- Altcoin season is likely beginning as Bitcoin dominance trends downward, signaling potential market shifts toward altcoins.

- Historical patterns and key indicators suggest altcoins may experience significant movements in the next three to six months.

In a recent video, Lark Davis discusses the growing anticipation of an altcoin season (altseason), which is backed up by crucial market indicators. This season, which is often marked by spectacular and highly profitable changes in crypto values, has received yet another big confirmation.

Davis explains how Bitcoin dominance—a key indicator of Bitcoin’s percentage of the whole cryptocurrency market—has begun to fall considerably, indicating a trend toward altcoins.

Bitcoin Dominance Reversal Marks the Start of Altcoin Season

Davis says that Bitcoin dominance has been rising since the FTX collapse, but has suddenly reversed, falling from 61.5% to 54.5%. While the market had a flash crash, with altcoins taking a heavy hit, dominance did not rebound considerably.

According to Davis, the collapse in Bitcoin dominance signals the start of a season in which altcoins are expected to take center stage.

He emphasizes that altcoin seasons are brief but tremendously profitable. Traders who time their moves well may find major possibilities over the next three to six months. Davis cites historical tendencies, stating that past cycles witnessed comparable dominance reductions over 150 to 370 days, resulting in quick increases for altcoins.

Altcoin Market Patterns Suggest Imminent Breakouts for Top Projects

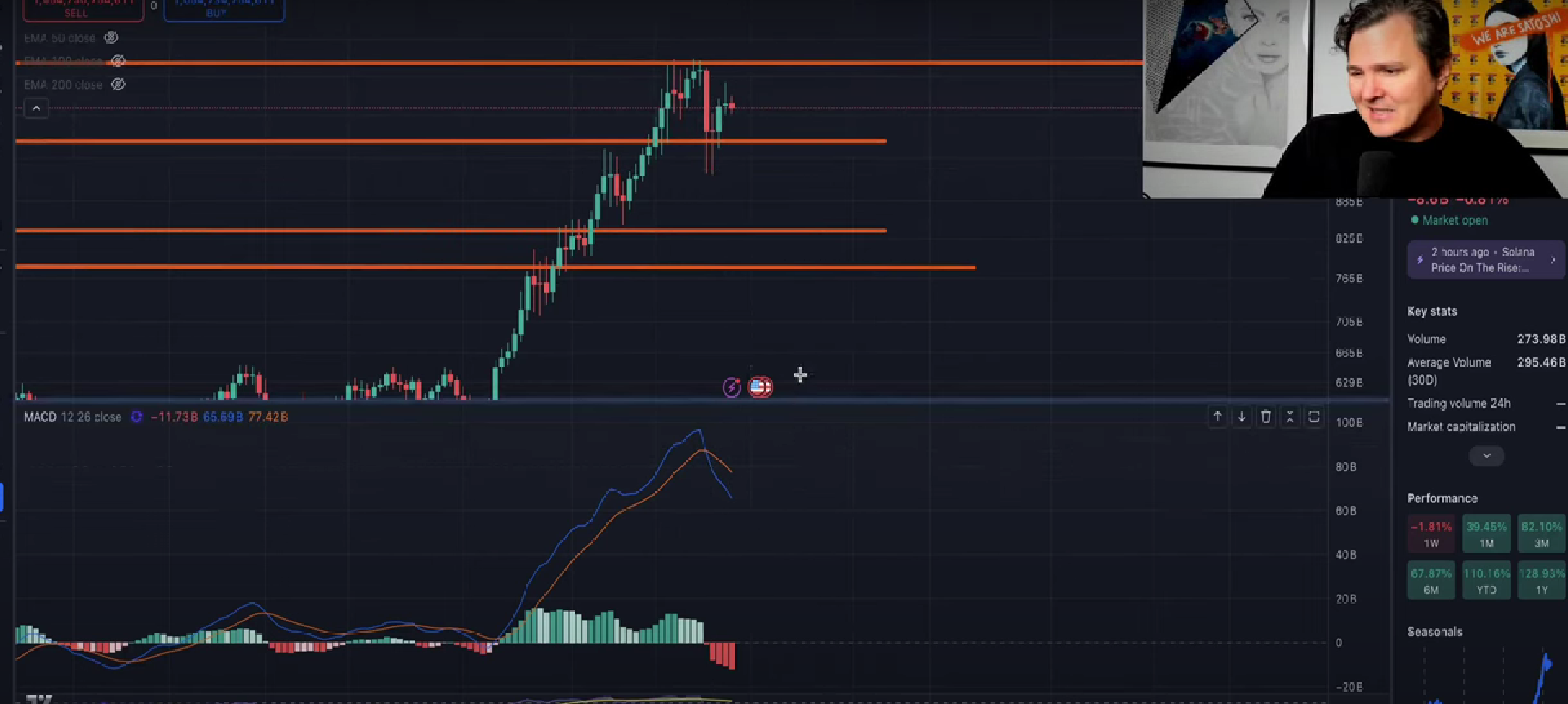

Davis also examines market data to support his thesis. The “Total3” chart, which tracks the market cap of all cryptocurrencies except Bitcoin and Ethereum, recently reached new highs before being strongly rejected.

Despite the setback, Davis believes it is only a matter of time until altcoins surpass the $1.15 trillion market size. Comparing the current situation to 2020-2021, he feels the market is following a well-known pattern of declines followed by significant upward movements.

Specific cryptocurrencies, such as Near Protocol, Avalanche, and Solana, are displaying promising trends. Near Protocol recently challenged its critical $6 support level during the flash crash and is now preparing for a breakout. Avalanche has emerged from a multi-year decline and is poised for a huge move.

Solana, after reaching new highs, is consolidating and preparing for its next great push. These examples support Davis’s assertion that the market is on the verge of considerable altcoin activity.

Opportunities Abound Amid Risks: Stresses Timely Action

Davis acknowledges potential risks, such as macroeconomic upheavals or unexpected market developments, but remains optimistic. He encourages traders to act immediately, as cryptocurrency seasons are characterized by rapid moves that might leave many behind.

Davis concludes with a cautious but optimistic perspective, emphasizing the need of tracking important measures like as Bitcoin dominance, market cap charts, and altcoin-specific configurations. He reiterates that, while past performance does not guarantee future outcomes, current indicators point to a fantastic opportunity for traders ready to handle turbulence.

Previously, CNF had highlighted the Altcoin Season Index surpassing 60 indicating potential upside for Bitcoin with historical data. The performance of Ethereum, the largest altcoin, has driven a greater wave of interest in altcoins.