Bitcoin transactions have dipped in recent weeks in a reflection of the bearish price action since it topped out at an all-time high.

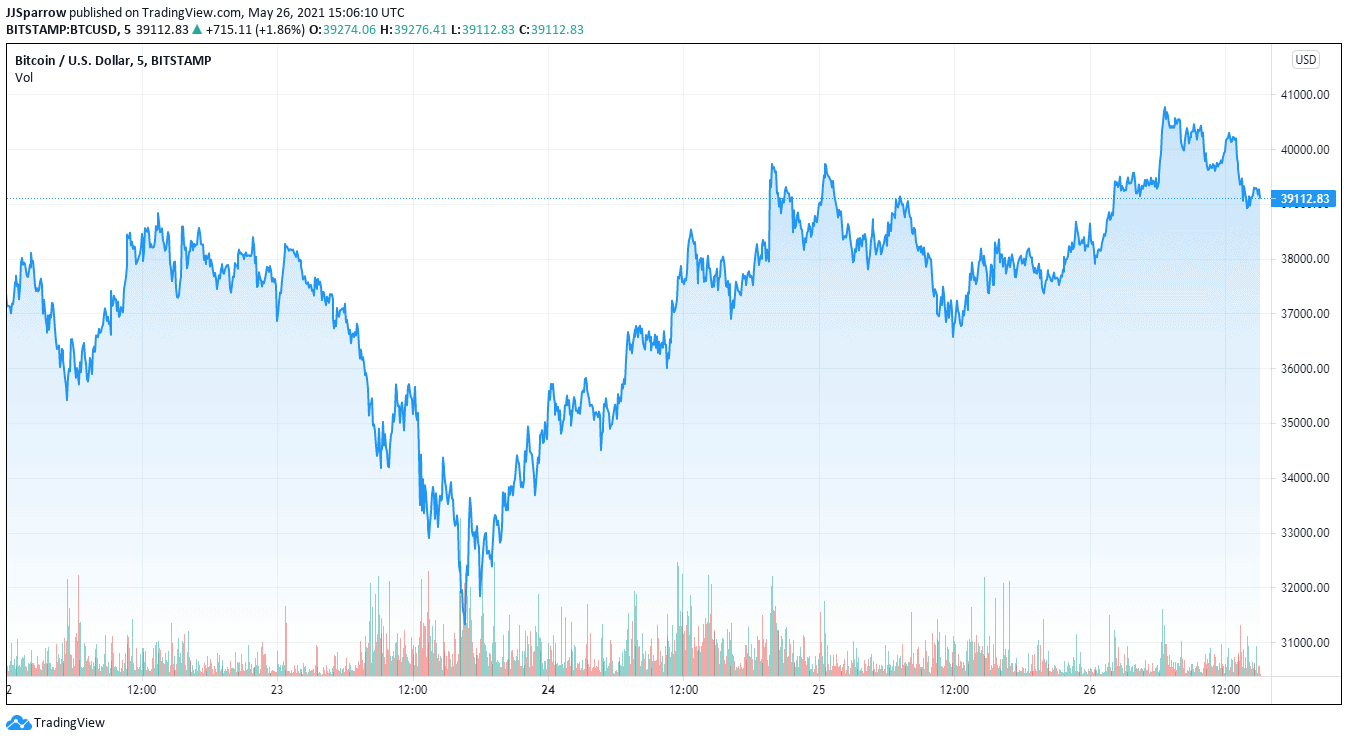

Trading as high as $65,000 in mid-April, Bitcoin’s valuation dropped to the lowly $30,000 price mark, after reports of China’s crypto payment ban. But despite the price swings, Bitcoin’s has rallied over the past few days, currently trading around the $40,000 mark. Will it sustain and possibly surpass the $40k resistance level? Market data suggests so.

Bitcoin Transactions Still Thriving Despite Slump

Crypto research firm Coin Metrics said in a report titled ‘Bitcoin’s Big Shift: A Data-Driven Analysis Of the May 2021 Crypto Crash’ that Bitcoin adoption continues to grow.

This is despite certain top altcoins getting significant attention due to their environmentally sustainable mining process.

According to the report, the number of addresses holding small amounts of BTC has grown by 710,000 since the start of the year till date. Coin Metrics defines small amounts of Bitcoin as values between 0.01 to 1 BTC. To put this in context, last year, only 610,000 wallet addresses held this amount in 2020 in total.

Coin Metrics researchers found that even though other altcoins are sharing the spotlight with Bitcoin, BTC’s network metrics continue to improve.

Bitcoin has dropped under $40K but could become rangebound around the high $30,000, with the price currently at the $39,200, seeking support to consolidate on its gains and break through $40K.

Institutional buyers will likely continue to buy the Bitcoin dips though. Institutional crypto exchange LMAX Digital registered a record daily volume of $6.6 billion on Bitcoin’s “Black Wednesday”. LMAX is the largest institutional exchange with over 450 institutional investors signed up on its platform.

Even former crypto critics and Wall Street veterans are reportedly turning their financial sails towards crypto land.

One such new convert is Bridgewater Associates founder Ray Dalio, who noted that the US greenback might face stiffer competition for the world’s reserve currency role from its Chinese counterpart and possibly lose some of its value.

According to Dalio, this makes Bitcoin a more attractive proposition for storing value, given its deflationary tendency. Noting in an interview at the Consensus conference organized by CoinDesk, Dalio said that he holds “some Bitcoin”.

Dalio, who has long been a skeptic of the digital asset class, said in a January letter to investors that he believes Bitcoin may soon become an alternative store of value alongside traditional fiat currencies.

Fintechs Look To Bitcoin For Revenue Growth

Payment networks don’t want to miss out on the tech innovation to drive down costs and the revenues from crypto transactions that could be brought to their balance sheets. Many of these trusted networks are starting to integrate with cryptocurrencies.

In the recently concluded earnings season, payment giants Visa, Mastercard, and PayPal mentioned the impact crypto payments have on their financial statement.

PayPal CEO Dan Schulman said the company could see more activities on its mobile division since supporting crypto payments.

But it’s not just these trios that are making moves in the Bitcoin-governed industry.

Remittance business MoneyGram announced a partnership with point-of-sale crypto firm Coinme to enable customers to trade BTC. Paysafe, an online payments firm, said it would be looking to its crypto suite of products to grow its revenue in Q2, 2021. FIS, a decentralized finance (DeFi) protocol, pointed to its cryptocurrency offering as an area of strength.

These efforts will not end anytime soon as most fintech firms partner with blockchain companies to attract a new customer segment. As more and more people adopt Bitcoin, it will increase its use case and invariably, create more positive sentiments for the asset. We might experience another bull’s run earlier than expected.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider