- Stani Kulechov says that Aave would prioritize three key pillars in 2026: Horizon, Aave V4, and Aave App.

- 2025 was the network’s most successful year yet, with cumulative deposits topping $3.3 trillion while loan originations edged closer to $1 trillion.

After having its “most successful year yet” in 2025, Aave is set to have an explosive run in 2026, built on three main pillars: Aave v4, Horizon, and Aave App. This is according to founder Stani Kulechov, who says the project’s goal is to bring the next trillion dollars in assets onchain and propel the AAVE token into an industry giant.

In 2025, the platform’s cumulative deposits broke past $3.3 trillion for the first time, with disbursed loans hitting $963 billion as of mid-December. It hit a 12-month high of $75 billion in net deposits.

Image courtesy of Stani Kulechov on X.

Aave now controls nearly two-thirds of the DeFi lending market, generating $885 million in fees this year, most of which was channeled to its token buyback program, Kulechov stated, adding:

For the past year or two, we’ve embraced the world of cross-chain within the Aave ecosystem. In true Aave fashion, it has become the only protocol with over $1 billion TVL on four networks. Better yet, the protocol is now comparable in size to the top 50 banks in the U.S., which is the world’s financial hub.

Despite this success, the founder believes that 2026 will be an even more explosive year, anchored on three pillars:

Aave v4

This protocol redesign will propel Aave to become the backbone of all finance, Kulechov says. As we reported, experts believe that v4 could make Aave the ‘Ethereum of DeFi lending.’

One of the most impactful developments will be the unification of liquidity using the Hub-and-Spoke model. As CNF previously detailed, this allows the platform to handle trillions of dollars in assets in one protocol, replacing the existing fragmented liquidity pools.

In addition to the redesign, Aave will launch a new developer experience next year that makes it easier to launch products on the network.

“In 2026, Aave will be home to new markets, new assets, and new integrations that have never existed before in DeFi,” the founder stated.

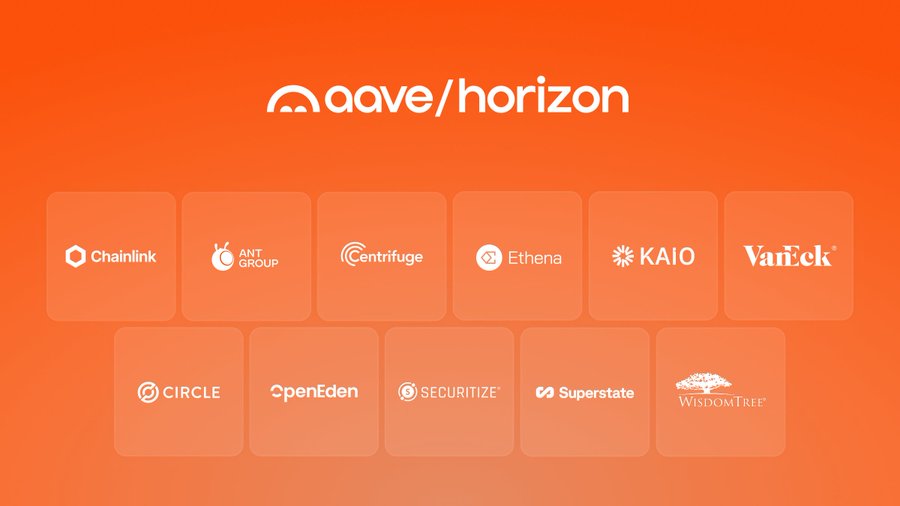

Horizon

Horizon focuses on the tokenization of real-world assets, a sector projected to hit $16 trillion by the end of the decade, as CNF has reported. It allows institutional players to use tokenized assets, including stocks and US Treasuries, as collateral and borrow stablecoins. Kulechov believes Horizon will be a critical tool in bringing Wall Street onchain.

Image courtesy of Stani Kulechov on X.

He noted:

Horizon will onboard many of the top financial institutions to Aave in a way that wasn’t possible before and expand Aave to a $500 trillion+ asset base.

Aave App

As the third pillar, the Aave App is designed to be the entryway for the next million DeFi users. It packs the most complex financial software, but it abstracts the technicalities for the users, presenting them with an easy-to-use and intuitive platform.

Aave App will do to DeFi what Cash App and Venmo did to mobile payments, “changing the way people save forever,” he added.

He concluded:

Our multi-decade vision is to build the foundational credit layer for the onchain economy. At Aave Labs we believe in a future where any type of value can be tokenized, used as productive collateral, or borrowed without intermediaries.