Bitcoin Magazine

What is mNAV? The Investor’s Guide to Valuing Bitcoin Treasuries

mNAV, or market net asset value, is a valuation metric that expresses the real-time economic value of a company’s bitcoin reserves. It adjusts the company’s holdings to the current market price of bitcoin, accounts for liquid cash and debt, and factors in share dilution.

mNAV provides a clearer picture of a bitcoin treasury company’s true financial position than conventional accounting standards. It has become the standard tool for evaluating corporate bitcoin strategies because it centers the analysis on bitcoin itself, rather than legacy accounting conventions that can distort value.

Key Takeaways

- Real-Time Precision: mNAV reflects the current market value of a company’s bitcoin reserves on a per-share basis, updated in real-time rather than quarterly.

- Economic Reality: It provides investors with a transparent measure of reserve value that cuts through GAAP reporting lags.

- Market Sentiment: Premiums and discounts to mNAV reveal how the market interprets a company’s execution, governance, and capital efficiency.

- Valuation Anchor: mNAV is essential for analyzing public bitcoin treasury companies and access vehicles.

Purpose: Why We Need mNAV

The purpose of mNAV is to provide an accurate, real-time valuation anchor for companies that hold bitcoin.

Historically, under US accounting rules (GAAP), bitcoin was treated strictly as an intangible asset. This required companies to recognize impairments when the price fell but prevented them from recognizing gains until the asset was sold. While recent updates to FASB rules (ASU 2023-08) now allow companies to report bitcoin at fair value, GAAP financial statements remain retrospective—snapshots taken only once per quarter.

Bitcoin markets move 24/7. A quarterly earnings report is often stale the moment it is published.

mNAV fills this gap. It replaces static quarterly reporting with dynamic, market-based valuation. Investors gain a consistent, transparent, and economically meaningful measure of the company’s bitcoin position that adjusts with the market. This provides a reliable basis for evaluating performance, governance, risk, and capital strategy.

Mechanics: How mNAV Works

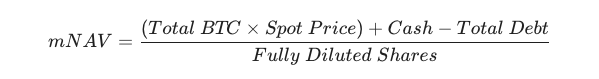

mNAV is straightforward to calculate, but precision is key. It treats the company effectively as a holding vehicle, netting out debts and cash to find the “naked” value of the bitcoin per share.

1. Holdings in BTC

Companies disclose their bitcoin reserves in BTC terms. This is the foundational input. Because bitcoin’s supply is fixed, the quantity held is the primary driver of long-term value.

2. Market Pricing

The real-time spot price of bitcoin is applied to the company’s total BTC holdings to determine the gross value of the reserves.

3. Net Debt (Cash vs. Liabilities)

To get an accurate “Net Asset” value, you must account for the balance sheet.

- Add Cash: Cash and cash equivalents are added to the bitcoin value.

- Subtract Debt: Total debt (including convertible notes and senior secured notes) is subtracted.

- Note: For operating companies (like software firms), this formula is conservative. It effectively values the operating business at zero, assuming its cash flows exist primarily to service the debt.

4. Fully Diluted Share Count

The result is divided by the fully diluted number of shares. This includes outstanding shares, options, Restricted Stock Units (RSUs), and shares underlying convertible notes if they are “in the money.”

Formula for mNAV per share

The output is a reserve-based valuation per share. Investors compare the stock price to this benchmark to understand if they are paying a premium (paying for future execution) or a discount (pricing in risk).

Background and Origins

mNAV emerged as a practical necessity once corporations began holding bitcoin in material size. Early adopters like MicroStrategy (now Strategy) revealed that standard accounting could not capture the reality of bitcoin’s market behavior. Impairment charges made healthy balance sheets look distressed, while massive unrealized gains went unreported.

Analysts began circulating market-value-adjusted figures to understand the true strength of these companies. Even as accounting rules modernize, mNAV remains the dominant metric because it is simple, comparable across companies, and focused on BTC terms rather than accounting classification.

Why Companies Trade Above or Below mNAV

Companies rarely trade exactly at mNAV. The market applies premiums or discounts based on how it interprets execution quality, treasury discipline, and capital structure.

Capital Market Arbitrage & Accretive Issuance: Some companies excel at transforming capital markets into bitcoin acquisition engines. They issue equity or debt at attractive terms to buy more bitcoin.

Notably, if a company trades at a premium to mNAV, it can issue new shares to buy bitcoin, effectively increasing the bitcoin-per-share for existing holders. The market often rewards this “accretive loop” with a sustained premium, as it accelerates the accumulation of reserves.

Bitcoin-Backed Financial Instruments: Companies with deep bitcoin reserves can issue financial products backed by those holdings, such as bitcoin-backed notes or yield-generating instruments. Markets reward the ability to use bitcoin to build new financial infrastructure.

Global Market Access: Large pools of institutional capital still cannot buy or custody bitcoin directly. Treasury companies offer a familiar entry point through equity and fixed income. This utility increases demand for shares, often pushing valuations above mNAV.

Discounts: The Market Referendum: Discounts often signal distress. If a company trades below mNAV, it implies investors are worried about governance, management fees, excessive leverage, or the inability to hold bitcoin long-term.

Premiums to mNAV

A premium to mNAV indicates that investors value the company’s capabilities beyond the raw value of its current holdings.

A premium is a vote of confidence. It suggests investors believe the company will:

- Generate Accretion: Issue capital efficiently to grow bitcoin-per-share.

- Mitigate Risk: Manage leverage intelligently to avoid forced selling.

- Create Utility: Build products or services on top of the bitcoin stack.

Premiums contract when confidence fades. Poor execution or deterioration in capital efficiency can reduce demand for the shares, causing valuations to drift back toward—or below—mNAV.

Example: Strategy ($MSTR)

Strategy is the largest and most studied bitcoin treasury company. Because its strategy involves active capital market management (issuing convertibles and equity to buy BTC), analysts, plebs and investors routinely track mNAV to interpret its valuation.

Strategy often trades at a significant premium to mNAV. This premium reflects the market’s valuation of its ability to borrow cheaply and buy bitcoin that appreciates faster than the cost of that debt. When the company successfully executes this arbitrage, the premium tends to hold. If market conditions weaken or leverage concerns rise, the stock may drift closer to mNAV.

For current data on Strategy’s mNAV, premium, and BTC Yield, view the Strategy’s Company Metrics on BitcoinMagazinePro.com.

mNAV vs. Book Value

Book value reflects historical cost based on accounting rules. It is a lagging indicator, whilst mNAV reflects current economic reality. mNAV replaces historical cost with live market data and adjusts for dilution.

For a bitcoin treasury, Book Value is more suitable for the accountants; and mNAV is preferred by investors.

Frequently Asked Questions

Does mNAV work like NAV in an ETF?

No. ETFs have an arbitrage mechanism (Authorized Participants) that forces the price to match NAV. Operating companies do not have this. Their shares float freely based on sentiment, allowing for significant premiums and discounts.

Does mNAV apply to private companies?

It can be calculated if the private company discloses holdings and liabilities, but it is most useful for public companies with transparent, liquid share counts.

Why do discounts appear?

Discounts usually reflect risk. If the market fears the company may be forced to sell bitcoin to pay debts, or if the management structure is poor, the stock may trade at a discount to the raw value of the assets.

Related Concepts

Bitcoin Strategic Reserve – A deliberate long-term allocation of bitcoin used to defend against fiat dilution and preserve capital over time. Treasury companies typically build this into their core strategy.

Bitcoin Treasury Company – Bitcoin treasury companies are redefining capital preservation. By placing bitcoin at the center of their balance sheet strategy, these firms unlock access to capital and absorb bitcoin’s supply.

Final Thoughts

mNAV has become one of the most important valuation tools in corporate bitcoin adoption. It reveals the true economic value of bitcoin reserves and gives investors a consistent benchmark for evaluating companies that anchor their balance sheets in the hardest monetary asset available.

As more firms adopt bitcoin strategies, mNAV will remain the central metric for understanding how capital markets integrate with sound money.

This post What is mNAV? The Investor’s Guide to Valuing Bitcoin Treasuries first appeared on Bitcoin Magazine and is written by Conor Mulcahy.