Key Insights

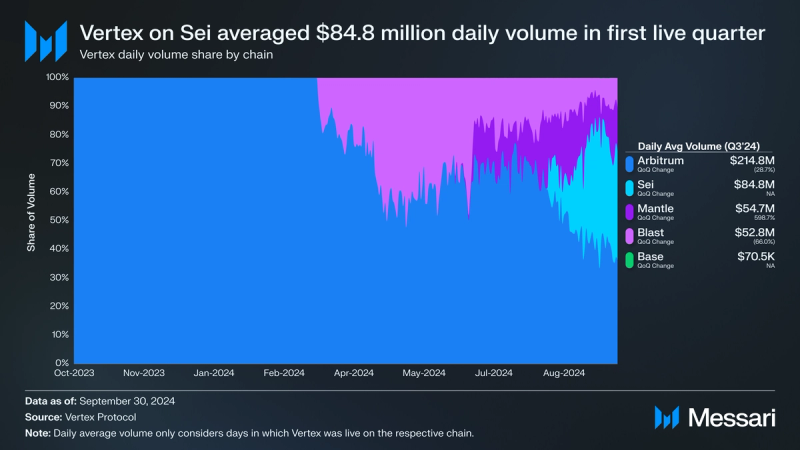

- Vertex expanded its operations in Q3 with new deployments on Sei and Base, bringing its multichain strategy into focus. The Sei deployment quickly gained traction, contributing 14% of quarterly trading volume and demonstrating the potential for growth in untapped markets.

- Vertex’s deployment on Mantle experienced significant growth, with average daily volume increasing 599% QoQ to $54.7 million, accounting for 15% of total trading volume in Q3.

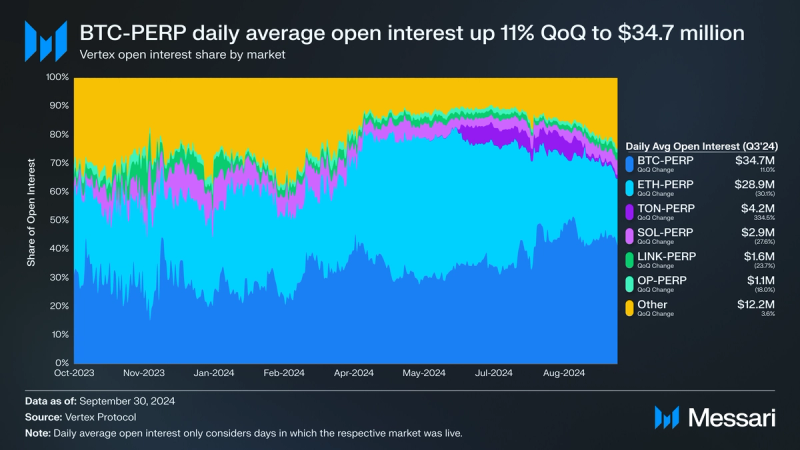

- BTC-PERP achieved the highest daily average open interest in Q3 at $34.7 million, growing 11% QoQ and surpassing ETH-PERP, which saw a sharp decline to $28.9 million following a market deleveraging event.

- Onchain activity was driven by power users, with daily average trades increasing 23% to 230,900 while daily active addresses fell 37% to 1,100. This indicates a growing concentration of trading activity among high-volume participants.

- Vertex launched the VRTX Vertical Program in September, introducing significant changes to tokenomics, such as reducing reward emissions and reallocating rewards to liquidity providers, signaling a focus on sustainable ecosystem development.

Primer

Vertex (VRTX) is a decentralized exchange (DEX) that combines spot trading, perpetuals, and a money market into a single vertically integrated platform. It features a hybrid model of a central limit order book (CLOB) and an automated market maker (AMM), enhancing liquidity as positions from LP markets are integrated into the order book. As a non-custodial platform, Vertex ensures that users always maintain control over their assets. The protocol is distinguished by its low-latency trading capabilities and efficient liquidity utilization across a diverse range of DeFi assets. This efficiency is bolstered by an offchain sequencer architecture, which mitigates MEV and supports exceptionally fast trading speeds. Vertex launched Edge in 2024, which aims to consolidate liquidity cross-chain into the application’s order book.

Vertex’s main value proposition is bundling three of the most sought-after DeFi services — AMM, perpetual DEX, and money market — into a single DEX. This integration allows users to engage with different financial primitives within one interface. As of this quarter, Vertex is live on Arbitrum, Blast, Mantle, Sei, and Base.

For a complete primer on Vertex, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

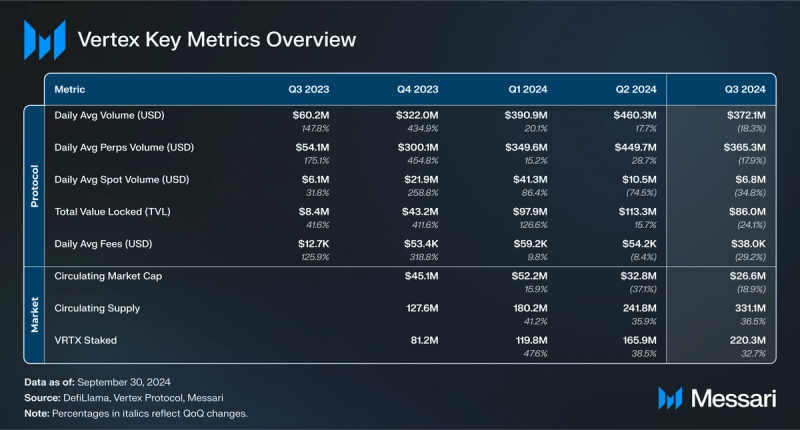

Key Metrics

Protocol Analysis

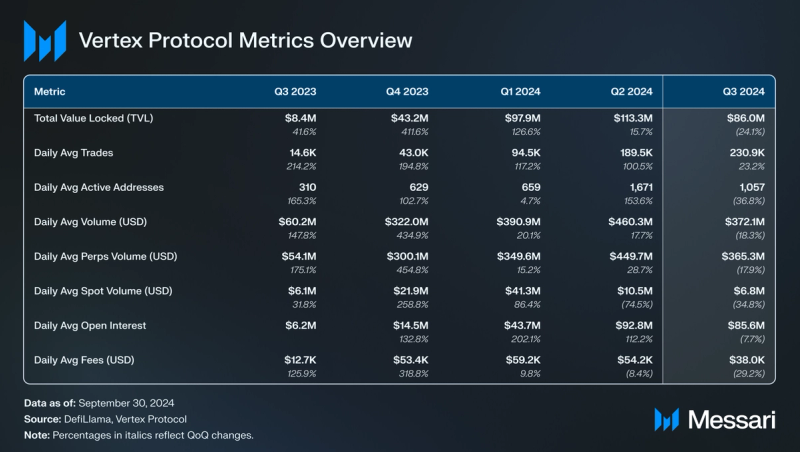

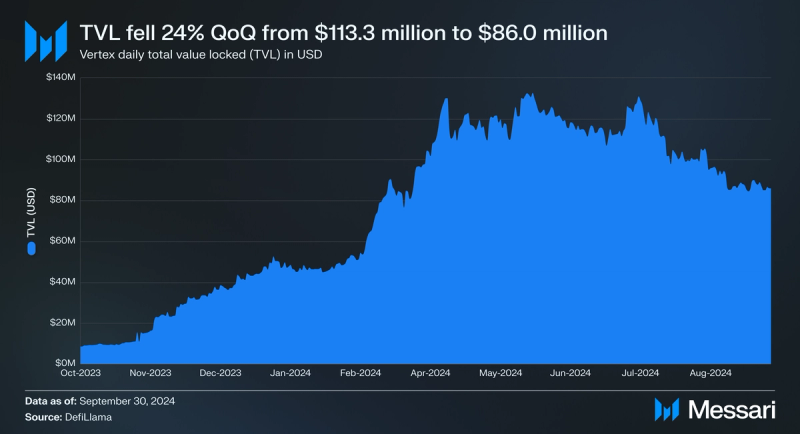

TVL

Total value locked (TVL) is a measure of the available onchain liquidity on Vertex at a given moment. Importantly, it does not portray all liquidity on Vertex, as Vertex also utilizes an offchain orderbook. In Q3, TVL fell from $113.3 million to $86.0 million, a 24% QoQ decrease. Although TVL is an important metric, it is not the sole determinant of success for a perp DEX.

Activity

Activity metrics trended higher in Q3, led by daily average trades. Daily average trades increased by 23% QoQ from 189,500 to 230,900. This marked an all-time high for trades on Vertex. Despite the increase in trades, daily average active addresses fell by 37% QoQ to 1,100. This dynamic suggests that power users are representing a larger share of trades on Vertex.

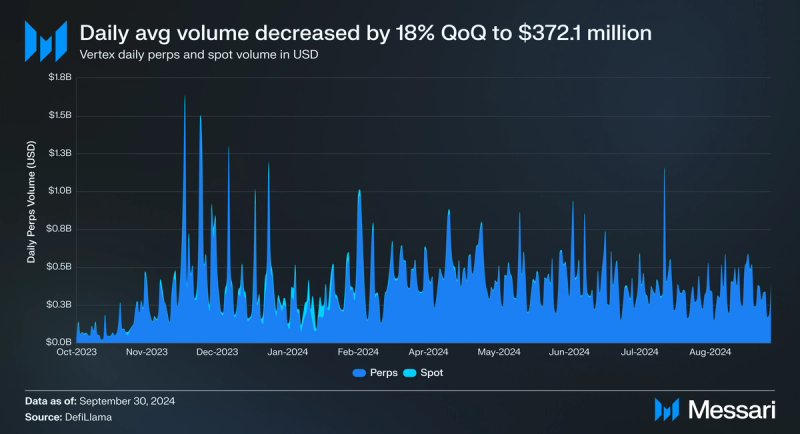

Volume

As a part of its product offering, Vertex offers both perps and spot markets. Across both market types, Vertex averaged $372.1 million daily volume, an 18% decrease from Q2’s $460.3 million. Notably, however, Q2 marked an all-time high for trading volume on Vertex. Perps markets averaged $365.3 million in daily volume, accounting for 98% of volume in Q3. For the quarter, perps volume was $33.61 billion, which was approximately 5.7% of all onchain perps volume ($592.13 billion) in Q3. Despite the overall decrease in perps volume, Vertex’s share of perps volume remained flat at 5.7% QoQ.

Broken down by chain, most of the volume on Vertex occurred on Arbitrum (57% of volume in Q3). Vertex’s Arbitrum deployment averaged $214.8 million in daily volume across both perps and spot markets. In early August, Vertex deployed on Sei, an integrated, general-purpose Layer-1 network. Vertex was the first high-profile perp DEX to deploy to Sei, allowing it to easily establish dominance in an untapped market. Additionally, the launch coincided with a trading rewards program of 5.1 million SEI ($2.4 million at Q3 end) that lasted from Aug. 14 to Sep. 25. Daily average volume on Sei for Q3 was $84.8 million, which ranked it second amongst all Vertex deployments. Ultimately, despite not being live for the entire quarter, Sei accounted for 14% of Vertex volume in Q3.

After launching last quarter, the Vertex deployment on Mantle saw significant growth in Q3. Average daily volume was up 599% QoQ from $7.8 million to $54.7 million. Similarly to Sei, Vertex launched a 12-week trading rewards program on Mantle that rewarded users with 900,000 MNT ($561,600 at Q3 end). 15% of the volume on Vertex occurred on Mantle this quarter. As for the Vertex deployment on Blast, average daily volume fell 66% QoQ to $52.8 million, yet still accounted for 14% of volume in Q3. Lastly, Vertex deployed on Base at the end of Q3, and therefore, the Base deployment accounted for minimal volume in Q3.

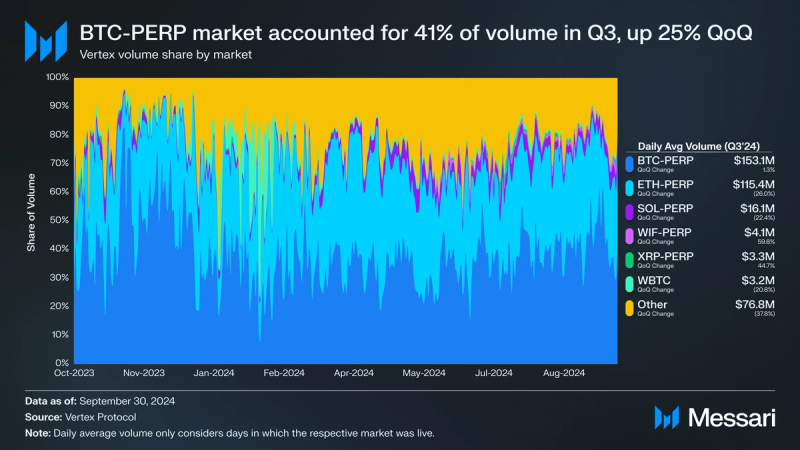

Taking a look at individual markets, the BTC-PERP market was the biggest market on Vertex in Q3. BTC-PERP daily average volume increased 1% QoQ from $151.2 million to $153.1 million. Furthermore, BTC-PERP accounted for 41% of volume in Q3, up 25% QoQ. BTC-PERP also surpassed ETH-PERP for the highest traded market this quarter as ETH-PERP’s daily average volume fell 26% QoQ from $155.9 million to $115.4 million. Combined, BTC-PERP and ETH-PERP were 72% of Q3’s volume. No other individual market surpassed 5% this quarter. A notable gainer this quarter was WIF-PERP. After launching last quarter, WIF-PERP averaged $4.1 million in daily volume, a 60% QoQ increase. As far as spot markets go, the only spot market within the top six overall markets was WBTC, which averaged $3.2 million in daily volume for Q3.

Open Interest

Open interest (OI) represents the total value of active, unsettled derivatives contracts at a given time. For Vertex, OI indicates the dollar amount of all currently open perp contracts. Higher OI reflects both increased risk, as more funds are tied up in funding active positions, and strong demand for perps, as it shows users are actively opening and maintaining perp positions on Vertex.

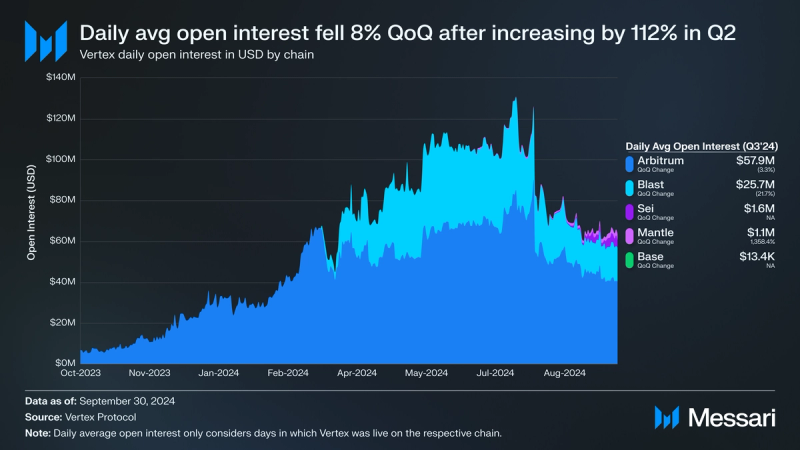

Starting Q3 at $110.8 million, OI peaked at $130.8 million. On August 5, crypto markets experienced a sharp deleveraging event due to the Bank of Japan raising interest rates for the first time in 17 years. Over a 24-hour period, BTC fell 15% and ETH fell 22%, causing billions in liquidations. OI on Vertex fell 34% from $126.1 million to $83.0 million. Afterward, OI trended downwards for the rest of the quarter. For the entire quarter, the daily average OI was $85.6 million (down 8% QoQ from $92.8 million). Broken down by deployments, the daily average OI was:

- Arbitrum – $57.9 million (down 3% QoQ and 68% share of OI in Q3)

- Blast – $25.7 million (down 22% QoQ and 30% share of OI in Q3)

- Sei – $1.6 million (2% share of OI in Q3)

- Mantle – $1.1 million (up 1,358% QoQ and 1% share of OI in Q3)

- Base – $13,400 (0% share of OI in Q3)

As for perp markets, BTC-PERP had the highest daily average open interest in Q3 at $34.7 million (up 11% QoQ from $31.3 million). BTC-PERP overtook ETH-PERP in both volume and open interest this quarter. ETH-PERP open interest sharply declined (from $45.7 million to $28.9 million) on August 5th due to the aforementioned deleveraging event. ETH-PERP open interest continued declining relative to BTC-PERP open interest as well, ending the quarter at $14.9 million. For the entire quarter, ETH-PERP average open interest was $28.9 million. Combined, BTC-PERP and ETH-PERP were 74% of open interest in Q3.

After BTC-PERP and ETH-PERP, TON-PERP averaged the third most open interest in Q3 at $4.2 million. This figure was up 335% QoQ, and TON-PERP’s share of open interest in Q3 was up 371% QoQ to 5%. TON rallied at the end of Q2, and the subsequent increase in open interest in Q3 could potentially be attributed to traders hedging spot holdings of TON. No other individual market eclipsed a 5% share of open interest in Q3.

Fees

The Vertex protocol earns from trading fees. There are two types of trading fees on Vertex:

- Taker Fee – A taker fee of 2 bps is charged on all taker orders.

- Maker Fee – A maker fee of 0.5 bps is charged as a rebate for maker orders.

As such, fees that accrue to Vertex are taker fees net of maker fees.

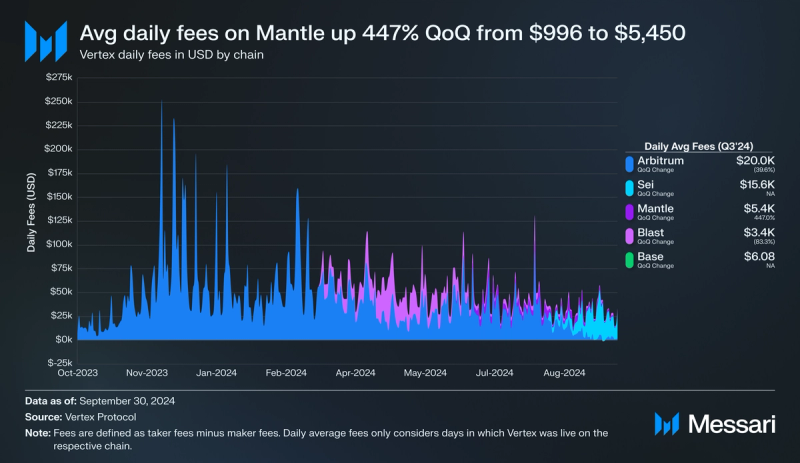

Daily average fees on Vertex were down in Q3, falling 29% QoQ from $54,200 to $38,000. Vertex’s daily average fee for Q3 annualized is $13.9 million. Broken down by chain, the majority of Vertex’s fees (53%) come from Arbitrum. However, Arbitrum lost ground to Sei as 24% of all fees in Q3 were generated through the Sei deployment of Vertex. The Mantle deployment also saw an uptick in fees in Q3, with daily average fees increasing 447% QoQ to $5,450.

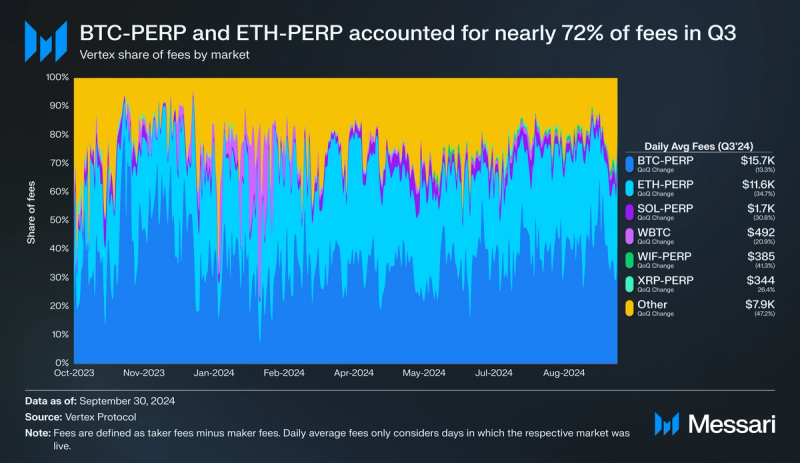

Broken down by markets, BTC-PERP and ETH-PERP took in the majority of fees as they drove the most volume in Q3. Nearly 72% of Vertex’s fees came from these two markets, up 9% QoQ from last quarter’s 66%. “Other” markets (all non-specified markets on Vertex) accounted for 21% of fees in Q3, signaling that Vertex has a well-diversified number of fee-earning altcoin markets on the platform.

Market Analysis

Market Capitalization

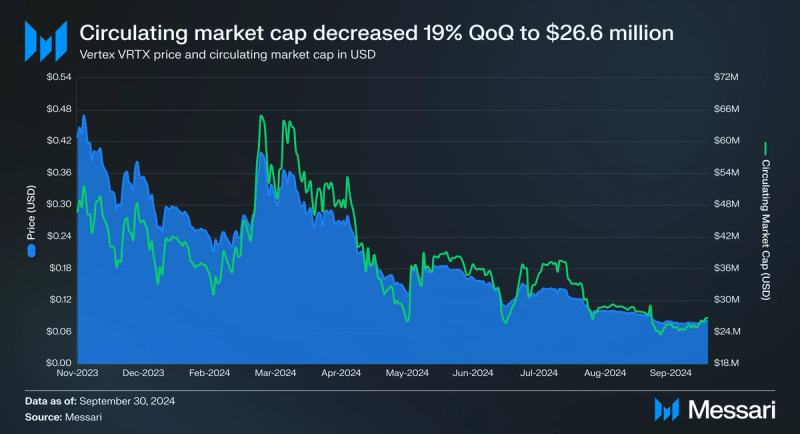

Similarly to the broader crypto market, VRTX’s circulating market cap declined in Q3, decreasing 19% QoQ from $32.8 million to $26.6 million. Additionally, the price of VRTX fell 41% QoQ from $0.14 to $0.08, signaling that the market was unable to fully absorb VRTX supply that unlocked this quarter. Furthermore, perp DEX tokens experienced weakness across the board in Q3. DYDX (-25%), AEVO (-23%), and GMX (-16%), all posted double-digit percent losses in Q3.

Supply

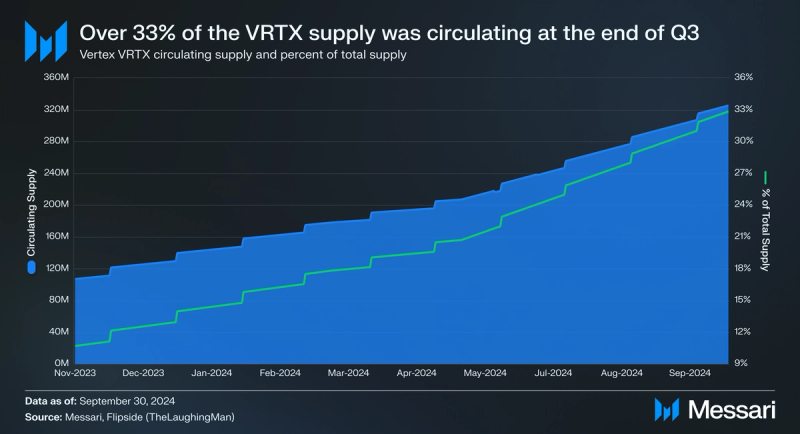

VRTX was launched with an initial total token supply of 1 billion. In Q2, two separate burns of VRTX occurred (totaling 3 million VRTX), bringing the total token supply down to 997.0 million. These burns were a part of Vertex’s “Buyback & Burn Program,” which aims to use a portion of protocol revenue to reduce the supply of VRTX. No VRTX was burned in Q3 as a part of this program. As previously mentioned, a portion of the VRTX supply was unlocked in Q3. The circulating supply of VRTX increased 37% QoQ from 241.8 million to 331.1 million. As of the end of the quarter, 33.2% of the VRTX supply was in circulation.

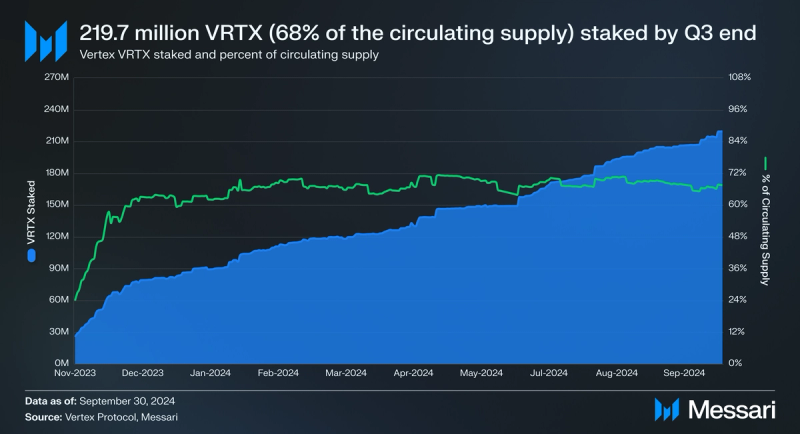

Staking

One of the core functions of the VRTX token is staking. VRTX stakers contribute to protocol security and can earn staking rewards as well. Staking rewards are sourced from protocol fees and paid out in USDC. By the end of Q3, 220.3 million VRTX was staked, a 33% QoQ increase from 165.9 million. Approximately 67% of the circulating supply of VRTX is staked, down 3% QoQ. Lastly, after the quarter ended, Vertex announced Staking V2, which incorporates several upgrades and fixes for VRTX staking.

Qualitative Analysis

New Deployments

Vertex deployed onto two new chains in Q3. First, on August 14, Vertex deployed on Sei, an integrated, general-purpose Layer-1 network. Additionally, the launch coincided with a trading rewards program of 5.1 million SEI ($2.4 million at Q3 end) that lasted from Aug. 14 to Sep. 25. Secondly, on September 17, Vertex deployed to Base, Coinbase’s Ethereum Layer-2 (L2) network.

VRTX Vertical Program

In September, Vertex launched the VRTX Vertical Program, which aims to enhance its tokenomics and promote growth. Stage 1 of the program (effective September 11) reduces VRTX reward emissions by 50% to better align incentives with ecosystem development. Additionally, the distribution of rewards was adjusted to allocate 75% to makers and 25% to takers, shifting from the previous equal split to encourage liquidity provision. The program also transitions reward epochs from monthly to weekly, facilitating smoother onboarding for trading firms and better integration with existing incentive structures.

Future stages of the program aim to further refine the VRTX ecosystem. Plans include increasing maximum maker rebates, expanding community-driven incentives across multiple chains, and upgrading the VRTX staking mechanism to enhance user engagement and loyalty.

Integrations, Partnerships, & Upgrades

Vertex made significant strides in expanding its ecosystem and enhancing its utility through a series of strategic integrations, partnerships, and upgrades in Q3:

- Leaderboard Launch (July 26) – Vertex launched a leaderboard that tracks the most profitable traders on Vertex.

- New Referral Staking Tiers (July) – Introduced 5 different commission tiers for VRTX stakers that refer new traders to use Vertex.

- Multiple Accounts Support Added (August 7) – This feature allows users to manage multiple accounts from the same wallet address on Vertex.

- Social Indicators Added (August 13) – In collaboration with The Tie, Vertex integrated social indicators such as tweets, newsfeeds, and sentiment tracking directly into the Vertex trading application.

- Fast Withdrawals Introduced (August 29) – New feature that allows users to withdraw assets quicker.

Closing Summary

Vertex had a transformative Q3, deploying to Sei and Base to expand its multichain presence. Sei accounted for 14% of Vertex’s Q3 trading volume despite being live for only part of the quarter, while Mantle saw significant growth in trading activity following the introduction of its rewards program. Trading metrics showed mixed results, with daily trades reaching an all-time high (+23% QoQ), but daily trading volume falling 18% to $372.1 million, driven by reduced ETH-PERP market activity. BTC-PERP overtook ETH-PERP as the largest market by volume and open interest, together representing 72% of trading volume and 74% of open interest.

VRTX token performance declined alongside broader market trends, with its price down 41% and circulating market cap falling 19% QoQ. However, staking grew 33% QoQ, with 67% of the circulating supply now staked. Vertex introduced the VRTX Vertical Program in September, reducing token emissions and reallocating rewards to incentivize liquidity provision. Additional upgrades included a referral program with tiered rewards, social indicator integration, and support for multiple accounts. As Vertex continues refining its tokenomics and expanding its multichain integrations, it is positioned to adapt to market conditions and grow its ecosystem.