Source – Cryptonews YouTube Channel

XRP, Decentralization, and Public Misunderstandings

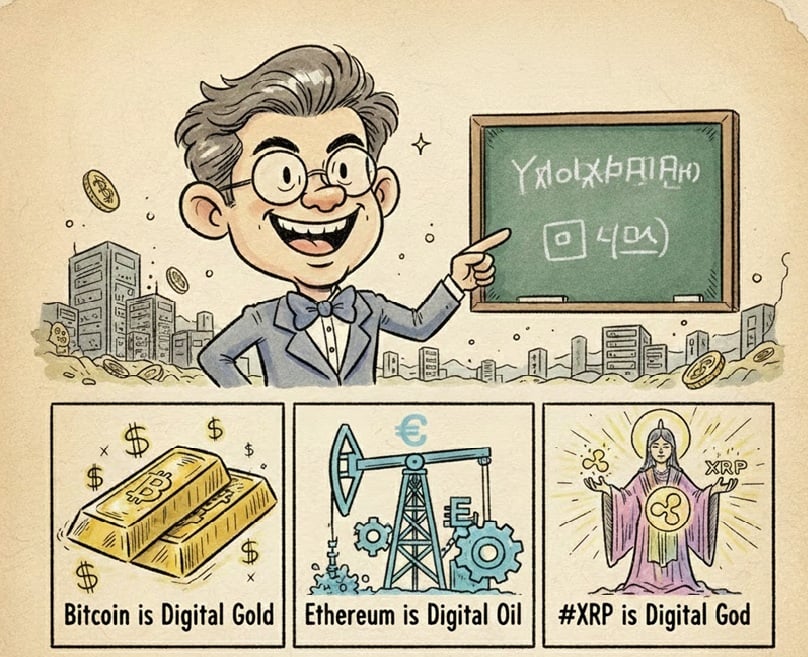

One of the most persistent misconceptions surrounding XRP is the assumption that it functions as a corporate product.

Crypto commentator Mason Versluis, in a post on X, highlighted that XRP itself is a decentralized cryptocurrency, not a company. It does not have a marketing department, advertising budget, or paid promotional structure.

This distinction is critical. Ripple is a separate corporate entity that develops payment solutions, while XRP operates independently on a decentralized network. Viral content and social media amplification often lead to assumptions about paid endorsements, even when none exist.

The intensity of attention surrounding XRP illustrates how visibility alone can fuel speculation, regardless of intent. In many cases, the conversation becomes less about promotion and more about the sheer engagement that XRP-related topics generate online.

Expanding Bitcoin’s Potential With Smart Contract Functionality

As the market matures, investor focus is increasingly shifting toward infrastructure projects that address fundamental limitations. One area receiving growing attention is Bitcoin scalability, where Layer 2 solutions aim to improve speed and efficiency without compromising security.

Bitcoin Hyper represents this shift toward practical innovation. Designed as a Layer 2 network for Bitcoin, the project seeks to enable faster and cheaper transactions through bridge technology.

When users transfer Bitcoin to the network, they receive wrapped Bitcoin, allowing near-instant transactions at significantly lower cost.

Beyond payments, Bitcoin Hyper introduces smart contract functionality to the Bitcoin ecosystem through compatibility with the Solana virtual machine.

This design expands Bitcoin’s potential use cases, enabling decentralized finance applications while maintaining Bitcoin as the settlement layer. The native HYPER token supports gas fees and staking, positioning Bitcoin as a programmable asset rather than a static store of value.

The project has raised close to $30 million, a notable achievement given current market conditions and reduced risk appetite across the broader crypto market. This level of participation suggests sustained interest rather than short-term momentum.

As the market looks ahead to the next phase of the crypto cycle, infrastructure projects tied directly to Bitcoin may benefit from renewed institutional and retail interest.

Capital inflows historically tend to favor networks that offer clear utility and long-term relevance, particularly during early expansion phases. Bitcoin Hyper sits at this intersection, and the project’s focus on extending Bitcoin’s capabilities rather than replacing them aligns with broader market trends.

Long-Term Trends Shaping the Crypto Market

The broader takeaway from these developments is not the ranking of one asset above another, but the direction in which the market is moving. High-profile commentary continues to influence sentiment, yet long-term capital is increasingly gravitating toward projects that offer tangible utility.

Infrastructure, scalability, and self-custody are becoming central themes as the ecosystem prepares for its next growth phase. Secure, non-custodial tools such as Best Wallet play an important role in this environment, particularly for users participating in upcoming crypto presales and managing long-term holdings.

Whether XRP is viewed as a digital god or simply an efficient payment-focused asset, its ability to command attention remains undeniable.

At the same time, Layer 2 solutions such as Bitcoin Hyper highlight a broader transition toward functionality over hype. As the crypto market moves toward 2026, narratives may spark interest, but utility is increasingly determining where lasting value resides.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.