- Ethereum (ETH) is expected to break into a crucial resistance level at $4,100 to hit $8,000 by 2025.

- This bullish thesis is supported by the rising performance of the Ethereum (ETH) ETFs which have printed net inflows for seven consecutive days.

Ethereum (ETH) has taken a nosedive from its yearly high of $4,100 to $3,334 after losing 14% of its weekly value. According to analysts, the asset is currently trading in a bearish short-term trend and moving below the 100-hourly Simple Moving Average.

Currently, a crucial resistance level is found at $3,420. Meanwhile, ETH has been predicted to continue its downward trend if it moves below the current support levels at $3,200, $3,120, and $3,000. However, breaking above the highlighted resistance level could see ETH reaching $3,500 and around $3,650.

Amid the backdrop of this, the spot ETH ETF has attracted a massive amount of inflow from institutional investors. According to data, the ETH ETF recorded a seven consecutive day net inflow, which included $2.2 billion recorded in late November. Just last week, the ETFs recorded a massive $62.7 million in net inflows to increase the total net asset value to $1.215 billion.

Further delving into this, we found that BlackRock’s ETHA continues to lead the industry with $143 million inflows, followed by Fidelity’s FESH, which has $26.1 million. Fascinatingly, the Ethereum NFT space is showing similar strength as weekly sales volume approaches $201 million. This represents 66% of the total sales, according to reports. Meanwhile, Pudgy Penguins and LilPudgys are reported to be leading the demand with $54.4 million and $20 million in total sales, respectively.

Analysts Make Bold Ethereum (ETH) Predictions

With the above factors at play, VanEck has predicted that ETH could hit $6000 by the fourth quarter of 2025 (Q4 2025) and $22,000 by 2030. An analyst has also predicted that the formation of an ascending triangle on the daily chart could set the asset up for a rally above the $8,800 level. However, it would need to cross the $4,100 psychological level before reaching this point.

$ETH Back above the triangle top line. A break above $4100 next and this could run to the ATH level at $4865. I am holding $ETH until $8800 pic.twitter.com/PhI6qVOUYF— The Long Investor (@TheLongInvest) December 13, 2024

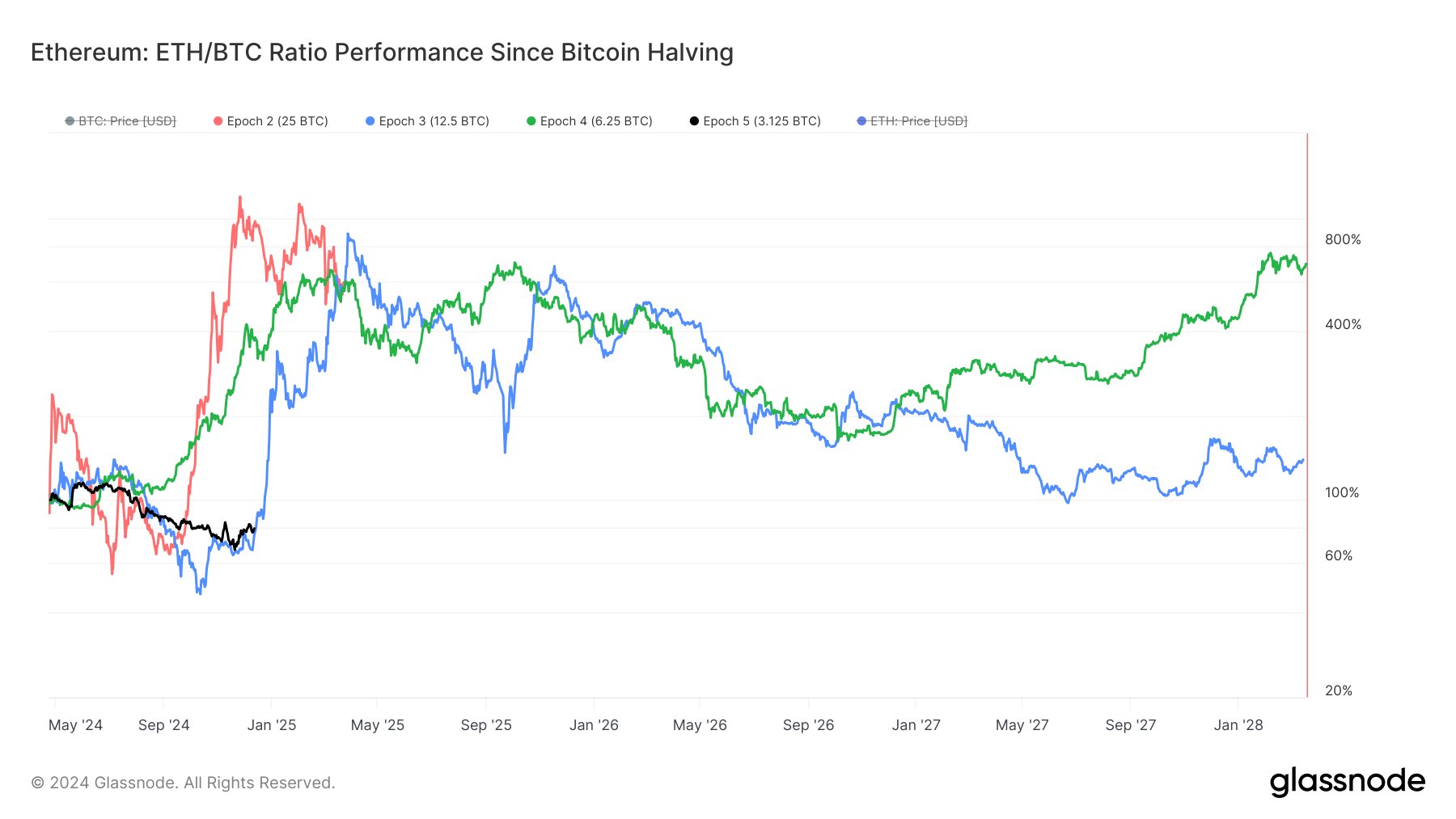

Further subjecting ETH to technical analysis, analyst Venture Founder has highlighted that the asset tends to underperform Bitcoin for no more than eight months before eclipsing the leading asset.

According to him, the market is in its 8th month since the Bitcoin halving event.

We are in the 8th month now. Right on track. Then ETH/BTC Ratio since halving goes to no less than 700% after, which for this cycle means ETH/BTC = 0.39.

Joining this discussion, renowned analyst and YouTuber Benjamin Cowen has hinted that ETH could embark on a rally in early 2025. He cited the 2022 cycle when the asset appeared in reds in both the first quarter (Q1) and second Quarter (Q2). However, the third and the final quarter (Q3 and Q4) were in green.

But what do you notice about 2021? ETH/BTC was green. What do you notice about 2017? At least ETH/BTC was green in the first half; it was red in the second half, but then it was green in 2018 as well. So I would argue as quarterly returns go, you’re probably going to see more green for ETH/BTC in 2025 and maybe even early 2026.