUSDe (~$4.84 million), and xSUSHI (~$2.70 million). Additional holdings included USDE (~0.52%, ~$23.02 million) and USDY (~0.51%, ~$22.93 million). This distribution underscores Mantle’s reliance on its native token, MNT, as the foundation of its treasury while supporting network growth and liquidity through strategic allocations to mETH and other assets.

On Sept. 11, 2024, MIP-31 was introduced by the Mantle Core Contributor team, and was a proposal to update Mantle’s treasury budget for the second budget cycle (12 months from Jul 2024 to Jun 2025). The terms of the proposal included limits, exclusions, and an updated budget cycle. Under the limits proposed in MIP-31, the total limits for USDx and MNT were raised to 52M Units and 200M Units, respectively, intending to provide flexibility for business expansion while maintaining an oversight checkpoint from Mantle Governance. The proposal also excluded financing activities, bridge liquidity, gas costs, and other non-USDx/MNT spending as part of the budget while extending the budget pro-rate for up to 3 months of the following budget cycle.

Telegram Gaming’s Role in Network Growth

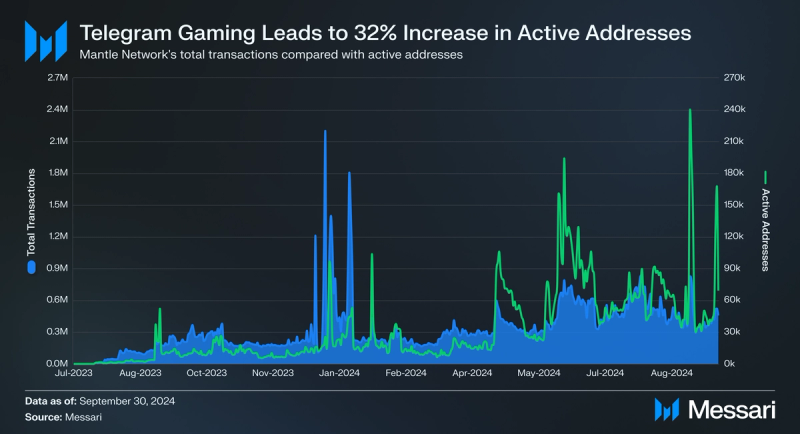

Mantle Network’s average daily transaction count was 496,313 in Q3 2024, reflecting a ~54.00% increase from Q1 (+174,035), and a ~21.56% increase from Q2 (+88,021). On Aug. 6, 2024, the protocol recorded a quarterly high daily transaction count of 831,687, influenced by a record 111 million MNT being locked on the Mantle Rewards Station throughout this day.

On the user front, daily active addresses averaged 18,845 throughout Q3, demonstrating a ~32.06% QoQ growth. The network’s largest number of active addresses was recorded on Sept. 10, 2024, which surged to 240,231 as a result of the network’s integration with the popular Telegram game, Catizen.

Ecosystem Overview

Methamorphosis Season 1 and mETH Protocol

On Jul. 5, 2024, Mantle launched Methamorphosis Season 1, a multi-protocol incentive program designed to boost engagement with the mETH token across various DeFi protocols on Mantle Network. This program rewards users with “Powder” for engaging in different DeFi activities centered around mETH. By holding mETH on the Layer-2, users earn Powder daily.

Mantle has partnered with several DeFi protocols to offer diverse earning opportunities for Powder. These partnerships include Ignition, Swapsicle, iZUMi Finance, Vertex Protocol, and Gravita Protocol. The reward structure varies across partners, incentivizing different DeFi activities with daily e ranging from 20-40 Powder per mETH, depending on the specific pool or activity.

Building on Methamorphosis, Mantle evolved its liquid staking offerings. By the end of July 2024, over 500,000 ETH in staked assets had been attracted. On Aug. 20, 2024, a rebranding from Mantle LSP to mETH Protocol was announced, aligning with the project’s expanded vision.

Through MIP-30 (mETH Improvement Proposal), the protocol announced and executed two new token launched: cmETH and COOK. The protocol’s liquid restaking token, cmETH, allows users to restake their mETH, enabling participation in various yield opportunities, such as ETH staking yields, Layer-2 application integrations, and potential future yields from Actively Validated Services (AVS). Complementing its staking tokens is COOK, the governance token for the mETH Protocol. With a total token supply of 5 billion, COOK is designed to allow stakeholders to participate in the project’s future governance and economics.

cmETH: Expanding Restaking Opportunities

The introduction of cmETH, a composable liquid restaking token (LRT), marks the next phase of growth for the mETH Protocol. Building on the success of the liquid staking token mETH, cmETH enables users to restake assets seamlessly, layering additional yield opportunities on top of Ethereum’s Proof-of-Stake (PoS) rewards. Designed to integrate across Mantle’s ecosystem, cmETH provides tokenholders with access to multiple revenue streams, including restaking protocols, Actively Validated Services (AVS), and Layer-2 decentralized applications. This innovation is poised to enhance Mantle’s ecosystem by driving further adoption of restaking strategies and unlocking new financial utilities for users.

COOK: Governance for mETH Protocol

COOK is the governance token of the mETH Protocol, granting tokenholders the ability to influence the protocol’s strategic direction and decision-making processes. With a total token supply of 5.00 billion, COOK was allocated across the community (60.00%), Mantle Treasury (30.00%), and core contributors (10.00%). Upon TGE, COOK tokens were allocated to (i) the mETH Protocol community, with 14.32% fully vested, (ii) the Mantle Treasury, with 4.00% fully vested, and (iii) the Core Contributor team%, subject to a 12-month cliff followed by a three-year linear vesting schedule. Beyond governance, COOK serves as an integral part of Mantle’s ecosystem, enabling integration with DeFi functions like liquidity pooling and collateralization across Mantle’s Layer-2 applications.

Gaming and Social Integration

Mantle Network expanded into gaming and social platforms to drive user adoption and engagement. A notable development in this area was the partnership with Catizen.

Catizen, developed by Pluto Studio, is a Web3 gaming project that uses Telegram’s to introduce users to blockchain technology. The game reported a peak of over 36 million players, with seven million daily active users (DAU) and one million paying users, generating $30 million in revenue within six months. Operating on The Open Network (TON) and Mantle Network, Catizen utilizes a cross-chain mechanism facilitated by Bybit, maintaining balances between the networks through mutual locking contracts. To boost engagement, Mantle Network launched a campaign in collaboration with Binance Web3 and Catizen AI. This initiative offered a prize pool of 30 million Fish Coins and 300,000 MNT tokens, including a gas subsidy event of 80,000 MNT to reduce entry barriers for new users.

Mantle also partnered with MetaCene, a blockchain-based massively multiplayer online role-playing game (MMORPG). In collaboration with Mantle, MetaCene’s Gold Rush event offered a reward pool of over $3 million. This event, targeting users in Asia and Latin America, showcased Mantle’s ability to support gaming applications and attract a diverse, global user base.

Gaming and social integrations expand Mantle’s reach beyond traditional DeFi applications. By making such connections, Mantle seeks to increase the adoption of blockchain technology and create additional avenues for community growth and engagement.

DeFi Expansion into Bitcoin

Mantle’s DeFi ecosystem expansion was not limited to Ethereum-based assets, as Bitcoin (BTC) was also integrated into its DeFi offerings. At the forefront of this initiative is FBTC, a token designed to enhance Bitcoin’s utility and yield opportunities. As of July 12, 2024, FBTC can be swapped on and bridged between Mantle Network and Ethereum. This launch, part of the “Ignition” initiative, expands yield options for BTC tokenholders.

Mantle Network’s ecosystem also includes Bedrock DeFi, enabling users to stake FBTC in return for uniBTC. This process involves locking FBTC into the Bedrock Dashboard to mint uniBTC.

Mantle Rewards Station: Unlocking Ecosystem Incentives

The Mantle Rewards Station serves as a gateway for MNT tokenholders to earn rewards by participating in the broader Mantle ecosystem. In 2024, the platform distributed (i) over 4.30 million ENA (~$2.19 million) in collaboration with Ethena, (ii) 200.00 million COOK (~$6.20 million) through initiatives like mETH Protoco, Methamorphosis Season 1, the Mantle Rewards Station, and additional rewards via partnerships with MYSO Finance, Skate Chain, and IntentX. Designed to incentivize user activity, the Rewards Station highlights Mantle’s emphasis on integrating DeFi, gaming, and NFT protocols into a cohesive ecosystem. By aligning token incentives with ecosystem participation, Mantle strengthens user engagement, positioning the Rewards Station as a cornerstone of its user engagement model.

Artificial Intelligence

Mantle hosted a successful artificial intelligence-oriented event in Q3 2024 called Mantle AI Fest: CH(AI)N REACTION. The event featured a 1 Million MNT prize pool, split according to one’s completion of specific tasks at the event.

During Mantle AI Fest: CH(AI)N REACTION, several innovative AI applications were showcased:

- ScopeChat by 0xScope: Provides a chatbot interface for interacting with blockchain networks using natural language processing.

- ORA: A trustless AI agent on Ethereum that makes blockchain networks AI-native through tokenized model ownership.

- AgentLayer: Creates a decentralized network of autonomous AI agents to perform tasks with minimal human intervention.

- FIDE AI: Allows users to compete with AI to identify opportunities in Web3.

- MUA DAO: Establishes a modular protocol that enhances interoperability between human and AI-created assets.

Closing Summary

Q3 2024 was a pivotal period for Mantle, marked by growth and strategic advancements across key areas. Mantle Network’s ecosystem development strategy, which spans DeFi innovations, technological upgrades, and high-profile partnerships – particularly in blockchain gaming – continues to expand its global footprint. With upcoming product launches, enhanced incentive programs, and ongoing decentralized application development, the network remains committed to strengthening its onchain economy. These efforts position the Layer-2 to drive sustainable yield, deepen liquidity, and enhance financial utility within its ecosystem while contributing meaningfully to the broader DeFi landscape.