Key Insights

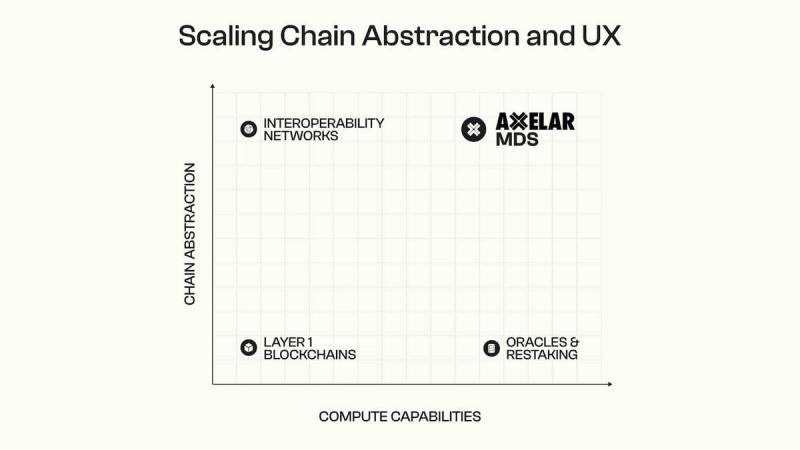

- At the end of Q3, Axelar introduced the Mobius Development Stack (MDS). This new development stack leverages the Interchain Amplifier, the Interchain Token Service (ITS), and the Axelar Virtual Machine (AVM) to provide the industry with cross-chain interoperability standards.

- MDS will allow new chain integrations via smart-contract layer Verifiers: Flow, Solana, Stellar, XRP Ledger, Hedera, Stacks, Sui, and Bitcoin are planned, subject to on-chain governance. MDS connections are secured by non-inflationary pools of AXL, with the option to augment security with restaked ETH or BTC via EigenLayer and Babylon.

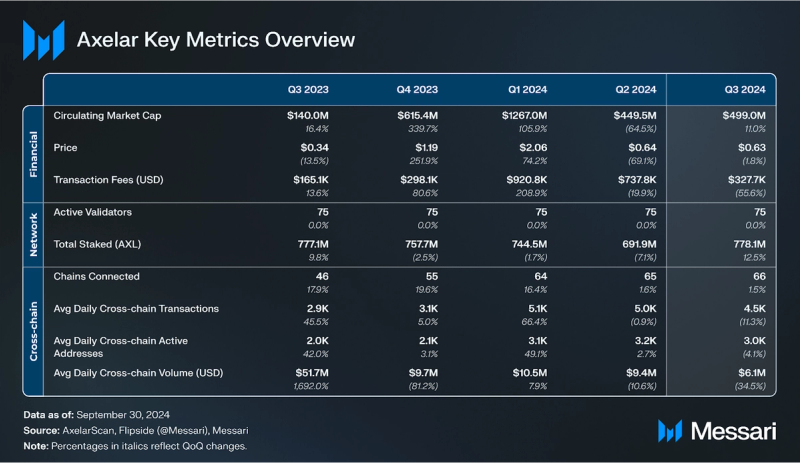

- In Q3, AXL’s circulating market cap increased by 11% QoQ to $499 million, a 257% YoY increase.

- Institutional adoption of Axelar for RWA interoperability: The Axelar Foundation released a whitepaper on institutional interoperability with insights from Citi, Deutsche Bank, Mastercard, Northern Trust, Metrika and Centrifuge. Axelar will be integrated into a Deutsche Bank pilot this year in the Monetary Authority of Singapore’s Project Guardian – the second year in a row Axelar has supported a Project Guardian initiative.

Primer

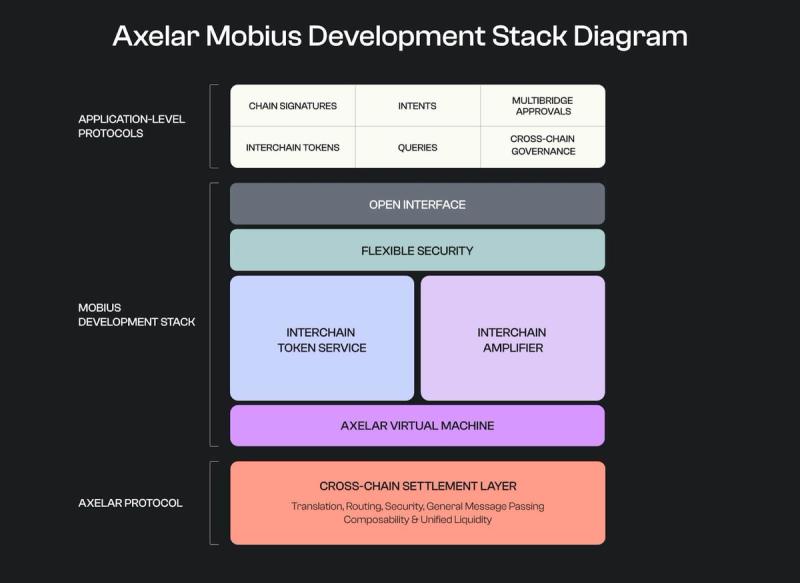

The Axelar network (AXL) is a Layer-1 network that enables cross-chain interoperability between various crypto ecosystems, i.e., a crypto overlay network. Axelar’s base protocol layer consists of a decentralized network and a set of Gateway smart contracts installed on interconnected external chains. It handles the core routing, security and translation for passing verified messages between blockchains, aka General Message Passing (GMP). Above the base protocol is a smart contract layer (Axelar Virtual Machine) that enables Axelar to function as a crypto overlay network, in which users and developers interact with many blockchains as though interacting with one. The AVM enables a developer environment comprising the Mobius Development Stack (MDS) and various other developer tools and APIs.

The Axelar network began as a project in 2020, built with various Cosmos technologies to provide interoperability across Ethereum and other networks. The Axelar network is much more than just a Cosmos interoperability hub or a cross-chain bridge: it supports the ability to program cross-chain logic and pass arbitrary data across an open network.

The Axelar network’s technology aims to allow cross-chain functions that are more advanced than simply transferring wrapped assets to different networks. To enable smooth UX at scale, Axelar focuses on programmable interoperability — supporting not only the bridging of any information/asset but also permissionless overlay programmability, executing smart contracts and dapps across networks. For a full primer on the Axelar network, refer to our Initiation of Coverage report. Complete information on Axelar MDS is included in this quarterly report and at axelar.network/mobius.

Website / X (Twitter) / Discord

Key Metrics

Financial Analysis

In Q3 2024, AXL’s circulating market cap increased by 11% QoQ to $499 million. Its market cap rank among all assets increased from 133rd to 117th through Q3.

While AXL’s market cap grew by 11% QoQ, AXL’s price fell by 2% to $0.63. The difference was due to AXL’s circulating supply increasing by 13% QoQ. AXL’s initial supply of 1 billion tokens is more than two-thirds of the way through a four-year vesting schedule.

In Q2, Axelar’s AXL token got two category comparables to benchmark against: Wormhole launched the W token in April, two days after the quarter started, and LayerZero launched the ZERO token a week before the quarter’s end. These launches were a watershed moment for the interoperability category.

Validators on Axelar are rewarded with inflationary AXL. Historically, the hardware requirements and costs of running an Axelar Validator have increased as AXL connects to more externally verified networks (such as EVM chains that do not support light-client validation as Cosmos IBC chains do). For this reason, Validator rewards historically increased as more non-native networks are connected – known as the per-chain reward.

That setup changed with the deployment of Interchain Amplifier, which went live in Q3 2024. Interchain Amplifier, part of Axelar MDS, allows new chains to connect to Axelar without increasing costs for the active set of protocol-level Validators. Instead, new connections are secured by bonded Verifiers, which operate at the smart-contract level on top of the core protocol, and verify events on connected chains. New connections set up non-inflationary pools out of the existing supply of AXL, which are used to reward these Verifiers.

Gas fees paid by network users constitute go to Verifiers and tokenholders as an added incentive. A current proposal would replace that system with a gas-burning mechanism (which burns 100% of fees).

Axelar’s total inflation dropped by half over the year ending June 30, 2024, despite adding new connected chains. AXL’s total inflation rate was 11.5% at the end of Q3’23 (comprising a base rate plus a per-chain reward multiplied by the number of connected non-native networks). However, in October 2023, new AXL tokenomics were proposed to gradually reduce the per-chain reward from 0.75% to 0.3%. In March 2024, the rate again decreased to 0.2%. The per-chain reward is only relevant for non-natively connected chains like EVM networks. The proposal was approved via an onchain vote and effected incrementally, with the final leg locked in on Dec 8, 2023. This brought annual inflation down from 11.5% to 5.2%, based on an equivalent number of chains (14 at the time of implementation). Axelar’s inflation rate stayed flat this quarter at 4.8% since no new EVM chains joined the network in Q3 (1% base inflation plus 0.2% for each of the 19 EVM chains) – as developer teams working on Axelar focus on the launch of Interchain Amplifier, designed to simplify connections with new chains and make them self-service.

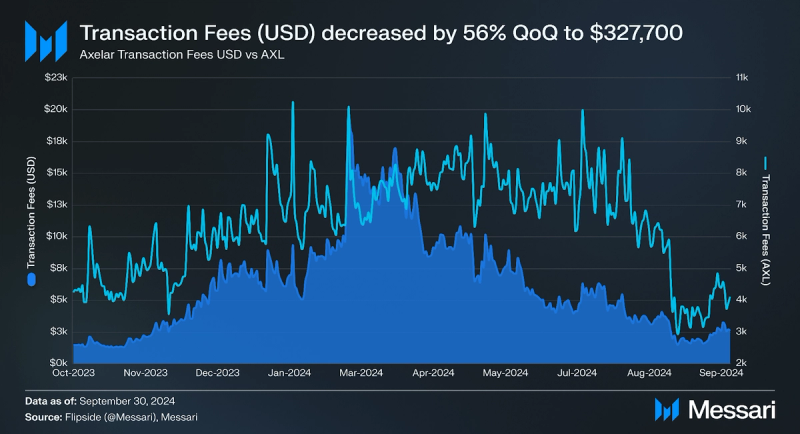

Transaction fees generated by the Axelar network decreased by 24% QoQ to 541,700 AXL; however, when denominated in USD, they decreased by 27% to $327,700 for the quarter. Dollar-denominated transaction fees were up 99% compared to Q3 2023. Fees generated on the Axelar network are paid to Validators and stakers.

Network Analysis

Up-to-date views of network metrics are available at Messari.io and axelarscan.io.

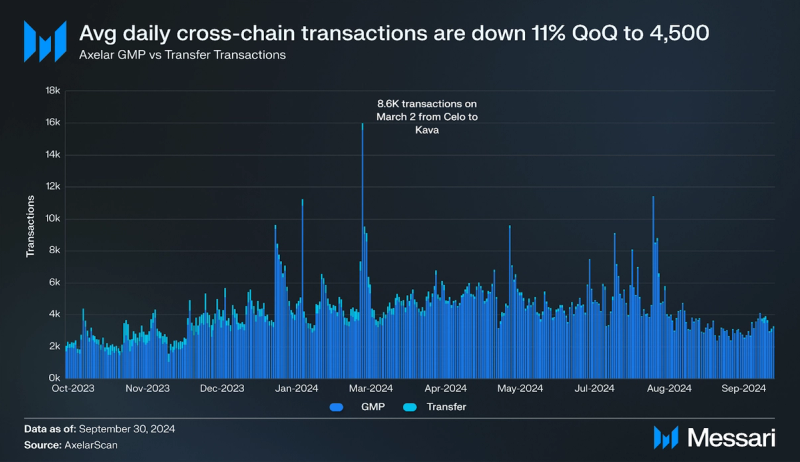

Cross-chain network activity on Axelar, i.e., transactions and active addresses, saw a slight reduction in Q3 compared with Q2. Average daily cross-chain transactions decreased by 11% QoQ to 4,500; transaction count was up 54% compared to 2023. General Message Passing (GMP) activity, which involves more complex logic than simple asset transfers, once again dominated total transactions, making up 98% of them in Q3 2024.

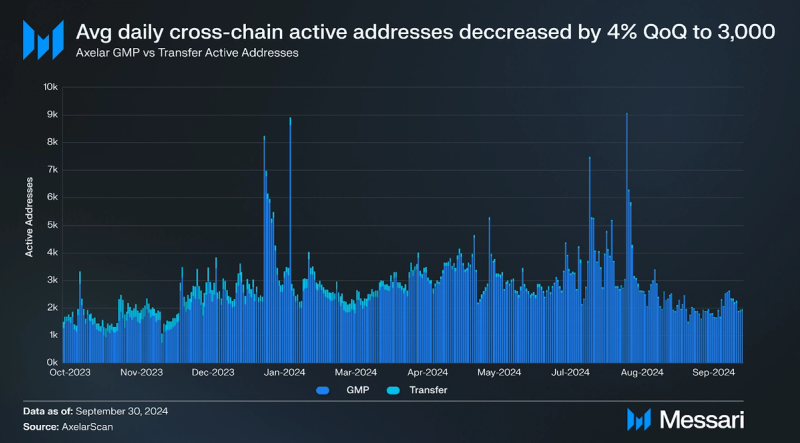

Active addresses decreased by 4% QoQ to 3,000. GMP also dominated total active addresses by making up 98% in Q3 2024. In Q3, active addresses were up 51% over the same period in 2023.

In Q3 2023, an upgrade to V0.34 enabled a refund for GMP events. This release also included a new call-contracts proposal type and smart contract governance.

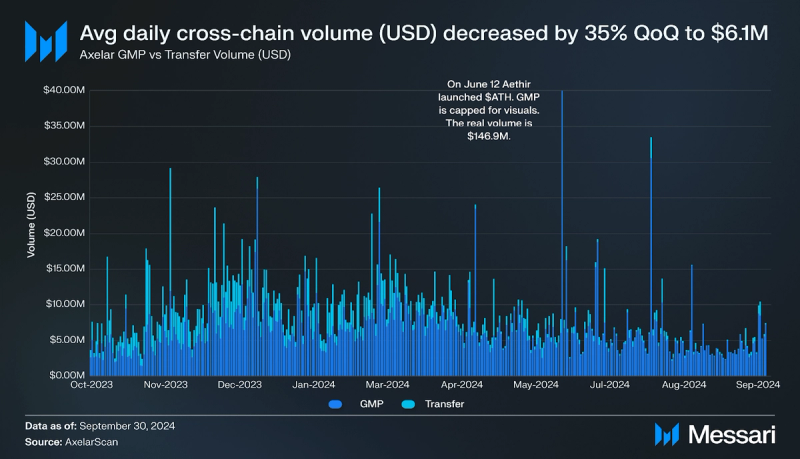

The average daily cross-chain volume decreased by 35% QoQ to $6.1 million. GMP accounted for 91% of the volume, totaling $471.5 million for the quarter. Transfer volume accounted for $48.1 million of the volume in Q3.

The network saw total staked AXL grow by 13% QoQ to 778.1 million, while active Validators remained constant at 75.

Axelar’s number of connected chains grew by one this quarter, adding Lava Network to the ecosystem. This is a 43% increase from 46 chains connected at the end of Q3 2023.

Ecosystem Analysis

Axelar Mobius Development Stack (MDS)

At the end of Q3, the Axelar team introduced the Mobius Development Stack (MDS). MDS allows developers a suite of tools to unlock a new interoperability standard that leverages the AXL token utility. Three main components power MDS:

- Interchain Amplifier: Now on mainnet since August 28, a simple, permissionless way to connect any chain with the Axelar network and its interconnected chains. It enables dynamic, customizable integrations, with chains like Sui, Aptos, and Solana cued up to connect. New connections take place at the smart-contract layer, where bonded Verifiers attest to on-chain events and are compensated in non-inflationary pools of AXL.

- Interchain Token Service (ITS): An institutional-grade set of tokenization tools that replace bridges completely, enabling the minting and managing of tokens across any connected blockchain. With ITS, tokens can move cross-chain natively while maintaining full functionality and fungibility.

- Axelar Virtual Machine (AVM): underpins Amplifier and ITS to enable smart contract logic at the cross-chain layer. This opens doors for a new generation of multichain developer tools and sophisticated dApps. Ethereum introduced programmable money; Axelar introduces programmable interoperability.

Axelar MDS will integrate with EigenLayer and Babylon to enhance cross-chain security guarantees with the option to add collateral in Bitcoin and Ether. This will be important for supporting institutional private-chain connections. Axelar has also expanded its integration with OpenZeppelin to develop an open cross-chain interface that is compatible with all major interoperability protocols, with the goal of advancing industry-wide standards for applications to connect cross-chain.

MDS Next Steps:

- New Chain Integrations: Flow, Solana, Stellar, XRP Ledger, Hedera, Stacks, Sui, and Bitcoin

- EigenLayer integration

- Babylon integration

- OpenZeppelin library integration and open interoperability interface

- Updated AXL token supply mechanism

Institutional Adoption

- The Axelar Foundation, in collaboration with Metrika, released its whitepaper on Institutional Interoperability with insights from Citi, Deutsche Bank, Mastercard, Northern Trust, and Centrifuge to. The paper highlights the importance of tokenized assets, which will need robust interlinked network models to power the tokenized future. In September, the SVP of Blockchain and Digital Assets at Mastercard discussed the need for institutional interoperability.

- Axelar initial developer Interop Labs will join Deutsche Bank in Project Guardian, exploring asset tokenization applications. Project Guardian is the Monetary Authority of Singapore’s (MAS) collaborative initiative with the financial industry to test the feasibility of asset tokenization and DeFi, aiming to enhance the liquidity and efficiency of current markets. 2024 is the second year in a row Axelar has supported a Project Guardian initiative, having joined Onyx by J.P. Morgan (now called Kinexys) in a 2023 proof-of-concept.

Closing Summary

Axelar’s Q3 2024 was marked by significant progress in establishing cross-chain interoperability standards and expanding institutional partnerships. The introduction of the Mobius Development Stack (MDS) brought a new level of cross-chain programmability, leveraging tools like the Interchain Amplifier, Interchain Token Service, and Axelar Virtual Machine to enhance developer capabilities. MDS will integrate with EigenLayer and Babylon to provide optional augmentation for cross-chain security via BTC and ETH collateral, highlighting Axelar’s commitment to providing a secure and scalable interoperability solution.

Institutional adoption saw promising developments, with Axelar Foundation collaborating with major financial institutions, including Citi, Deutsche Bank, and Mastercard, to explore tokenized assets and interoperability. Axelar’s inclusion in Project Guardian alongside Deutsche Bank and Onyx by J.P. Morgan further underscores its leading role in institutionalizing blockchain technology. These advances, along with the addition of new connected chains, reinforce Axelar’s position as a critical player in the evolving landscape of decentralized cross-chain ecosystems.